Over the past two years, Workday has continued its growth with an increased focus on midsize enterprises, and those based outside North America. With the rising demand for Workday HCM solutions, businesses increasingly rely on service providers for implementation and managed services. In addition, use cases have expanded beyond streamlining processes and scaling HR operations to providing self-service capabilities and enhancing real-time insights.

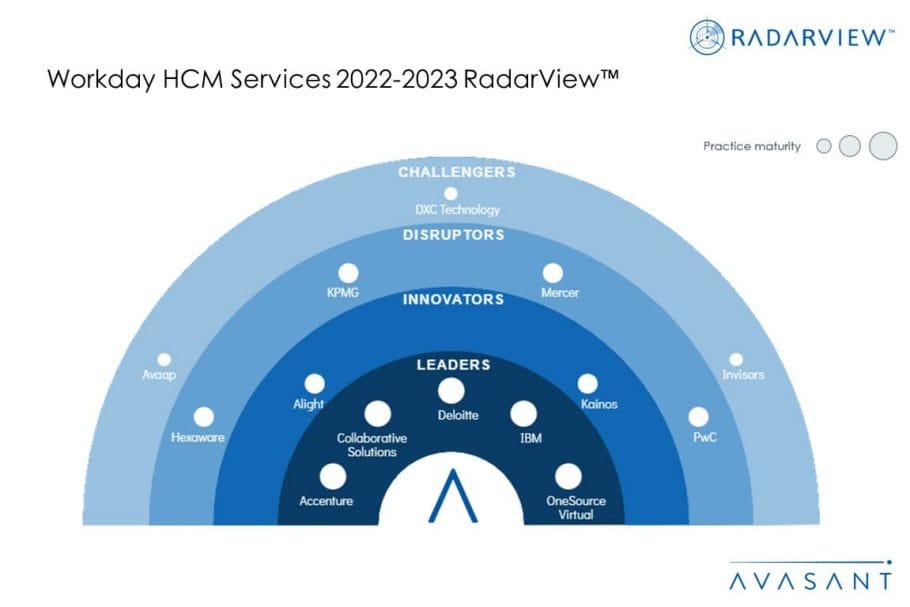

This is one of the top findings from Avasant’s Workday HCM Services 2022–2023 RadarView™, a comprehensive study on Workday HCM service providers. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

This report also addresses the need for organizations to accelerate their digital journeys, embrace the cloud, and identify the right Workday HCM service providers. It highlights key trends in the Workday services market and our view on the market’s direction over the next 12 to 18 months.

Avasant evaluated 36 providers using three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 36 providers, 14 are recognized as having brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Accenture, Collaborative Solutions, Deloitte, IBM, and OneSource Virtual

- Innovators: Alight and Kainos

- Disruptors: Hexaware, KPMG, Mercer, and PwC

- Challengers: Avaap, DXC Technology, and Invisors

The following figure from the full report illustrates these categories:

“Workday has always had a pretty substantial professional services group along with its services partner ecosystem,” said Frank Scavo, a partner at Avasant. “But to support its growth into the midsize segment and into international markets, it’s having to lean more heavily on those partners.”

Here are some key findings from the full report:

-

- Workday is increasing its reliance on service providers for implementation and managed services to diversify its target customers from large global enterprises to include small and midsized organizations and regional players outside North America.

- Enterprises are implementing Workday HCM to streamline HR processes, improve real-time visibility, and enhance self-service capabilities.

- Companies are benefitting from proprietary tools and accelerators developed by service providers. These tools and accelerators help firms address data errors while migrating data, standardizing HR processes, delivering faster outcomes, and identifying process redundancies.

- Organizations want service providers who understand their business requirements and offer industry-specific solutions and accelerators. They look for service providers with Workday HCM-certified consultants to handle their end-to-end transformation projects.

- Many customers rely on service providers to manage the day-to-day operation and administration of the Workday HCM suite. These usually include application maintenance and support, service optimization, and enhancements.

“You might think that Workday, as a pure cloud system, wouldn’t have a need for ongoing application management services,” said Gaurav Dewan, associate research director with Avasant. “But we see many customers still finding value in using service providers for day-to-day process optimization and to maintain integration points with third-party systems.”

The full report also features detailed profiles of the top 14 service providers, including their solutions, offerings, and experience in assisting enterprises in digital transformation.

This Research Byte is a brief overview of the Workday HCM Services 2022 RadarView™ (click for pricing).