-

![Striking a Balance with Low-Code/No-Code Platforms Business and Data Analytics - Striking a Balance with Low-Code/No-Code Platforms]()

Striking a Balance with Low-Code/No-Code Platforms

Low-Code/No-Code (LC/NC) platforms are becoming increasingly popular in enterprise software development. They enable non-technical users and citizen developers to quickly create software applications with little to no manual coding. However, LC/NC tools are not just meant for personnel outside of the IT organization. They are also incredibly useful for professional developers. This Research Byte is a summary of our full report, which covers LC/NC adoption and investment trends along with the economic experience and overall satisfaction rates for LC/NC platforms.

January, 2024

-

![Low-Code/No-Code Adoption Trends and Customer Experience 2024 Business and Data Analytics - Low-Code/No-Code Adoption Trends and Customer Experience 2024]()

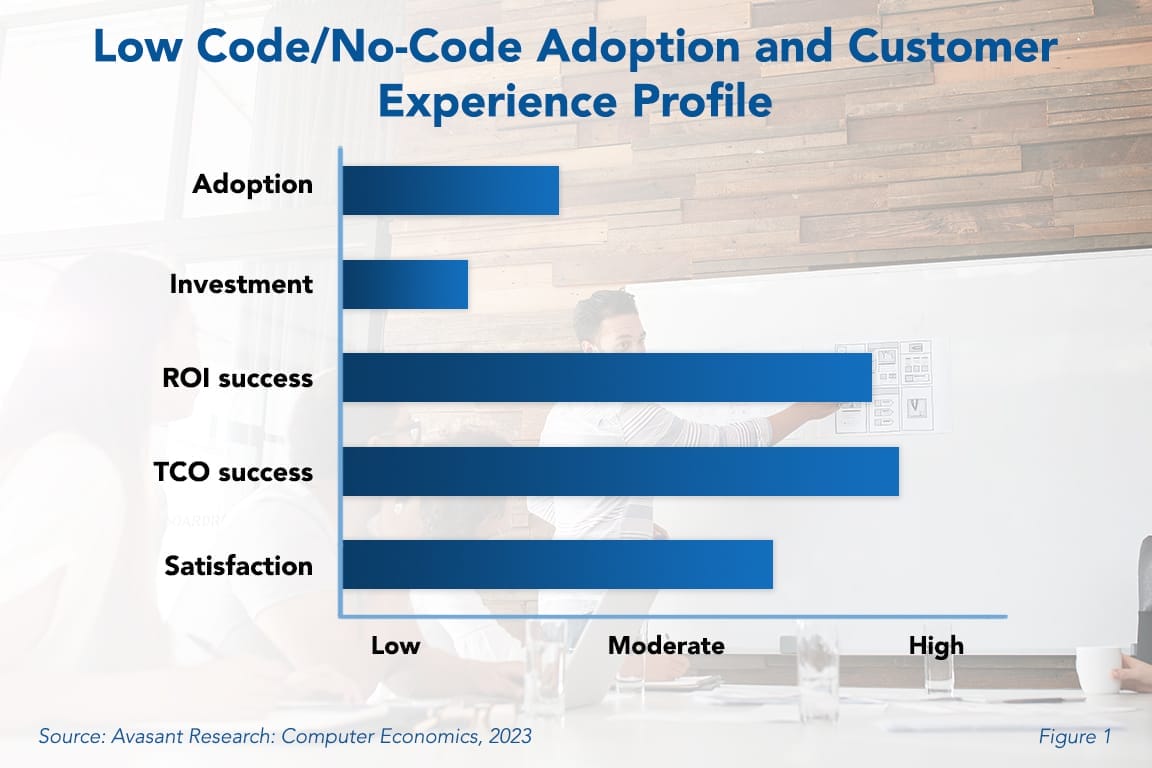

Low-Code/No-Code Adoption Trends and Customer Experience 2024

Low-Code/No-Code (LC/NC) platforms are becoming increasingly popular in enterprise software development. LC/NC enables non-technical users and citizen developers to quickly create software applications with little to no manual coding. Using a visual drag-and-drop interface, pre-built components, and templates, LC/NC platforms allow users to create applications without requiring a high level of coding knowledge. This capability is invaluable for companies of all sizes because it lowers development costs, speeds up development, and improves agility.

January, 2024

-

![Generative AI Commands C-Suite Leadership Network Operations Outsourcing Trends and Customer Experience 1 - Generative AI Commands C-Suite Leadership]()

Generative AI Commands C-Suite Leadership

In this, our first survey-based report on generative AI strategy, spending, and adoption, we provide metrics on how much enterprises are spending on this ground-breaking technology, where they are spending it, and how they are governing it. Given the hype, it is not surprising that our survey respondents rank generative AI as strategically important to their organizations. In fact, it is so important that the C-suite is typically leading the effort. This research byte is a brief description of some of the findings of our eight-chapter report on Generative AI Strategy, Spending, and Adoption Metrics.

January, 2024

-

![Vendor Discount Report January 2024 Vendor Discount Report Jan 2024 - Vendor Discount Report January 2024]()

Vendor Discount Report January 2024

The largest and best discounts are often only offered to the vendors’ best customers, and buyers may find it difficult to determine whether the discount offered is typical or whether a better deal can be negotiated. The Vendor Discounts Report is designed to give procurement personnel, lessors, lessees, and departmental manager’s insight and guidance regarding current discount structures on a variety of categories of equipment in the marketplace.

April, 2024

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 8: IT Services and Solutions Sector Benchmarks Gen Ai Product Images 08 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 8: IT Services and Solutions Sector Benchmarks]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 8: IT Services and Solutions Sector Benchmarks

This chapter provides generative AI metrics for the IT services and solutions sector. It features a sample of 55 IT services and solutions companies including software companies, hardware companies, cloud providers, and tech consultants. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 7: Professional Services Sector Benchmarks Gen Ai Product Images 07 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 7: Professional Services Sector Benchmarks]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 7: Professional Services Sector Benchmarks

This chapter provides generative AI metrics for the professional services sector. It features a sample of 11 professional services companies including consulting firms, business solutions companies, real estate brokerages, and data analysis firms. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 6: Healthcare Sector Benchmarks Gen Ai Product Images 06 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 6: Healthcare Sector Benchmarks]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 6: Healthcare Sector Benchmarks

This chapter provides generative AI metrics for the healthcare sector. It features a sample of 11 healthcare organizations including hospitals, hospital systems, clinics and retirement homes. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 5: BFSI Sector Benchmarks Gen Ai Product Images 05 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 5: BFSI Sector Benchmarks]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 5: BFSI Sector Benchmarks

This chapter provides generative AI metrics for the banking, financial services, and insurance (BFSI) sector. It features a sample of 34 such firms, ranging from commercials and investment banks to brokerages, financial advisors, and wealth management firms. They also include regional and national insurance including health insurance and property and casualty. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 4: Retail Sector Benchmarks Gen Ai Product Images 04 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 4: Retail Sector Benchmarks]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 4: Retail Sector Benchmarks

This chapter provides generative AI metrics for the retail sector. It features a sample of 15 retailers including department stores, apparel retailers, multinational brick-and-mortar chains, toys, and office supplies, as well as online retailers. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 3: Manufacturing Sector Benchmarks Gen Ai Product Images 03 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 3: Manufacturing Sector Benchmarks]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 3: Manufacturing Sector Benchmarks

This chapter concentrates on the manufacturing sector. It features a sample of 32 manufacturers including both process and discrete manufacturing.This chapter provides generative AI metrics for the manufacturing sector. It features a sample of 32 manufacturers including both process and discrete manufacturing. Among the sample are those that manufacture food and beverages, life sciences and pharmaceuticals, cars and car parts, industrial equipment, chemicals, and consumer goods. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 2: Composite Benchmarks Gen Ai Product Images 02 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 2: Composite Benchmarks]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 2: Composite Benchmarks

In this, our first survey-based report on generative AI strategy, spending, and adoption, we provide metrics on how much enterprises are spending on this ground-breaking technology, where they are spending it, and how they are governing it. This chapter provides statistics for nearly 200 companies that have already adopted some form of generative AI. It includes 22 figures providing data ranging from the strategic importance of AI to staffing and budget numbers, to usage data. It also covers the reservations and fears of using Gen AI and provides an understanding of the art of the possible.

December, 2023

-

![Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 1: Executive Summary Gen Ai Product Images 01 scaled - Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 1: Executive Summary]()

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 1: Executive Summary

Chapter 1 provides a free executive summary for our first survey-based report on generative AI strategy, spending, and adoption. The full report provides metrics on how much enterprises are spending on this ground-breaking technology, where they are spending it, and how they are governing it. It provides statistics for nearly 200 companies that have already adopted some form of generative AI, providing data ranging from the strategic importance of AI to staffing and budget numbers, to usage data. Metrics are provided for the composite sample along with six industry chapters. [Free Download]

December, 2023

Avasant acquires Computer

Economics for IT Metrics and Analytics

Economics for IT Metrics and Analytics

Leverage the definitive source of IT spending ratios

and staffing metrics for over 25 industry and government sectors.