Many IT executives start a benchmarking exercise believing that they should benchmark themselves against a set of companies as close to possible to their narrowly-defined industry and company size. Essentially, they want to benchmark themselves only against organizations “just like us.” However, doing so can be difficult because it is often impossible to find a peer group based on both industry and company size that is more than a handful of organizations. The confidence level for such a sample is low.

Fortunately, there is a better and easier way. Our research and benchmarking services over several decades have shown that some IT benchmarking metrics are more influenced by the size of the IT organization than by the industry sector. Likewise, there are other IT spending ratios that are more dependent on the industry sector than the size of the company.

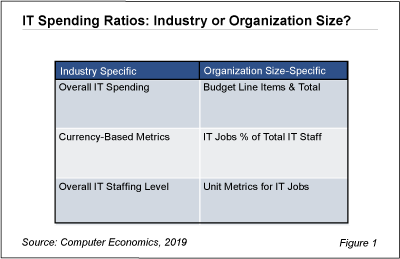

In this post, we outline which types of IT spending ratios you should compare against your industry peers (regardless of company size) and which you should compare against organizations that are roughly your same size (regardless of industry sector). A summary is provided in Figure 1.

The concepts in this Research Byte are drawn from our annual IT spending and staffing benchmarks study. A 60+ page executive summary is available at no charge.

Download the Free Executive Summary

IT Spending Metrics That Are Industry-Specific

Essentially, any IT spending ratio that is currency-based (i.e. it has a dollar sign in it) is likely to be more influenced by industry than by company size. This is because overall IT spending varies quite a bit by industry. For example, banks and insurance companies spend much more—several times more—on IT as a percentage of revenue or per employee, than do manufacturing companies, retailers, or construction firms. Therefore, if overall IT spending in financial services firms is high, then the constituent line items of the IT budget will also be high on a currency (e.g. dollar) basis.

Here are some of the overall IT budgetary metrics that are highly industry-specific: IT spending as a percentage of revenue, IT spending per employee, IT spending per user, and IT spending per desktop. These metrics may be calculated for IT operational spending or total IT spending (including IT capital spending).

Likewise, IT benchmarks that have dollars (or other currency) in the numerator are also highly industry-specific. These include: business applications spending per user, data center spending per user, network spending per user, IT security spending per user, PC/desktop spending per user, and so forth.

Interestingly, the overall size of the IT staff is also highly industry-specific. Our key metric for overall IT staffing is the number of users per IT staff member. For high-spending sectors, such as banking and financial services, this ratio is quite low (each IT staff member supports a small number of users). For lower-spending sectors, such as manufacturing, distribution, and construction, this ratio tends to be much higher (each IT staff member supports a greater number of users).

Our benchmarks report provides benchmarks for over 25 industry sectors, including manufacturing, banking and finance, insurance, retail, wholesale distribution, energy and utilities, healthcare, professional services, transportation and logistics, construction and trade services, IT services, government, nonprofit and charitable organizations, higher education, commercial real estate, high-tech, food and beverage, industrial and automotive, commercial banking, online retail and e-commerce, hospitals, city and county government, government agencies, and logistics.

IT Spending Metrics That Are Company Size-Specific

Company size (or, more precisely, IT organization size) is a primary factor for many IT spending metrics. One reason is that for many areas of spending, IT organizations have economies of scale. A large IT organization can get larger discounts on IT products and services. For example, as a percentage of their IT budgets, large IT organizations spend less for network carrier services per user than small organizations do. Working in the other direction, for some areas of IT spending, large IT organizations simply have greater needs. For example, as a percentage of the overall IT budget, large organizations tend to spend more on data centers.

Therefore, when looking at IT budgetary line items as a percentage of the IT budget it is best to pay more attention to the organization size peer group instead of the industry sector. These metrics include the percentage of the IT budget spent on IT personnel, business applications, data center hardware/software, energy/utilities, IT facilities/floor space, network infrastructure, security, voice/data carrier expenses, PCs/end-user devices, and printers/printing.

IT Staffing Ratios Are Largely Organization Size-Specific

IT staffing ratios at the individual job-position level tend to be more dependent on organization size than they are on industry sector. For example, help desk as a percentage of the total IT staff tends to be higher for small companies than for large companies, which enjoy economies of scale in help desk staffing.

In like manner, as a percentage of the total IT staff, these jobs show economies of scale: desktop support, application development and maintenance, data management, quality assurance/testing, database administration, server support, network support, communications support, web/e-commerce, and IT security personnel.

However, we do not see economies of scale for IT managers, IT finance jobs, or other administrative positions. These tend to be fairly consistent across various sizes of IT organizations.

Unit metrics for many IT job positions also show economies of scale. These metrics include servers (or OS instances) per server support staff member, network devices per network support staff member, PCs per desktop support staff member, and users per help desk staff member.

Therefore, when benchmarking IT staffing at the individual job-position level, be sure to pay close attention to metrics for organizations of similar size, regardless of industry sector.

Other IT Spending Ratios Vary by Industry and Company Size

Despite the above, some ratios are influenced by both industry sector and organization size. In this case, it is best to review the metrics for both. If you see a significant difference by industry sector, go with those metrics. If there is variation by size of organization, go with organization size metrics. If both, you may want to consider both.

Finally, although we said that overall IT spending levels vary by industry sector, there is a secondary influence by organization size. We can see in our data that larger companies within the same sector tend to spend more on IT as a percentage of revenue than their smaller counterparts. The same is true for IT spending per employee, IT spending per user, and IT spending per desktop. Therefore, if you see that your overall IT spending level is greater than your industry peers, check to see if you differ significantly in terms of organization size, and factor that into your analysis. This can partially or even fully explain the variance.

Good Sources for IT Spending Ratios and IT Budget Metrics

Computer Economics offers a wide range of IT spending, staffing, and budget ratios by industry sector and organization size. These are available in our annual IT Spending and Staffing Benchmarks study. Individual chapters are available for over 20 industry sectors and subsectors, and for small, midsize, and large organizations. A free executive summary is available.

For those considering purchase of more than one chapter, becoming a Computer Economics client may be a more cost-effective option, as it gives you discounted access to all chapters, as well as access to all our publications on IT spending metrics, IT staffing ratios, IT outsourcing statistics, technology trends, IT best practices, and other advisory reports. In addition, it comes bundled with analyst support at no charge.

For those who are looking for more hands-on assistance, we offer custom IT benchmarking services, which can be bundled with a website subscription for even greater discounts.