The growing enterprise demand for multisourcing service integration (MSI) is mainly driven by complexities in multivendor environments and the need for optimizing IT costs and enhancing service outcomes and quality. Service providers offer multiple end-to-end services to help organizations streamline service delivery processes, enhance supplier management, mitigate risks, and improve vendor collaboration. Additionally, service providers invest in advanced technologies such as AI/ML, automation, and proprietary IT service management tools to optimize service delivery and improve overall outcomes. This rising demand for MSI has also led to a 46% increase in the number of full-time employees working in this field.

Both demand-side and supply-side trends are covered in our Multisourcing Service Integration 2022–2023 Market Insights™ and Multisourcing Service Integration 2022–2023 RadarView™ , respectively. These reports present a comprehensive study of MSI service providers and closely examine market leaders, innovators, disruptors, and challengers.

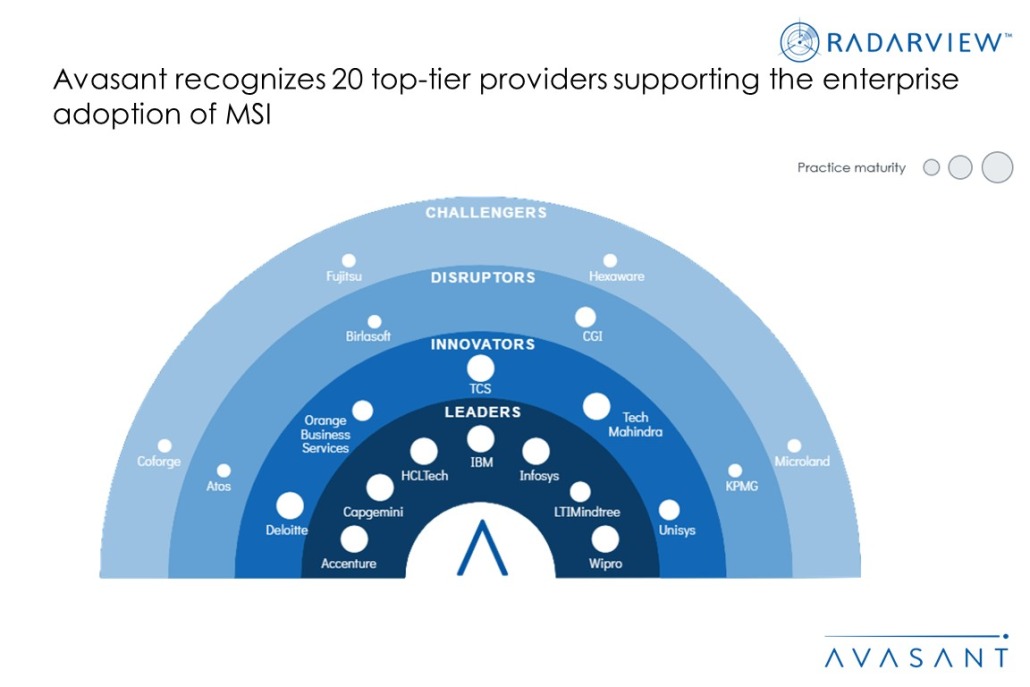

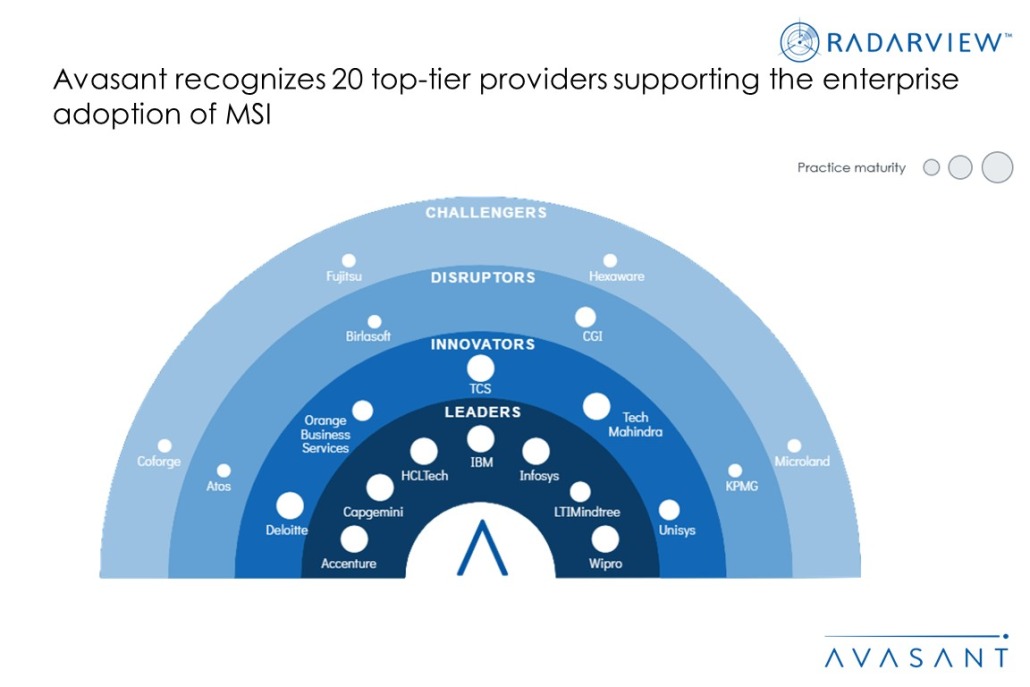

We evaluated 32 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 32 providers, we recognized 20 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, HCLTech, IBM, Infosys, LTIMindtree, and Wipro

- Innovators: Deloitte, Orange Business Services, TCS, Tech Mahindra, and Unisys

- Disruptors: Atos, Birlasoft, CGI, and KPMG

- Challengers: Coforge, Fujitsu, Hexaware, and Microland

Figure 1 below from the full report illustrates these categories:

“The success of MSI lies in its ability to provide a unified view of service delivery processes,” said Avasant Principal James Lee. “This approach allows organizations to make informed decisions and optimize their overall service delivery performance.”

The reports provide several findings, including the following:

-

- Around 40% of MSI traction comes from the financial services and manufacturing industries. The adoption rate in these industries is high because financial institutions operate in various locations with multiple local vendors and manufacturing companies dealing with complex supply chains.

- The MSI workforce grew by 46% YOY. The roles in demand include service level manager, contract manager, and governance manager.

- Service providers plan to invest 50% of their MSI investment budget in asset development and practice growth. These investments include developing platforms with automation capabilities and training resources to meet the required digital skill sets.

- MSI engagements that involve issues related to change management amount to 95%. This is followed by engagements tackling challenges of contractual complexities, which lack a clear definition of supplier roles and responsibilities.

“Enterprises seek value in MSI to improve overall business agility,” said A. Tarun, senior research analyst with Avasant. “By streamlining service delivery processes and optimizing supplier relationships, organizations can better manage risks and respond more quickly to changing market conditions.”

The report also features detailed RadarView profiles of 20 service providers, along with their solutions, offerings, and experience in assisting enterprises in their MSI journeys.

This Research Byte is a brief overview of the Multisourcing Service Integration 2022–2023 Market Insights™ and Multisourcing Service Integration 2022–2023 RadarView™. (click for pricing).