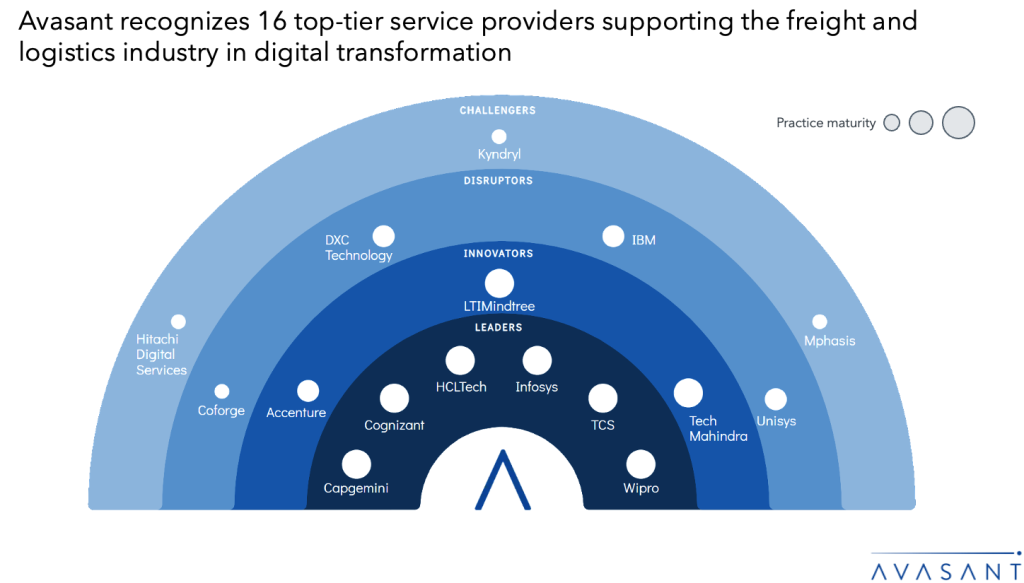

Freight and logistics enterprises are defending margins by renegotiating contracts, adopting flexible analytics-driven pricing, diversifying revenue through the rail/air/sea mix, and expanding value-added services via digital platforms. They are tackling volatility with AI-powered scenario planning, while adding dynamic pricing engines and integrated cargo tracking for real-time control. To accelerate capability buildout, they are acquiring robotics, IoT cargo tracking, and advanced planning platforms. They are also strengthening sustainability and resilience through climate-scenario modeling, satellite/IoT monitoring, and disruption-risk analytics, while raising ESG targets with low-carbon fleets, renewable-energy warehousing, and supplier audits. Freight and logistics companies are redesigning networks around nearshoring corridors with alternative hubs and network-optimization software, and orchestrating multimodal flows across air, trucking, and warehousing to capture growth on new trade lanes. They collaborate with service providers to drive digital transformation, which requires strong technological expertise and delivery capabilities. Both demand-side and supply-side trends are covered in our Freight and Logistics Digital Services 2025 Market Insights™ and Freight and Logistics Digital Services 2025 RadarView™, respectively.