-

![Engineering and Construction Digital Services 2024 Market Insights™ Primary Image EC 2024 Market Insights - Engineering and Construction Digital Services 2024 Market Insights™]()

Engineering and Construction Digital Services 2024 Market Insights™

The Engineering and Construction Digital Services 2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the engineering and construction industry. The report also highlights key challenges that enterprises face today.

January, 2024

-

![Engineering and Construction Digital Services 2024 RadarView™ PrimaryImage Engineering and Construction Digital Services 2024 RadarView - Engineering and Construction Digital Services 2024 RadarView™]()

Engineering and Construction Digital Services 2024 RadarView™

The Engineering and Construction Digital Services 2024 RadarView™ can help engineering and construction enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 47-page report also highlights top market trends in the engineering and construction industry and Avasant’s viewpoint.

January, 2024

-

![Reinventing Digital Commerce through Infrastructure Upgrade and Next-Gen Commerce MoneyShot Digital Commerce Services 2023 2024 - Reinventing Digital Commerce through Infrastructure Upgrade and Next-Gen Commerce]()

Reinventing Digital Commerce through Infrastructure Upgrade and Next-Gen Commerce

Enterprises are increasingly shifting their focus from traditional e-commerce models like B2B and B2C to D2C, B2B2C, and online marketplaces to increase market reach and drive business agility and growth. To enable this, they are adopting new order fulfillment strategies that help reshape digital commerce operations, boost delivery speeds, and reduce costs. They are also upgrading their legacy digital commerce infrastructure and uplifting customer engagement through next-generation commerce to drive scalability and flexibility. Further, personalization boundaries are being pushed by digital commerce platform vendors who integrate generative AI capabilities in their current solutions. Aligned with these trends, service providers’ priorities are underscored by investments in next-generation commerce, expanding partner ecosystems, and practice growth. Both demand- and supply-side trends are covered in Avasant’s Digital Commerce Services 2023–2024 Market Insights™ and Digital Commerce Services 2023–2024 RadarView™, respectively.

January, 2024

-

![Disaster Recovery Plan Testing Best Practices 2024 Practice adoption Stages 2 - Disaster Recovery Plan Testing Best Practices 2024]()

Disaster Recovery Plan Testing Best Practices 2024

In today’s unpredictable business environment, there is an increasing reliance on data and digital systems to operate efficiently. With this comes the need for robust disaster recovery (DR) plans and testing to reduce the impact of unforeseen events. The effectiveness of a DR plan can only be truly validated through routine testing. However, while this practice is growing, few organizations are testing their DR plans formally and consistently. This Research Byte summarizes our full report on disaster recovery plan testing as a best practice.

January, 2024

-

![Disaster Recovery Plan Testing: A Formal but Inconsistent Practice Practice adoption Stages 2 - Disaster Recovery Plan Testing: A Formal but Inconsistent Practice]()

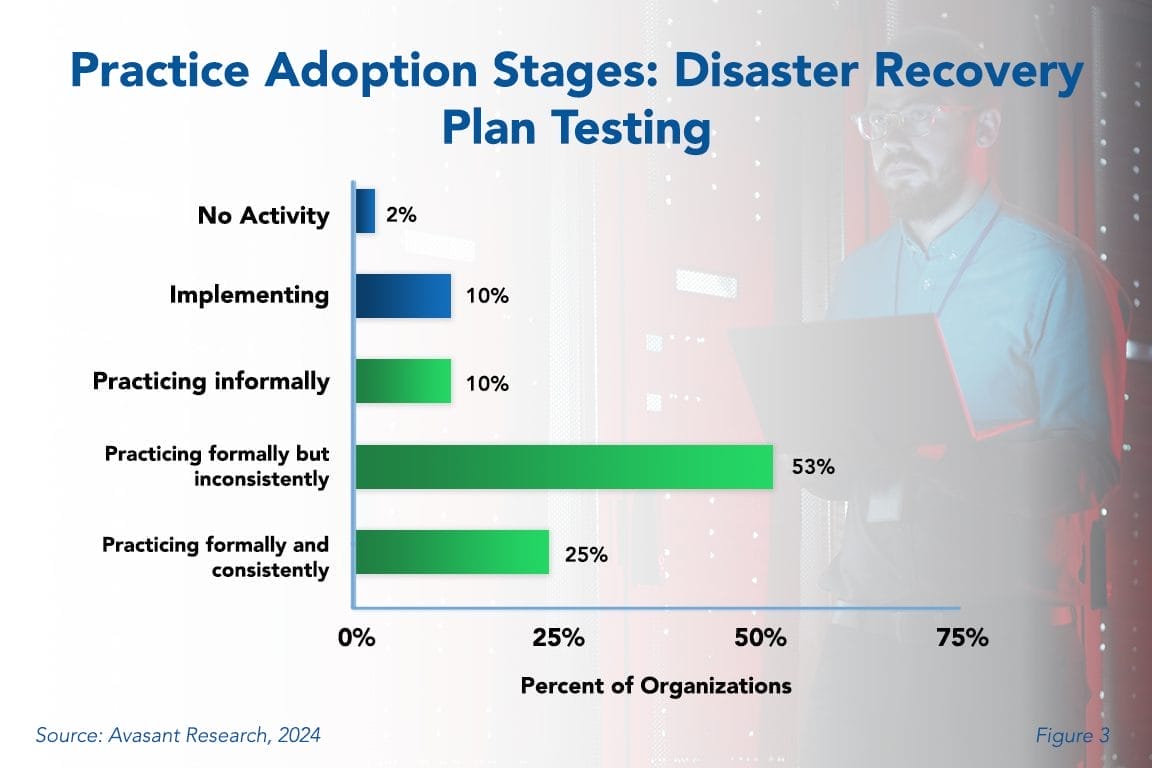

Disaster Recovery Plan Testing: A Formal but Inconsistent Practice

In today’s unpredictable business environment, there is an increasing reliance on data and digital systems to operate efficiently. With this comes the need for robust disaster recovery (DR) plans and testing to reduce the impact of unforeseen events. The effectiveness of a DR plan can only be truly validated through routine testing. However, while this practice is growing, few organizations are testing their DR plans formally and consistently. This Research Byte summarizes our full report on disaster recovery plan testing as a best practice.

January, 2024

-

![Click with Caution: Why Every Company Needs to Enforce Personal Use Policies Practice adoption Stages - Click with Caution: Why Every Company Needs to Enforce Personal Use Policies]()

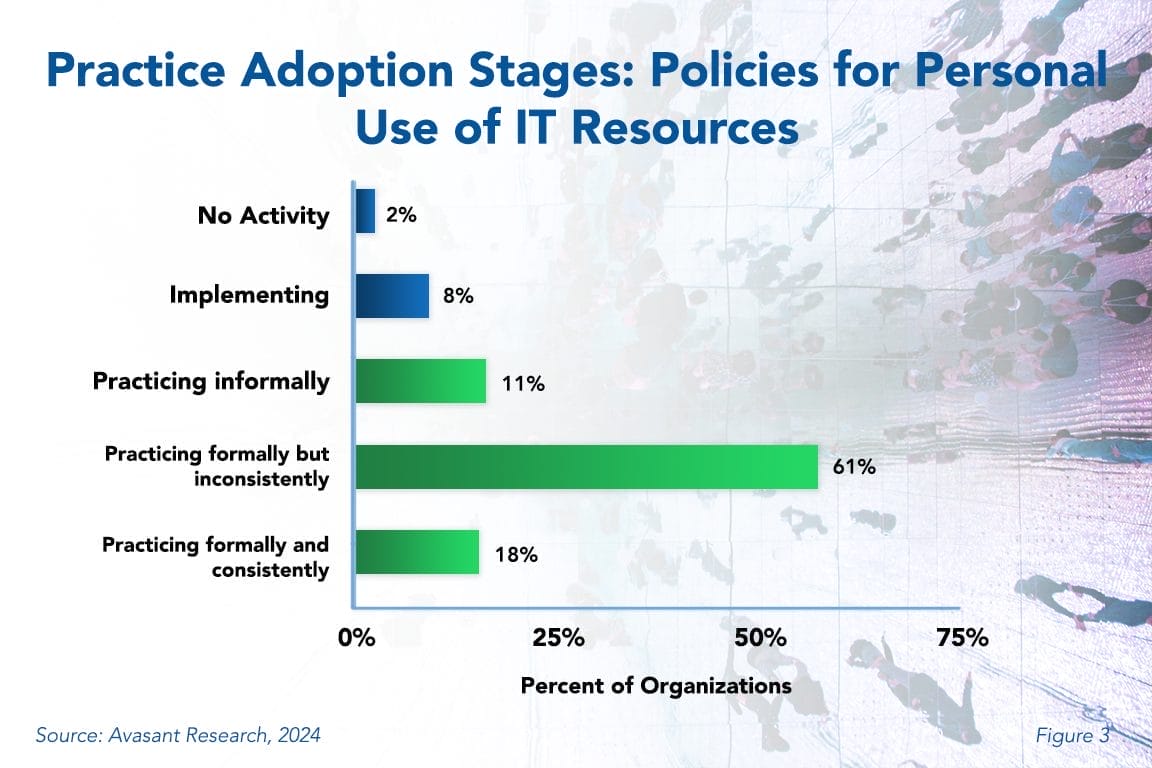

Click with Caution: Why Every Company Needs to Enforce Personal Use Policies

Policies for personal use of IT resources are policies that explicitly restrict or permit use of the organization’s IT resources for personal reasons. The good news is that 90% of survey respondents have adopted personal-use policies, at various levels of commitment. However, despite high adoption, not all companies consistently and formally practice them. This Research Byte summarizes our full report on policies for personal use as a best practice.

January, 2024

-

![Policies for Personal Use of IT Resources Best Practices 2024 Practice adoption Stages - Policies for Personal Use of IT Resources Best Practices 2024]()

Policies for Personal Use of IT Resources Best Practices 2024

Policies for personal use of IT resources are policies that explicitly restrict or permit use of the organization’s IT resources for personal reasons. The good news is that 90% of survey respondents have adopted personal-use policies, at various levels of commitment. However, despite high adoption, not all companies consistently and formally practice them. This Research Byte summarizes our full report on policies for personal use as a best practice.

January, 2024

-

![ERP Support Staffing Ratios 2024 ERP Users per ERP - ERP Support Staffing Ratios 2024]()

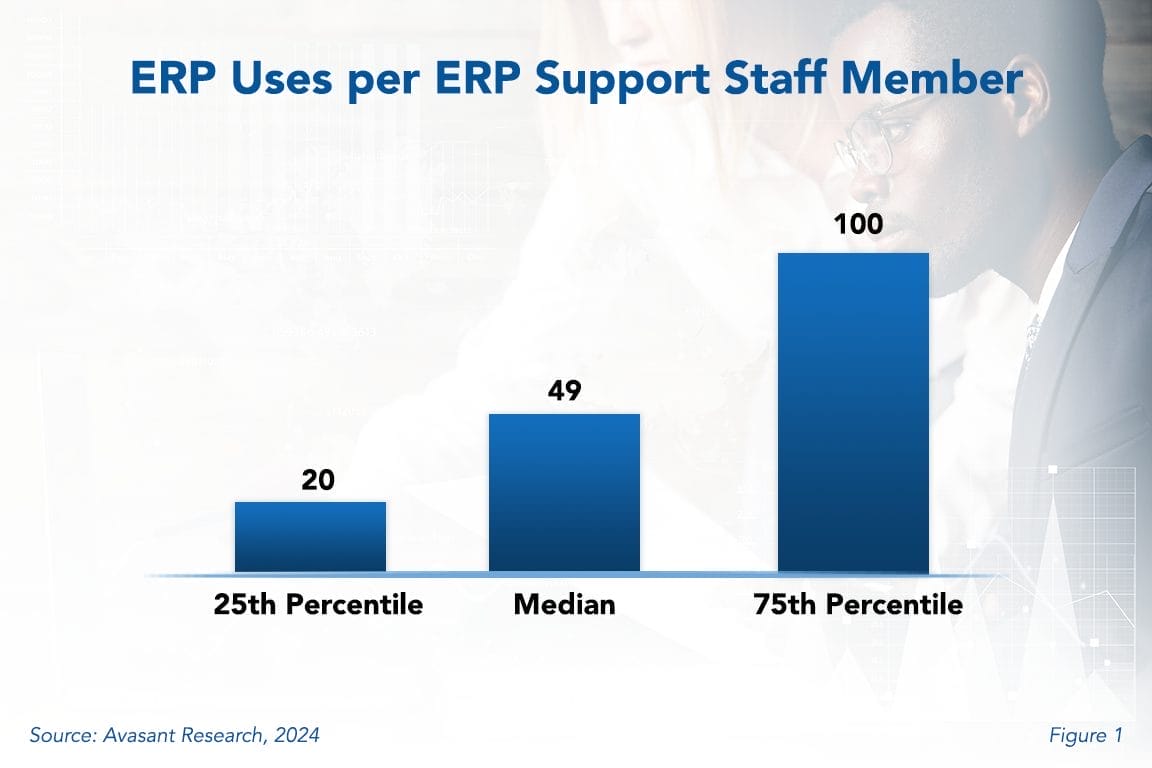

ERP Support Staffing Ratios 2024

Rightsizing the support staff for an ERP system can be difficult. This is because many factors affect the support staffing ratio. These include the type of ERP system, its age, the extent of modification, and the industry sector. Nevertheless, understanding support requirements for ERP systems is vital for IT leaders. This research byte summarizes our full report on ERP support staffing ratios.

January, 2024

-

![Rightsizing ERP Support Staffing ERP Users per ERP - Rightsizing ERP Support Staffing]()

Rightsizing ERP Support Staffing

Rightsizing the support staff for an ERP system can be difficult. This is because many factors affect the support staffing ratio. These include the type of ERP system, its age, the extent of modification, and the industry sector. Nevertheless, understanding support requirements for ERP systems is vital for IT leaders. This research byte summarizes our full report on ERP support staffing ratios.

January, 2024

-

![SAP S/4HANA: Reducing Time to Market Through Industry-Specific Solutions and Generative AI Capabilities money - SAP S/4HANA: Reducing Time to Market Through Industry-Specific Solutions and Generative AI Capabilities]()

SAP S/4HANA: Reducing Time to Market Through Industry-Specific Solutions and Generative AI Capabilities

Migrating to SAP S/4HANA presents a challenge for enterprises encompassing multiple business processes across the value chain, intricate data structures, and several customizations. Current macroeconomic headwinds have made this transition more complex as customers reassess their SAP S/4HANA implementation strategies to develop a cost-optimal road map and seek quick ROI on their IT investments. Service providers are also addressing these trends, reducing time to market for clients through industry-specific solutions with preconfigured process workflows. They have also invested in generative AI solutions to strengthen horizontal capabilities, such as testing and documentation.

January, 2024