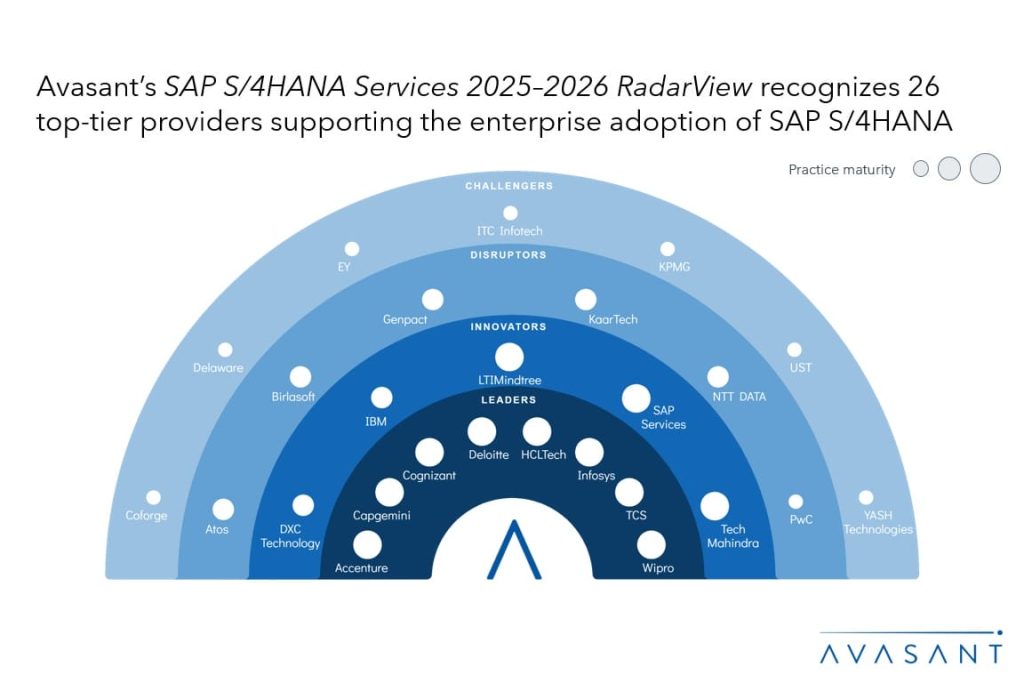

Enterprises are accelerating their SAP S/4HANA transformations to modernize the digital core, enhance operational resilience, and scale Gen AI across end-to-end business processes. Momentum is shifting from strategy design to execution, driven by the urgency to address legacy complexity, strengthen data foundations, and embed automation and decision intelligence where it directly enhances business performance. Sustainability and regulatory alignment are becoming integral priorities, with organizations leveraging S/4HANA to operationalize carbon tracking, ethical sourcing, and audit-ready ESG reporting. To deliver outcomes at scale, service providers play a critical role, bringing guided transformation frameworks, industry-specific assets, automation toolkits, and delivery governance to reduce risk and accelerate value realization.