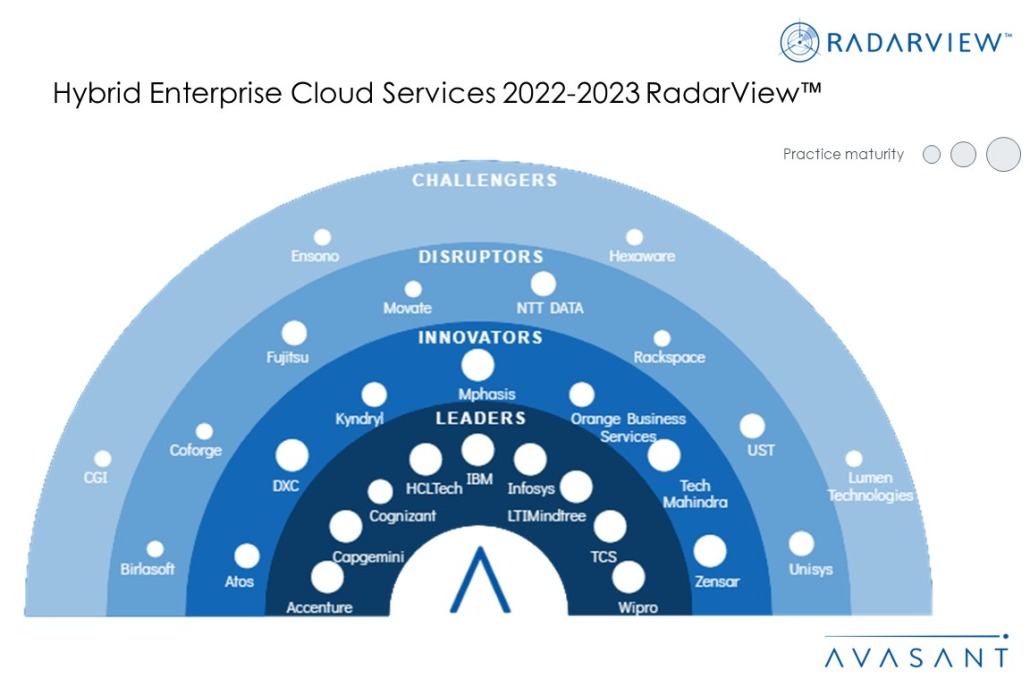

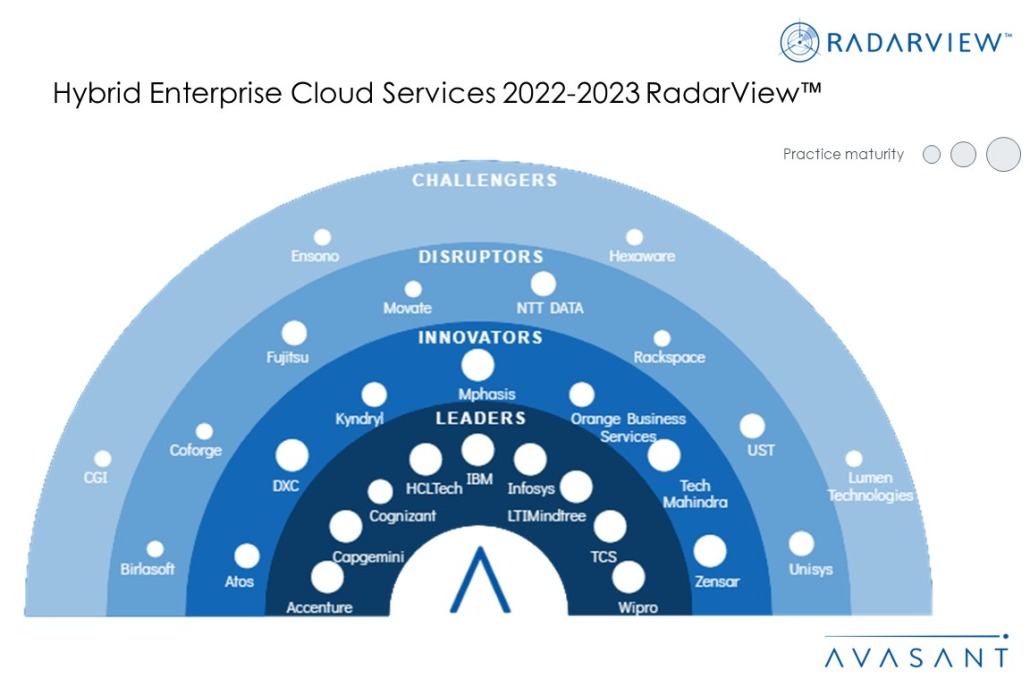

This report helps enterprises chart their action plan for developing a hybrid cloud environment by identifying potential service providers. It begins with a summary of key trends and challenges shaping the hybrid cloud space. Avasant completed a detailed assessment of 28 service providers for hybrid cloud. Each profile provides an overview of the service provider, its cloud-specific solutions, and a list of representative clients and partnerships, along with brief case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovations.

Why read this RadarView?

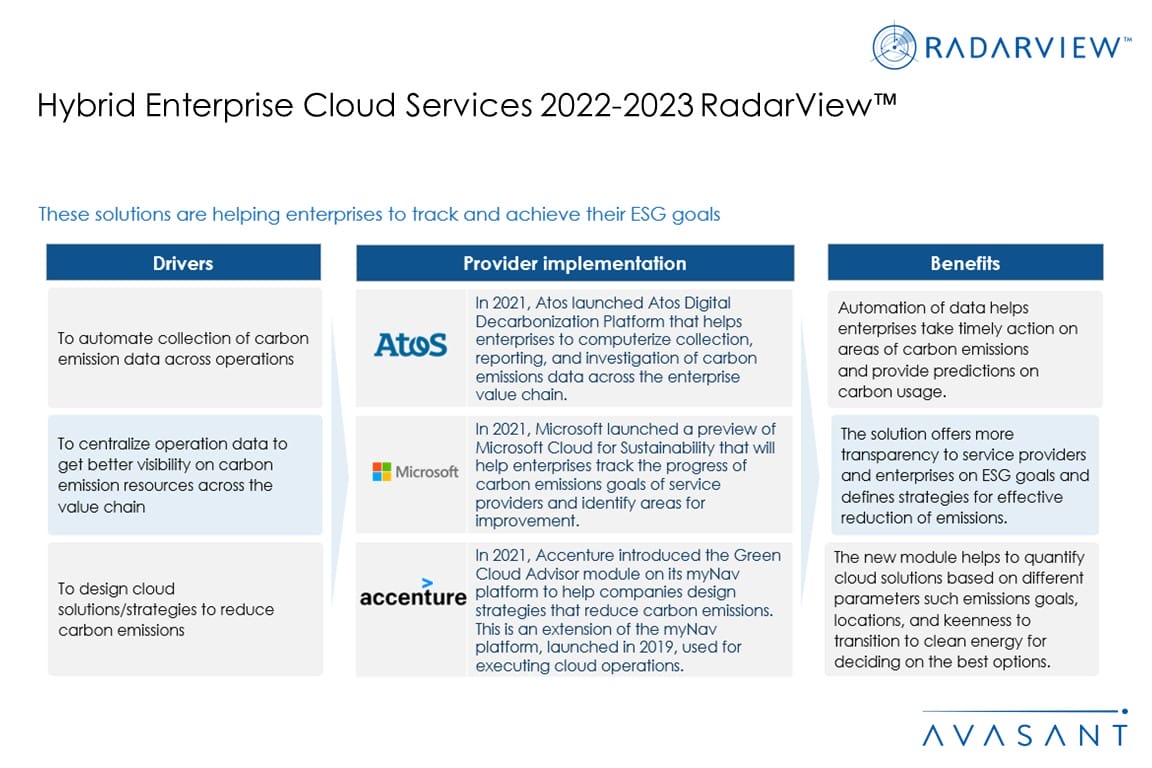

Enterprises want to automate cloud operations for faster rollout of features and upgrades to deliver personalized products and services. Thus, service providers are addressing the changing needs of businesses by developing assets and accelerators that facilitate customized cloud transformation strategies and ensure seamless performance across a hybrid cloud environment.

This report helps companies use hybrid cloud to accelerate their digital journey. It also provides information to assist businesses in identifying the right hybrid cloud service provider to support them in their implementation plan.

Featured Providers

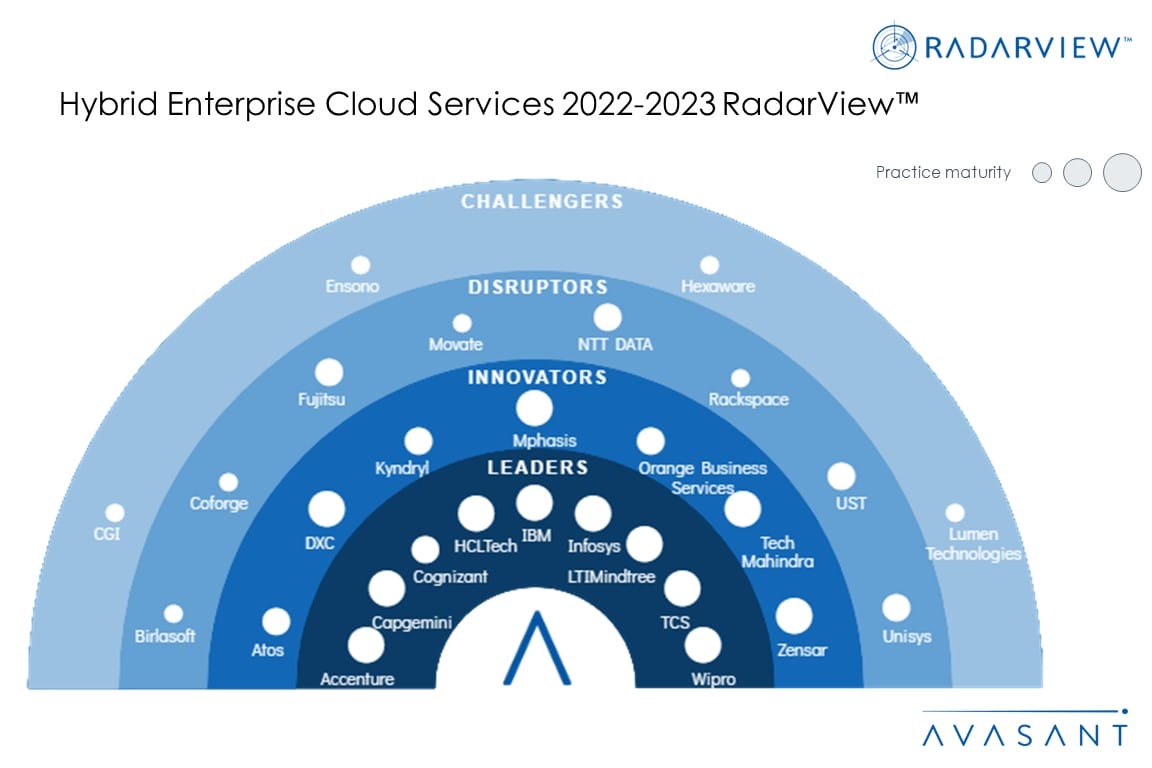

This RadarView includes an analysis of the following digital service providers in the hybrid cloud space: Accenture, Atos, Birlasoft, Capgemini, CGI, Coforge, Cognizant, DXC, Ensono, Fujitsu, HCLTech, Hexaware, IBM, Infosys, Kyndryl, LTIMindtree, Lumen Technologies, Movate, Mphasis, NTT DATA, Orange Business Services, Rackspace Technology, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

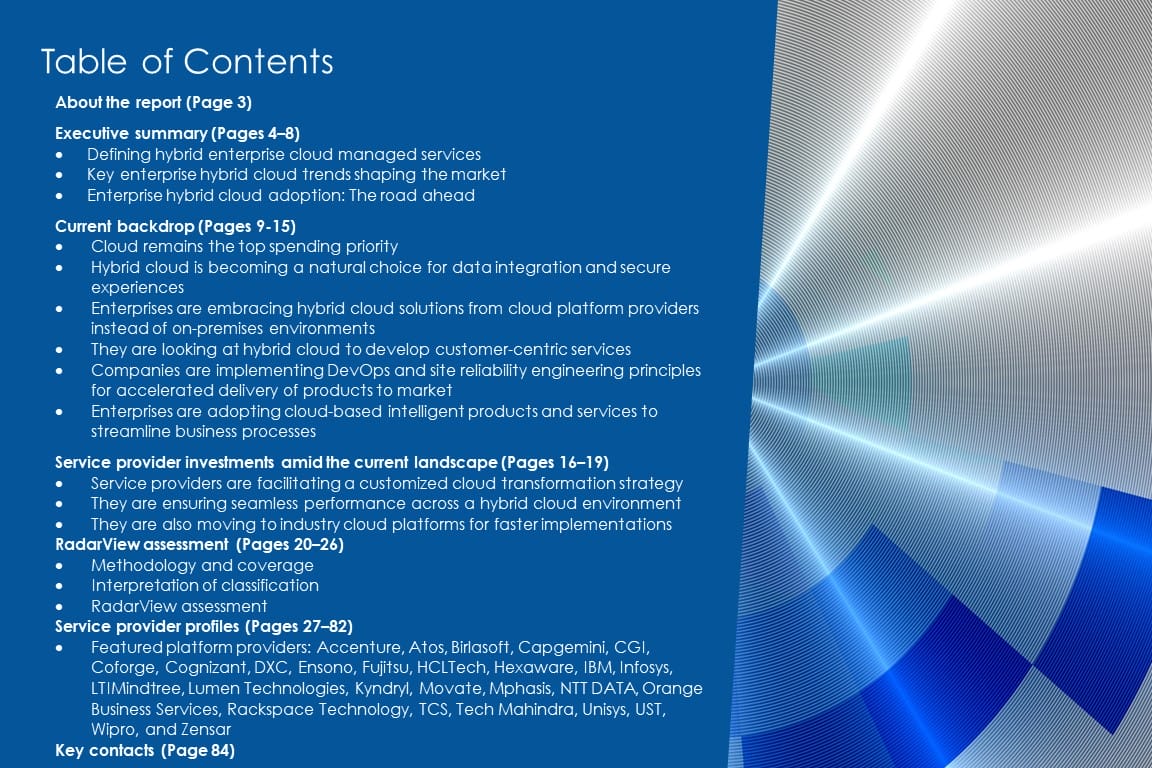

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining hybrid enterprise cloud managed services

- Key enterprise hybrid cloud trends shaping the market

- Enterprise hybrid cloud adoption: The road ahead

Current backdrop (Pages 10–15)

-

- Cloud remains the top spending priority

- Enterprises are embracing hybrid cloud solutions from cloud platform providers instead of on-premises environments

- They are looking at hybrid cloud to develop customer-centric services

- Companies are implementing DevOps and site reliability engineering principles for accelerated delivery of products to market

- Enterprises are adopting cloud-based intelligent products and services to streamline business processes

Service provider investments amid the current landscape (Pages 16–19)

-

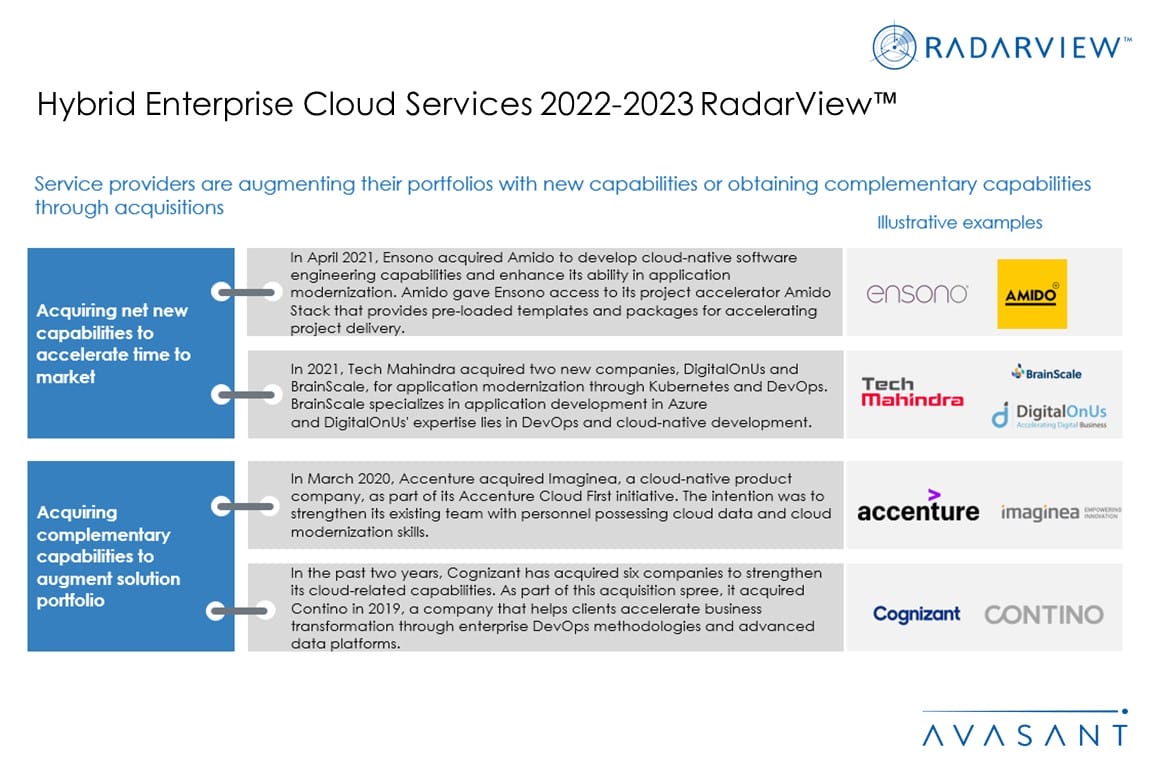

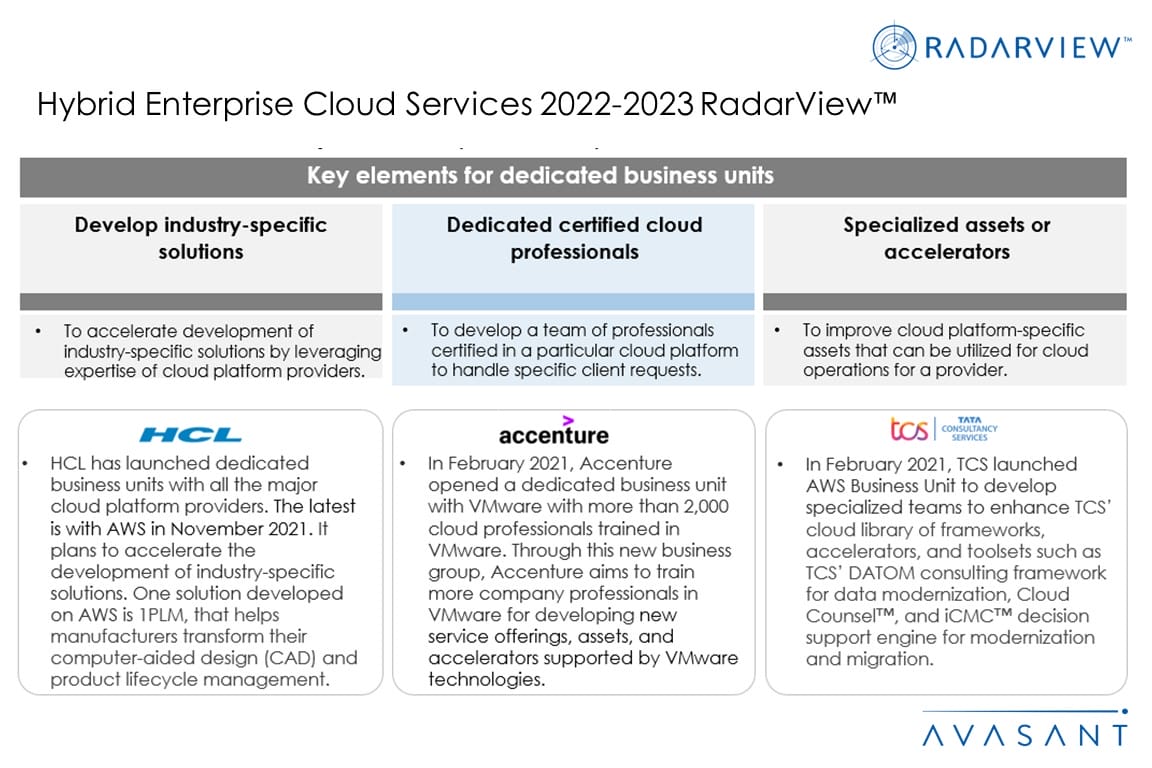

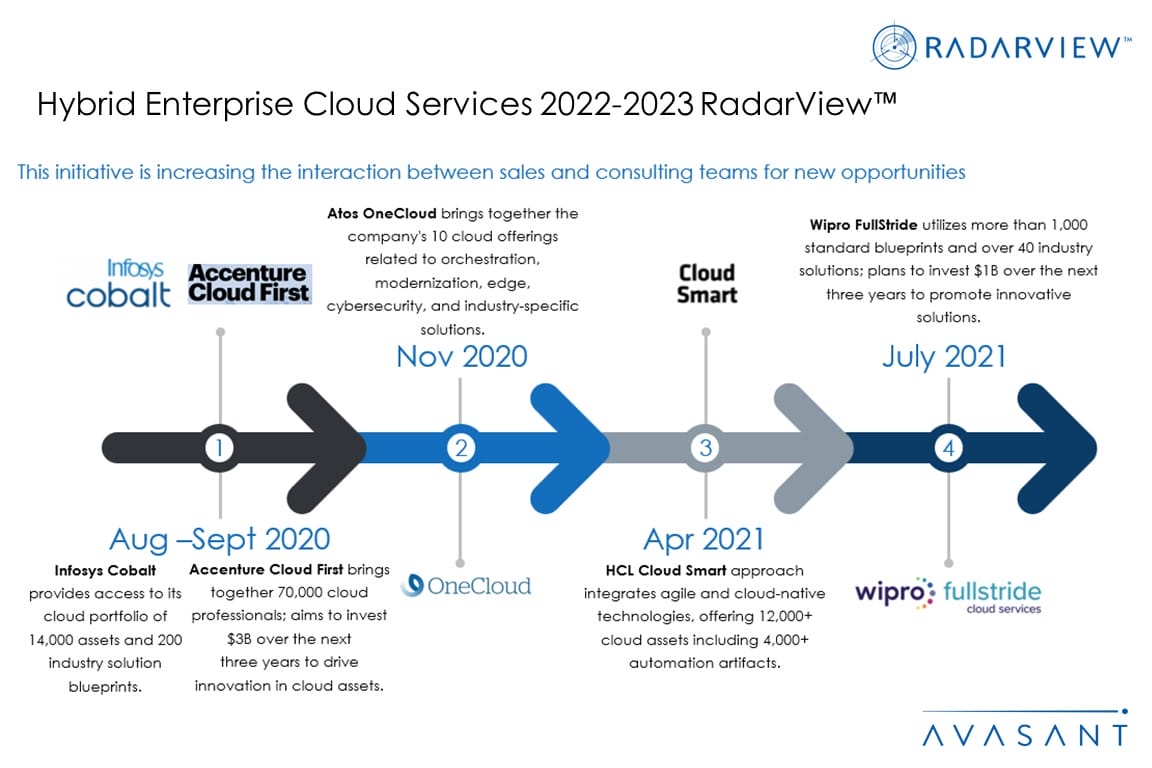

- Service providers are developing assets and accelerators that facilitate a customized cloud transformation strategy

- They are ensuring seamless performance across a hybrid cloud environment

- They are also moving to industry cloud platforms for faster implementations

RadarView overview (Pages 20–26)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 27–82)

-

- Accenture, Atos, Birlasoft, Capgemini, CGI, Coforge, Cognizant, DXC, Ensono, Fujitsu, HCLTech, Hexaware, IBM, Infosys, Kyndryl, LTIMindtree, Lumen Technologies, Movate, Mphasis, NTT DATA, Orange Business Services, Rackspace Technology, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Authors (Page 84)

Read the Research Byte based on this report.