The increased enterprise interest in AR/VR/XR over the past year driven by the introduction of the metaverse has led to heightened conversations with service providers. Businesses sought to understand how these technologies could enhance their processes, improve productivity, and provide immersive experiences to their customers. Although the initial hype around the metaverse has subsided, the enterprise demand for features such as personalized digital avatars, metaverse-specific marketing content, and blockchain-powered virtual marketplaces is growing.

Both demand-side and supply-side trends are covered in Avasant’s AR/VR/XR Services 2023 Market Insights™ and AR/VR/XR Services 2023 RadarView™, respectively. These reports present a comprehensive study of AR/VR/XR service providers and closely examine the market leaders, innovators, disruptors, and challengers.

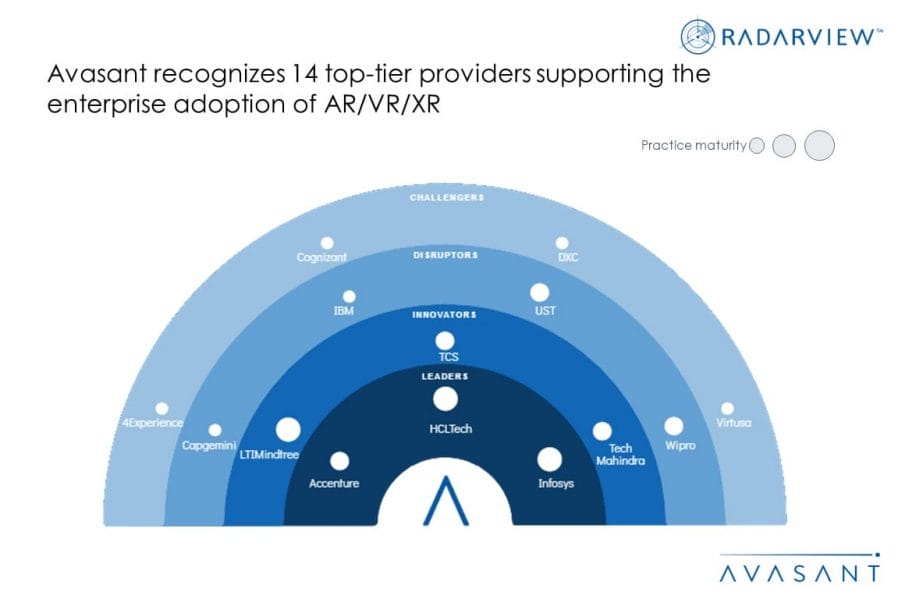

Avasant evaluated 40 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 40 providers, we recognized 14 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, HCLTech, and Infosys

- Innovators: LTIMindtree, TCS, and Tech Mahindra

- Disruptors: Capgemini, IBM, UST, and Wipro

- Challengers: Cognizant, DXC, 4Experience, and Virtusa

Figure 1 below from the full report illustrates these categories:

“The need for accurately replicating the real world in AR/VR/XR experiences presents a significant obstacle to enterprise adoption,” said Anupam Govil, Avasant partner and digital practice lead. “To overcome this barrier, advancements in hardware, software, and content creation must deliver high visual fidelity, realism, and interactivity.”

The reports provide several findings, including the following:

-

- The share of AR/VR/XR projects in production stands at 28%, a decline of 2% compared to last year. The need for more interactive and photo-realistic experiences hinders growth. As the AR/VR/XR industry advances with the inclusion of 3D spatial sounds, high resolution, haptics, realistic gestures, and other sensory elements, enterprise adoption is expected to increase.

- Over 50% of enterprises respond to end-user demand for immersive virtual experiences by planning to increase investments in AR/VR/XR technologies, primarily across three themes. These are data visualization (smart city layout, network optimization, and product placement), remote collaboration (employee training, virtual events, and field service management), and digital payments (virtual store and banking lounge).

- Manufacturing, healthcare, and retail are leading the adoption of AR/VR/XR because of the growing demand for industrial metaverse, enhanced customer engagement, and immersive data visualizations. Convergence with technologies such as digital twins, blockchain, and non-fungible tokens (NFTs) is enhancing user interactivity and data security, including the development of personalized avatars from generative AI.

“AR/VR/XR applications have evolved from experiential purposes to commercially viable solutions,” said Abhisekh Satapathy, senior research analyst with Avasant. “By introducing loyalty programs and NFT-based payments, enterprises are not only incentivizing user engagement but also creating new business opportunities within the immersive technology space.”

The AR/VR/XR Services 2023 RadarView™ report also features detailed profiles of 14 service providers, along with their solutions, offerings, and experience in assisting enterprises in their AR/VR/XR journeys.

This Research Byte is a brief overview of the AR/VR/XR Services 2023 Market Insights™ and AR/VR/XR Services 2023 RadarView™ (click for pricing).