The procurement business function has traditionally been cost-focused. However, supply chain disruptions from recent global crises have shown the need for a more agile procurement process. CPOs are responding by planning for inflation with advanced purchasing, using AI to find alternate sourcing options to deal with disruptions, and even personalizing the employee buying experience to look more like e-commerce. To meet these evolving demands, enterprises are increasingly turning to service providers to transform their procurement functions. Service provider procurement business process transformation revenue grew by 13% between March 2021 and March 2022.

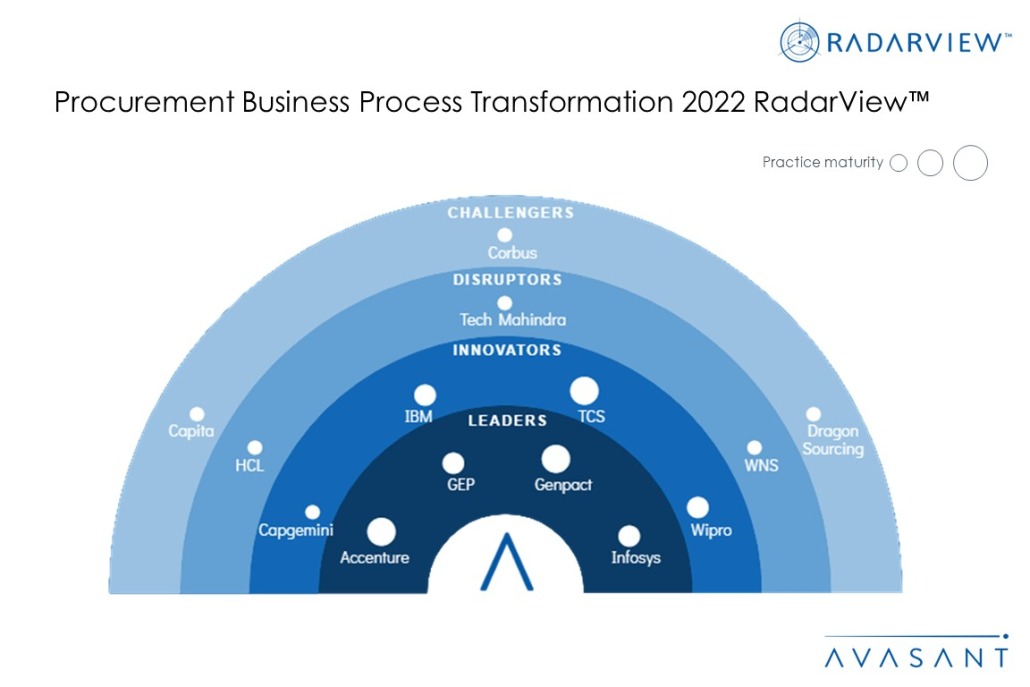

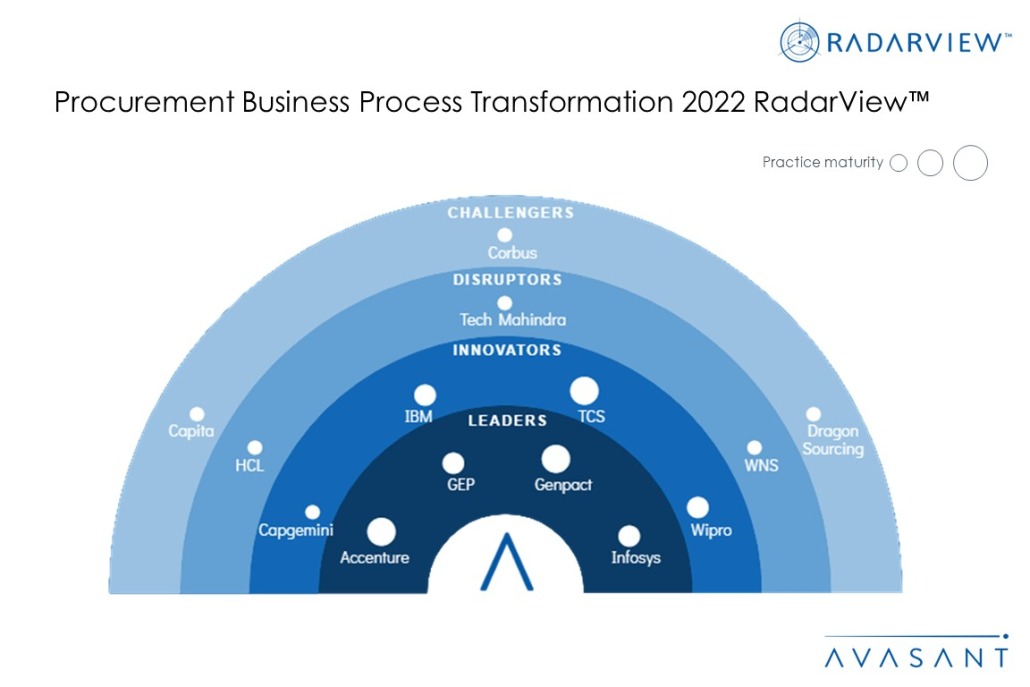

These trends and others are covered in our Procurement Business Process Transformation 2022 RadarView™. The report is a comprehensive study of procurement business process transformation service providers, along with top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

We evaluated over 20 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of these, we recognized 14 providers that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, GEP, Genpact, and Infosys

- Innovators: Capgemini, IBM, TCS, and Wipro

- Disruptors: HCL, Tech Mahindra, and WNS

- Challengers: Capita, Corbus, and Dragon Sourcing

Figure 1 from the full report illustrates these categories:

“CPOs are reimagining the procurement function in the face of high inflation and global supply chain disruptions,” said Shobhit Patnaik, partner at Avasant. “Enterprises need to adopt digital procurement platforms, invest in strategic sourcing skills, and integrate their processes to become more resilient.”

The full report provides a number of findings and recommendations, including the following:

-

- To meet new business challenges, enterprises need advanced technology systems, specialized skillsets, and streamlined processes. They often engage with service providers to meet these demands, leading to a 13% growth in procurement service provider revenue between March 2021 and March 2022.

- To minimize concentration risk, enterprises are looking to reduce their dependence on select low-cost nations such as China. Furthermore, firms are adopting artificial intelligence, analytics, and automation solutions to proactively manage supply chain risks and improve supplier collaboration.

- Enterprises continue to focus on managing their core and tail spend through spend categorization and analytics. Further, they are setting up procurement buy desks to reduce maverick spend by employees.

- To improve procurement compliance, companies are striving to deliver an “Amazon-like” guided buying experience through which employees get access to a conversational user interface, a preferred list of suppliers, and seamless order tracking capabilities.

“The procurement business function is suddenly crucial. It is no longer just about the bottom line. Without a good procurement function, assembly lines stop.,” said Shwetank Saini, research leader at Avasant. “Digital transformation of procurement is vital to agility and resiliency, and enterprises need all the help they can get.”

The full RadarView also features detailed profiles of 14 service providers, along with their solutions, offerings, and experience in delivering procurement business process transformation services.

This Research Byte is a brief overview of the Procurement Business Process Transformation 2022 RadarView™ (click for pricing).