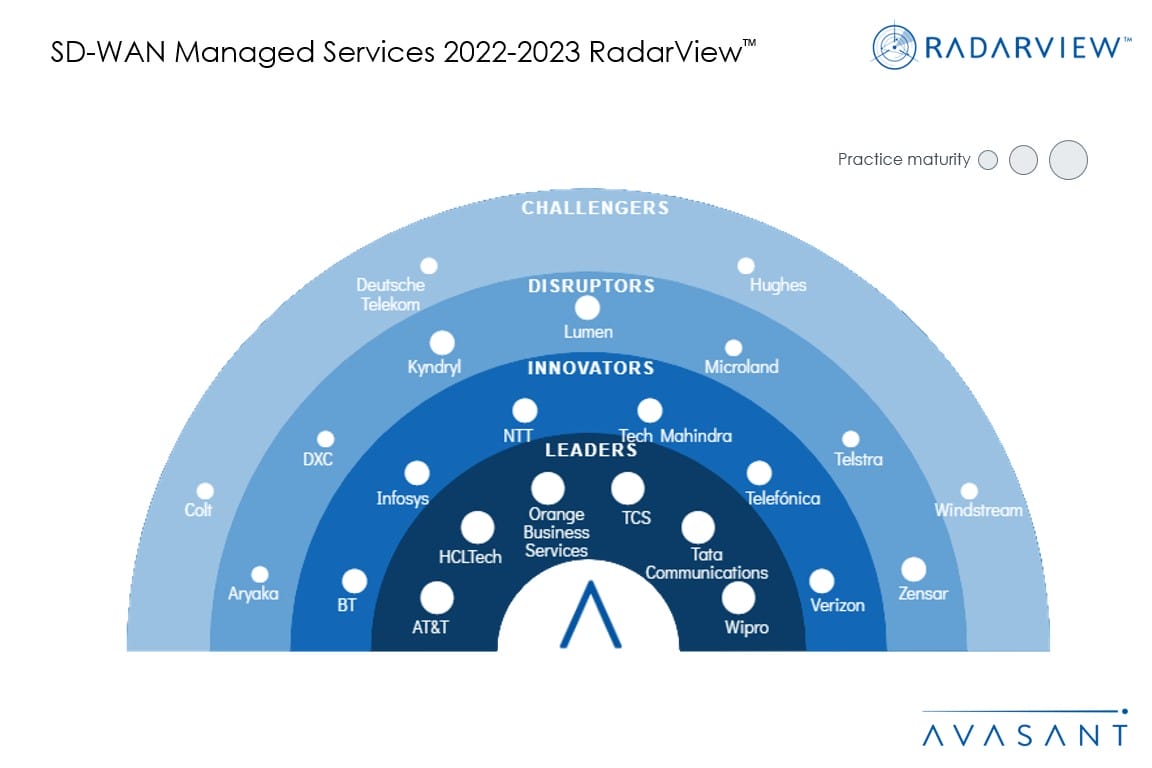

This RadarView helps enterprises identify key service providers that could assist them in implementing and managing software-defined wide area network (SD-WAN) services. It begins with the key market trends and challenges in the managed SD-WAN services space. It is followed by a detailed assessment of 23 leading providers offering SD-WAN managed services.

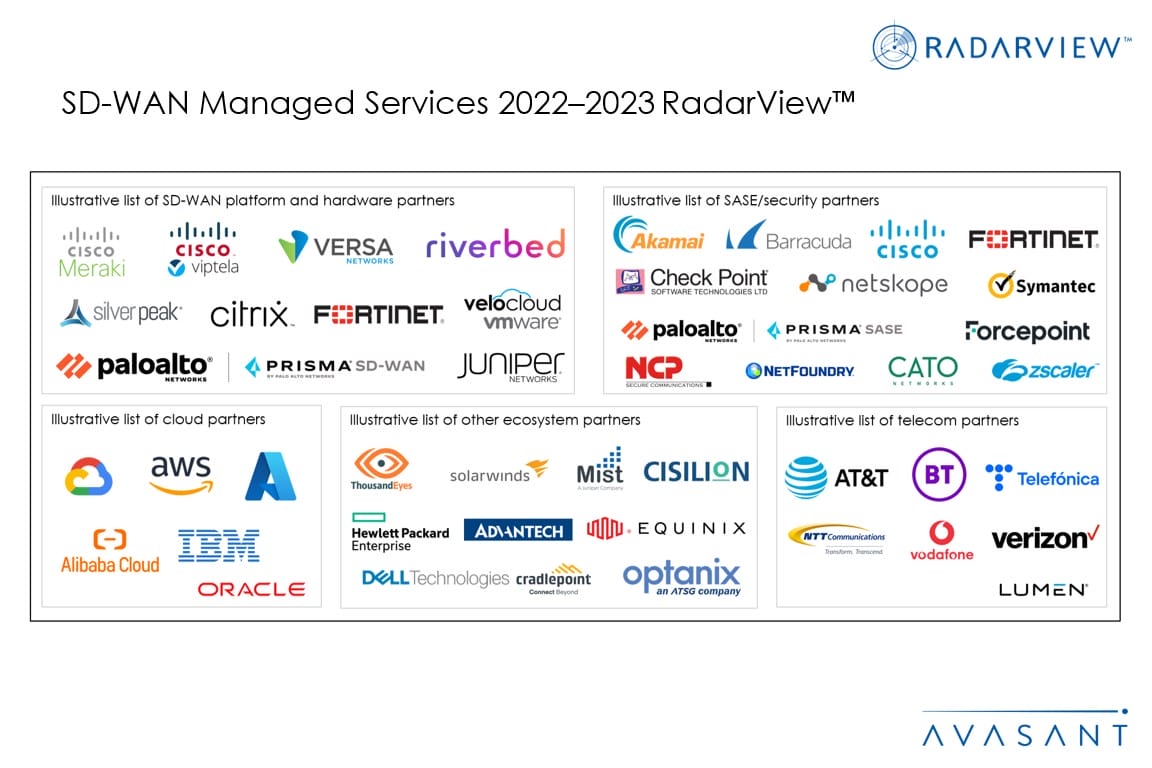

Each profile provides an overview of the service provider, their key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

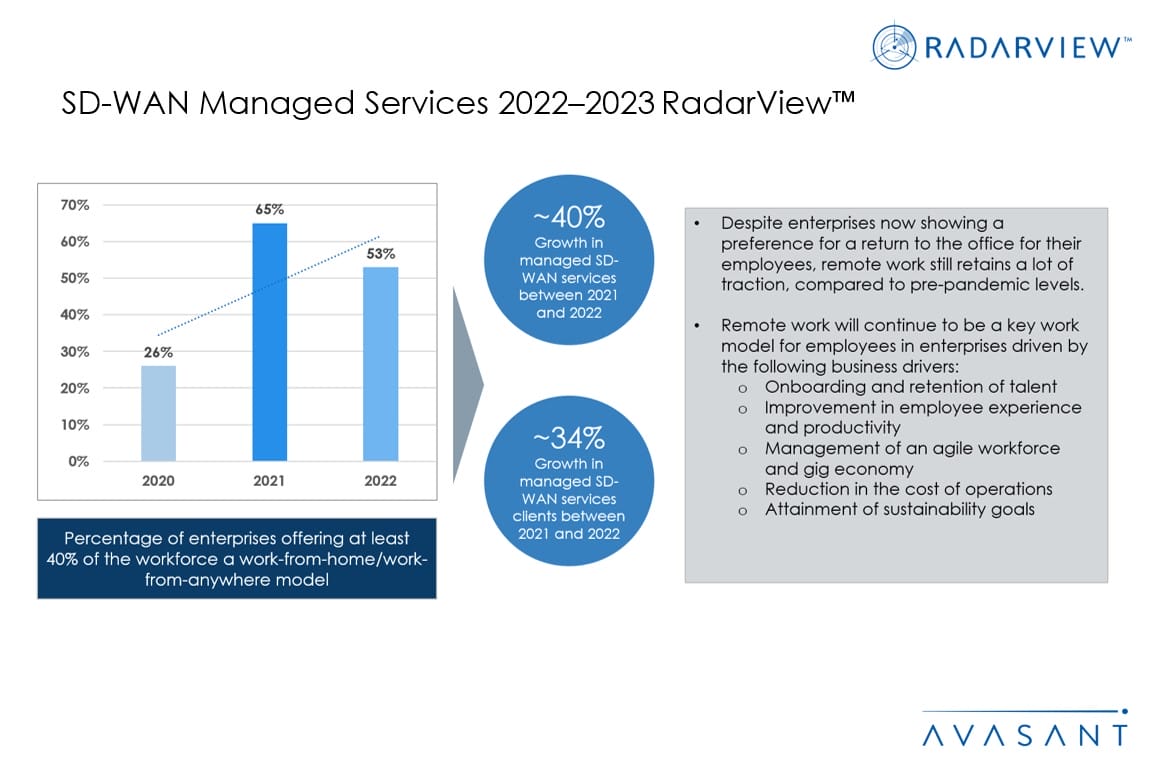

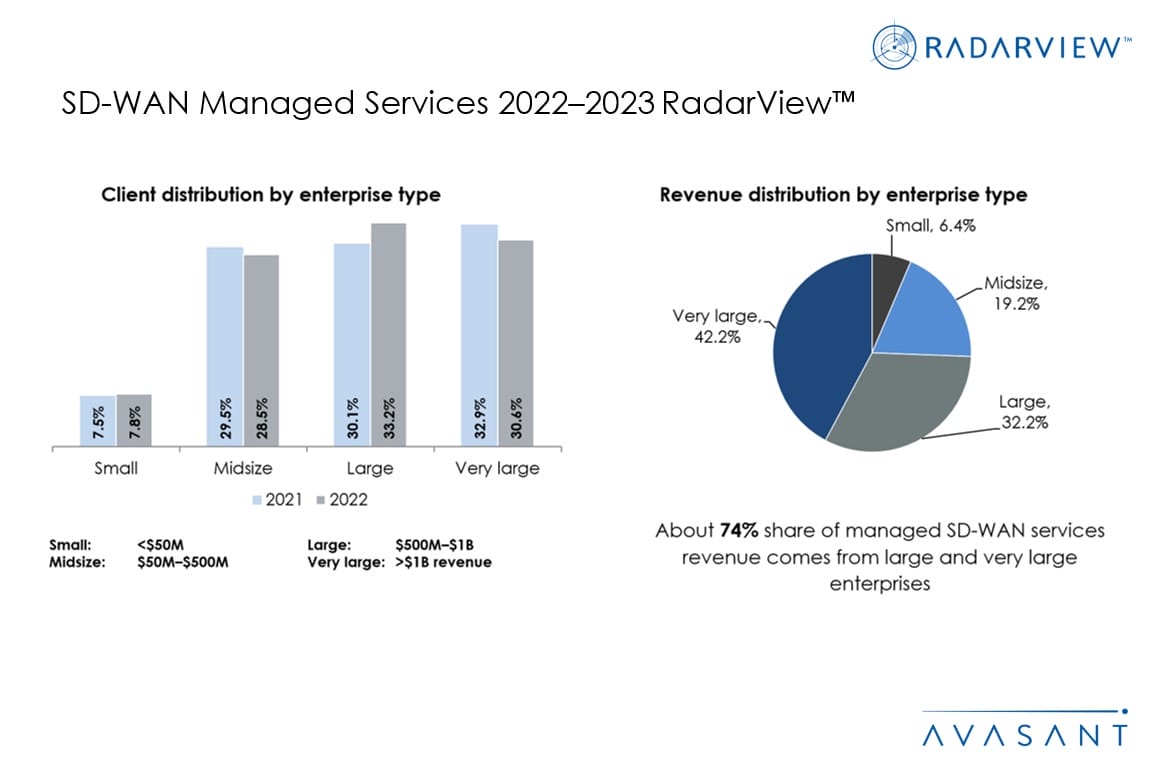

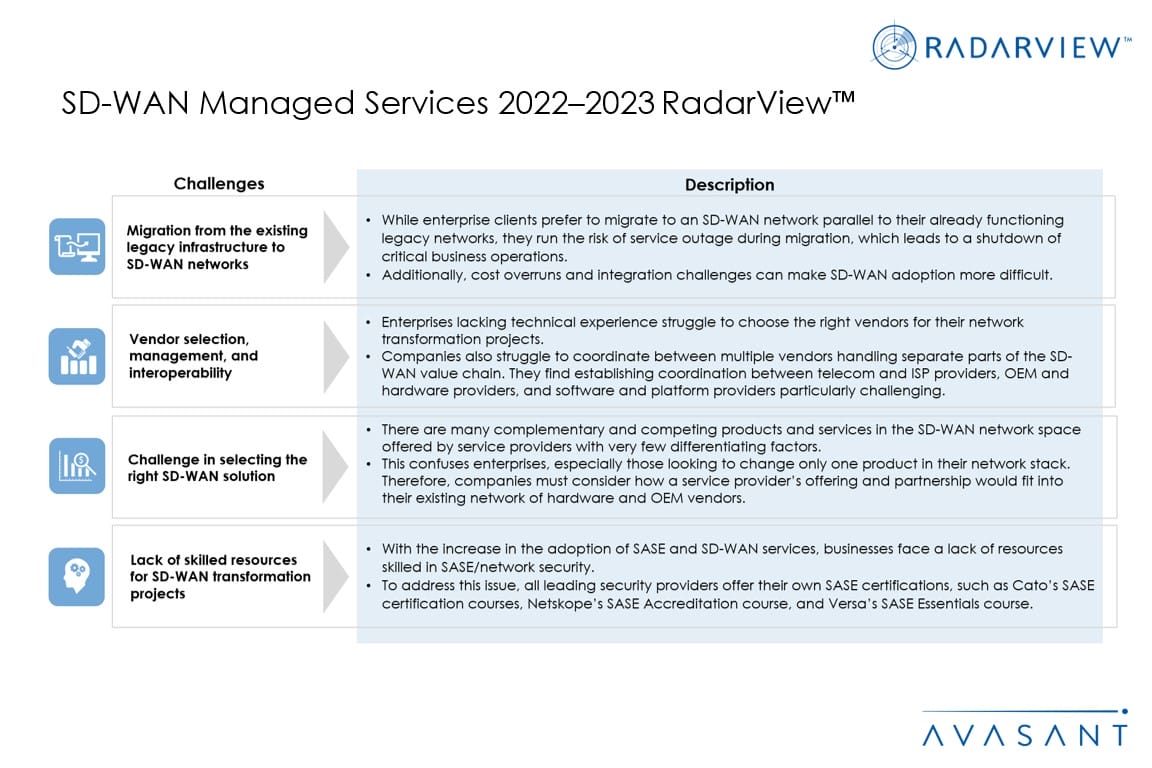

The adoption of managed SD-WAN services has steadily increased in the past couple of years across geographies and industries, driven by a rise in remote work. SD-WAN managed services outsourcing grew by about 40% from 2021 to 2022. Additionally, the enterprise need for network security, effective application, and user and policy optimization is driving joint SD-WAN and SASE implementations. However, businesses still face challenges, such as migration from existing legacy networks, vendor management, and lack of skilled resources, while implementing SD-WAN.

The SD-WAN Managed Services 2022–2023 RadarView highlights key outsourcing trends in the SD-WAN outsourcing space and Avasant’s viewpoint on them. It also offers an analysis of each service provider’s capabilities in technology and delivery support, thus enabling organizations to identify the right strategic partners for their network transformation initiatives.

Featured providers

This RadarView includes a detailed analysis of the following SD-WAN managed services providers: Aryaka, AT&T, BT, Colt, Deutsche Telekom, DXC, HCLTech, Hughes, Infosys, Kyndryl, Lumen, Microland, NTT, Orange Business Services, Tata Communications, TCS, Tech Mahindra, Telefónica, Telstra, Verizon, Windstream, Wipro, and Zensar.

Methodology

The industry insights and recommendations are based on our ongoing interactions with company CXOs and other top executives, targeted discussions with service providers, subject matter experts, and Avasant fellows, and lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and our ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

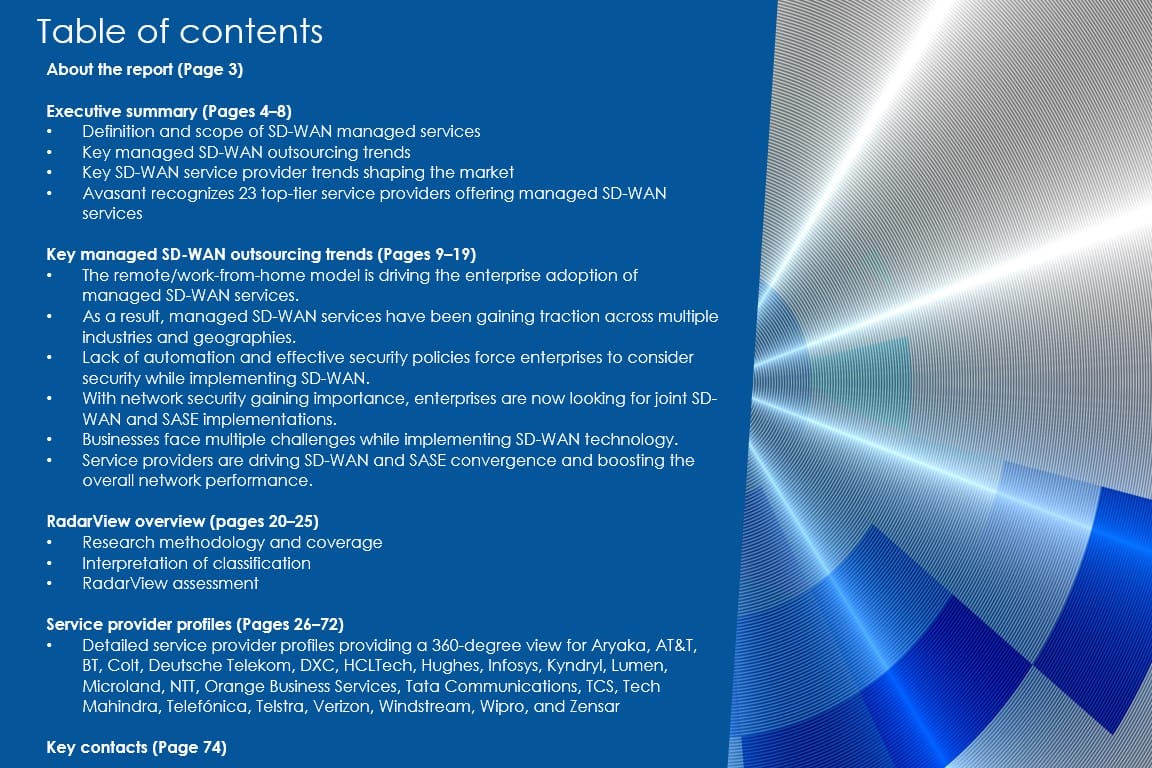

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Definition and scope of SD-WAN managed services

- Key managed SD-WAN outsourcing trends

- Key SD-WAN service provider trends shaping the market

- Avasant recognizes 23 top-tier service providers offering managed SD-WAN services

Key managed SD-WAN outsourcing trends (Pages 9–19)

-

- The remote/work-from-home model is driving the enterprise adoption of managed SD-WAN services.

- As a result, managed SD-WAN services have been gaining traction across multiple industries and geographies.

- Lack of automation and effective security policies force enterprises to consider security while implementing SD-WAN.

- With network security gaining importance, enterprises are now looking for joint SD-WAN and SASE implementations.

- Businesses face multiple challenges while implementing SD-WAN technology.

- Service providers are driving SD-WAN and SASE convergence and boosting the overall network performance.

RadarView overview (pages 20–25)

-

- Research methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 26–72)

-

- Detailed service provider profiles providing a 360-degree view for Aryaka, AT&T, BT, Colt, Deutsche Telekom, DXC, HCLTech, Hughes, Infosys, Kyndryl, Lumen, Microland, NTT, Orange Business Services, Tata Communications, TCS, Tech Mahindra, Telefónica, Telstra, Verizon, Windstream, Wipro, and Zensar

Key contacts (Page 74)

Read the Research Byte based on this report.