IT spending should rise faster in the financial services sector than in any other sector, according to the annual Computer Economics IT spending and staffing study. Financial service organizations are hiking IT operational budgets by 5% at the median, while capital budgets are up 2.5%.

The study has been gathering IT budget and staffing data from about 200 organizations in the U.S. and Canada annually since 1990 to provide benchmarks for key industries. This year, banks, insurers, and other financial service firms reported the strongest growth in both operational and capital budgets.

“These budget plans are predicated on the idea that interest rates would be rising, which would be positive for the sector,” said John Longwell, vice president of research. “If that doesn’t occur, we could see some retrenchment on the capital spending side. But as of now, financial services are showing positive trends in IT spending. IT hiring in this sector should be fairly robust as well.”

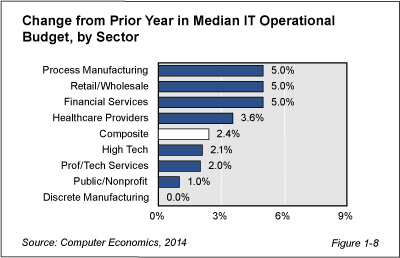

As shown in Figure 1-8 from our study, IT Spending and Staffing Benchmarks 2014/2015, the retail and wholesale distribution sector and process manufacturing also report a 5.0% rise in IT operational spending at the median. However, IT capital budgets remain unchanged in those sectors. Typically, that seems is the case in most sectors where operational spending is rising but capital spending remains restrained.

Another sector showing above-average growth in IT operational spending is health care, with budgets rising 3.6% at the median. Hospitals appear to be hiring IT staff at a rate faster than most other sectors, with headcount rising 3.9% at the median. That compares with 5.0% headcount growth in financial services and 1.0% median headcount growth across all sectors.

In other sectors, IT operational budgets are growing slower than the median. Spending is up 2.1% in the high-tech sector, 2.0% for professional and technical services, and 1.0% for public and nonprofit organizations. Discrete manufacturers, meanwhile, are not anticipating any growth in IT spending at the median. The Irvine, Calif.-based research firm is forecasting a muted 2.5% growth in IT operational budgets across all sectors and no growth in capital spending.