This RadarView Scan provides key information on vendors that offer autonomous medical coding (AMC) products. The report begins with the definition and evolution of AMC products. It then highlights key challenges faced by enterprises and how AMC products will resolve these challenges. The report compares features and functionalities for the top 10 AMC product vendors.

Each profile provides an overview of the vendor, its key AMC offering, and a list of representative clients and partnerships, along with key developments and value proposition. The report can aid healthcare and revenue cycle management providers in identifying the right partners and product vendors to support their medical coding process transformation journeys.

Why read this RadarView?

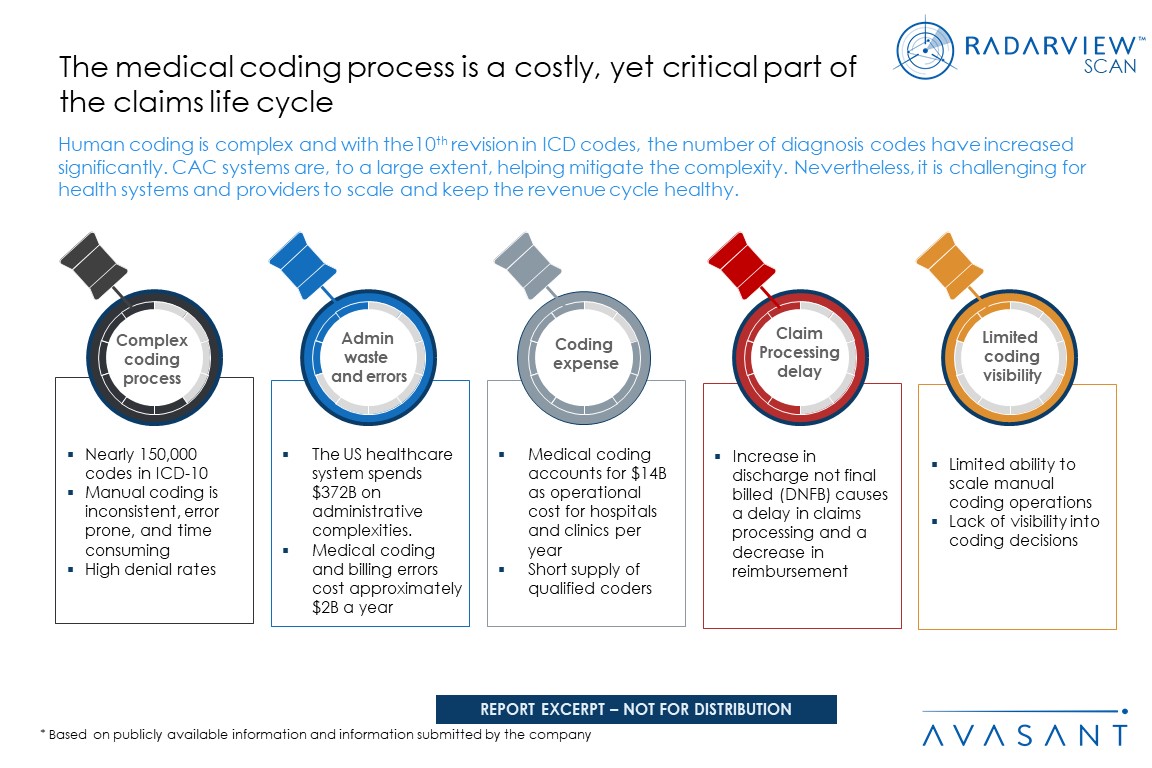

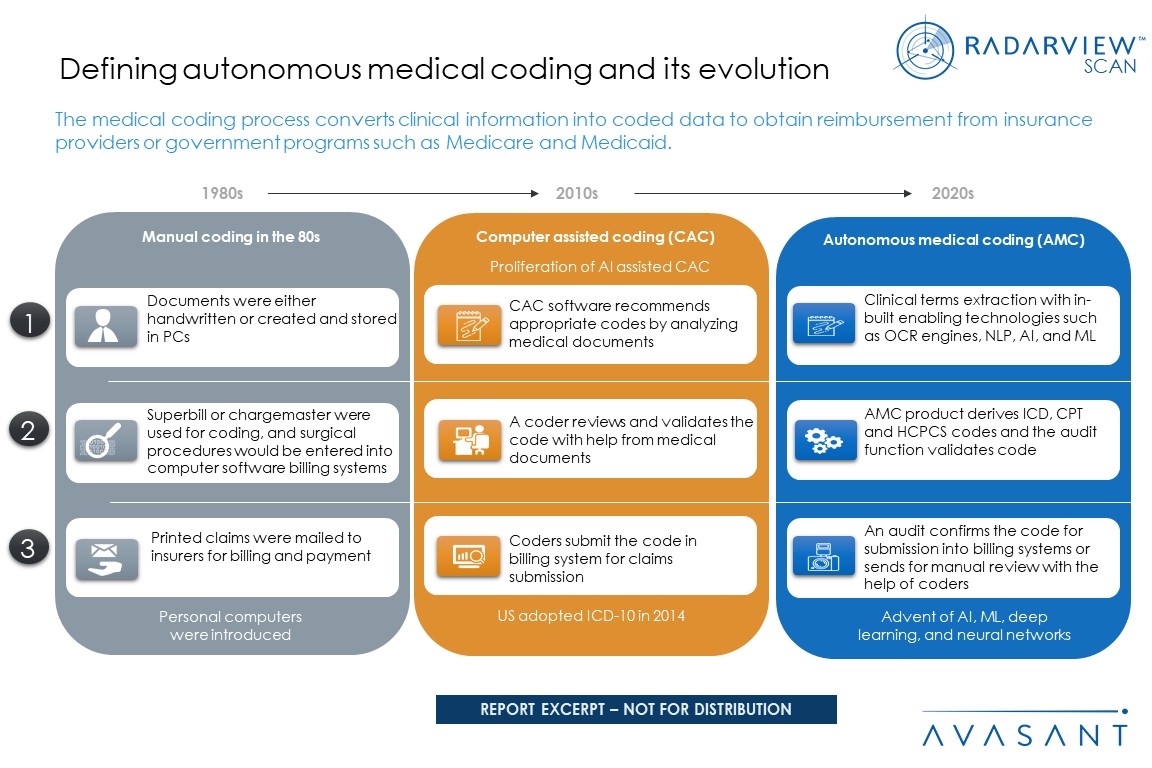

Adoption of the newer version of ICD (International Classification of Diseases), ICD-11, will increase the number of medical codes to the existing version of ICD-10. Medical coding is a mandatory compliance requirement for providers to be reimbursed for insurance claims from insurers. For many healthcare providers, the entire coding process is complex and human-dependent. Most healthcare providers find their medical coding process error-prone and slow-moving. Errors in medical coding lead to claim denials and process delays, resulting in lost revenue for healthcare providers. AMC product vendors can play a strong role in redefining the manual process by integrating their solutions into the existing revenue cycle management process.

This report identifies leading AMC vendors and their offerings. It also provides a comparative view on solution capabilities, along with vendor comparisons.

Featured providers

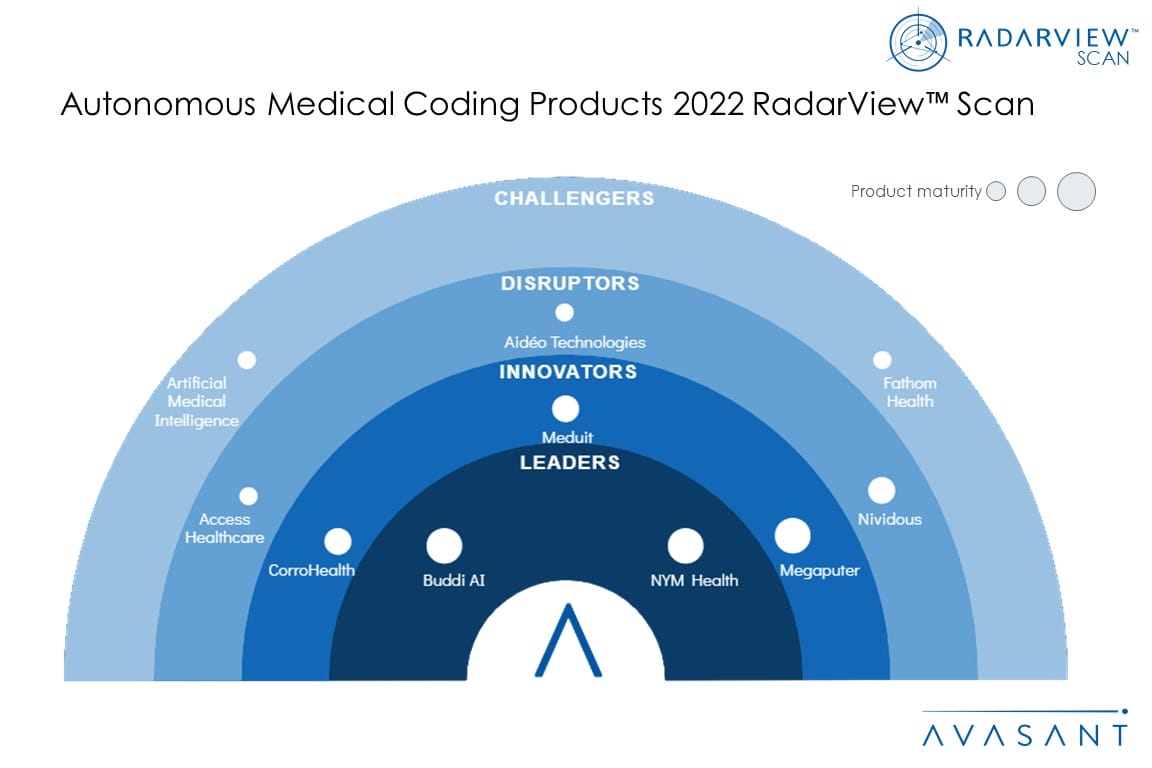

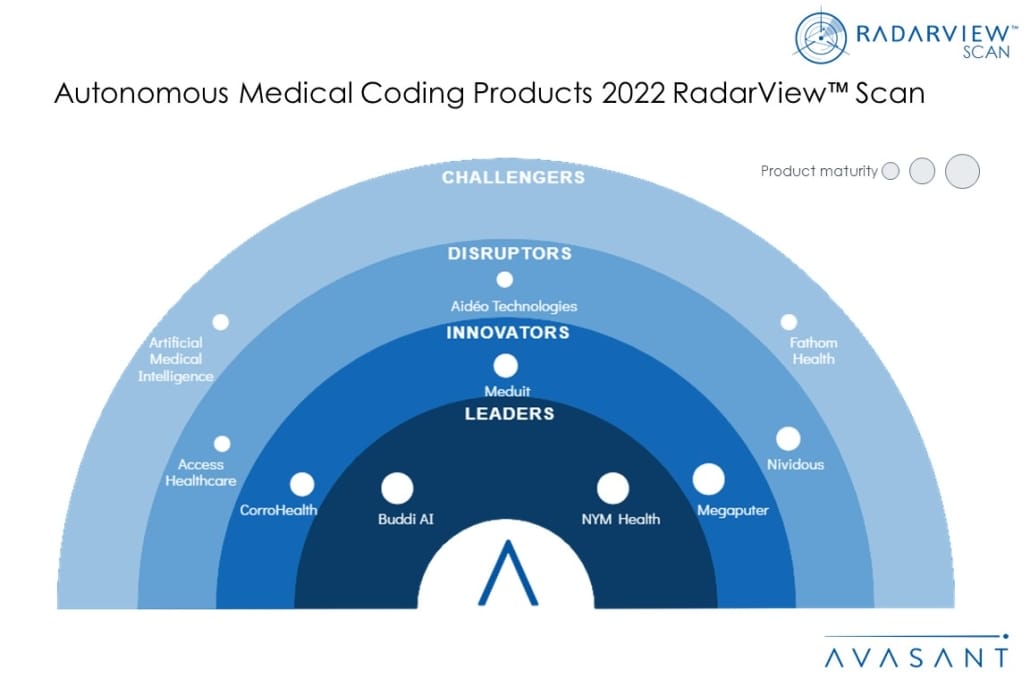

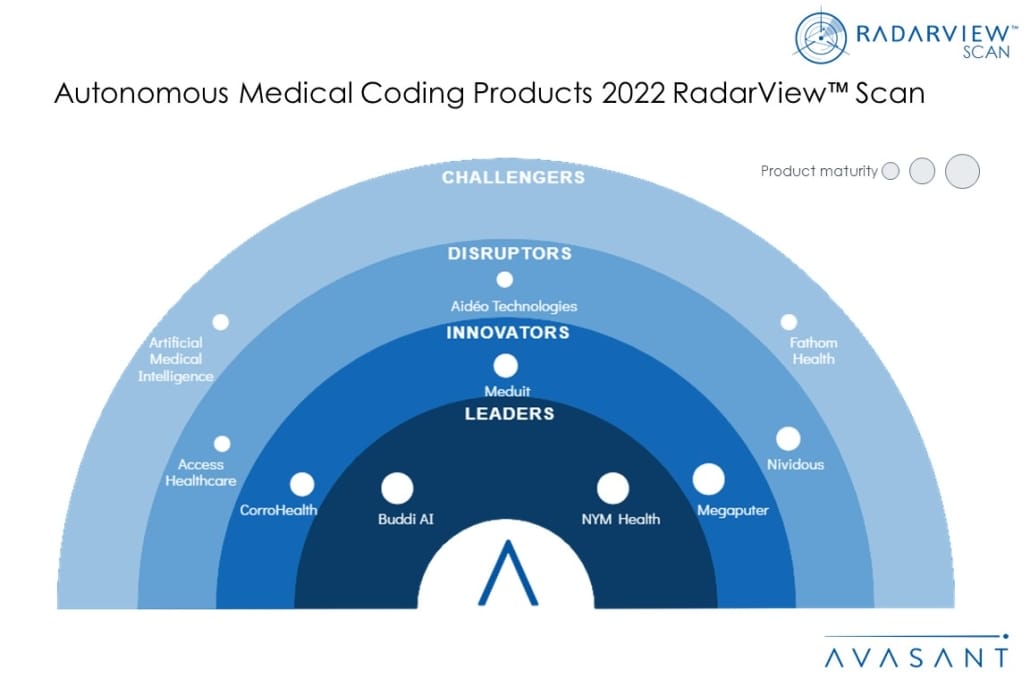

This RadarView includes an analysis of the following AMC product vendors in the revenue cycle space: Access Healthcare, Aidéo Technologies, Artificial Medical Intelligence, Buddi AI, CorroHealth, Fathom Health, Meduit, Megaputer, Nividous, and NYM Health.

Methodology

The insights and analysis presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of product vendors is based on primary input from the vendors, public disclosures, case studies, product sheets, executive interviews, and our ongoing market interactions. The assessment is across the three dimensions of product maturity, enterprise adaptability, and future readiness, leading to our recognition of those vendors that have brought the most value to the market over the last 12 months.

Table of contents

About the report (Page 3)

-

- Defining autonomous medical coding and its evolution

- Avasant recognizes 10 top AMC platform vendors

Lay of the land (Pages 6–8)

-

- The medical coding process is a costly, yet critical part of the claims life cycle

- AMC can reduce costs, improve transparency, and simplify IDC-11 coding

Overview (Pages 9–14)

-

- Research methodology and coverage

- RadarView Scan assessment

- Product maturity dimension

- Enterprise adaptability dimension

- Future readiness dimension

Autonomous Medical Coding Platforms 2022 RadarView Scan (Pages 15–19)

-

- Reading the RadarView Scan

- Avasant recognizes 10 top AMC product vendors

- Vendor assessment dimensions

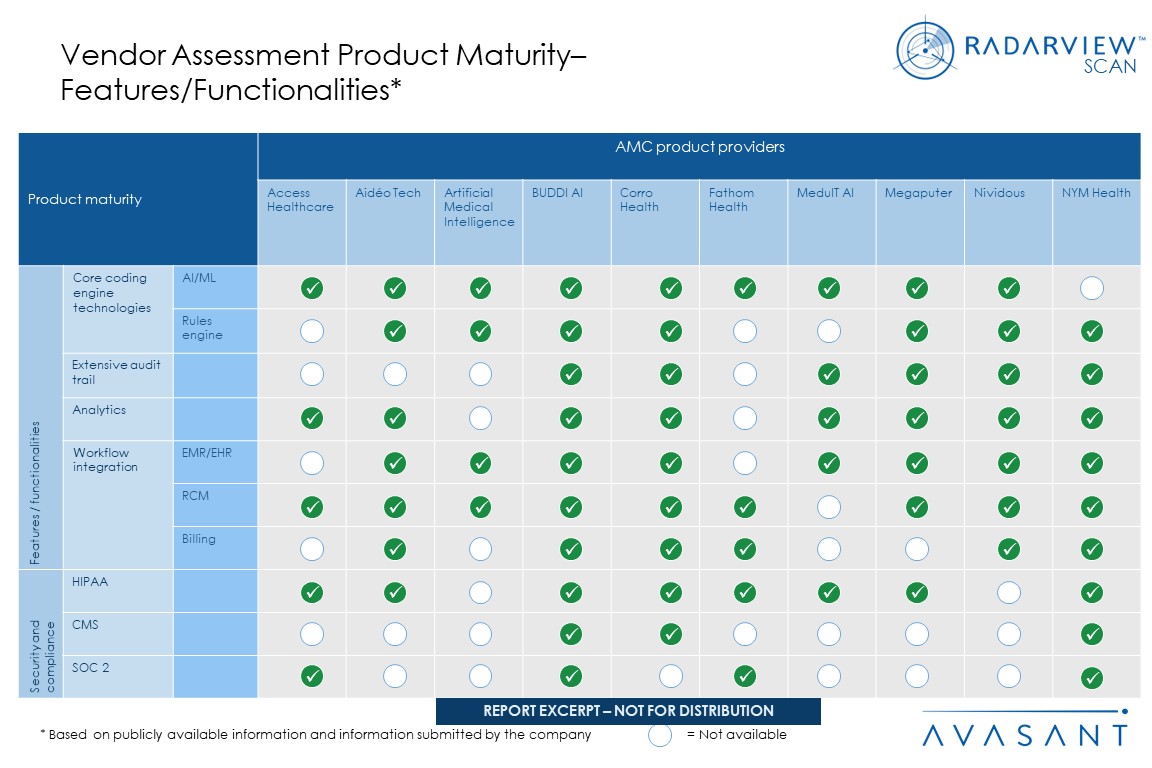

- Vendor Assessment Product Maturity–Features/Functionalities

Product vendor profiles (Pages 20–31)

-

- Profiles for Access Healthcare, Aidéo Technologies, Artificial Medical Intelligence, Buddi AI, CorroHealth, Fathom Health, Meduit, Megaputer, Nividous, and NYM Health.

Authors (Page 32)

Read the Research Byte based on this report.