Reports

Showing 993–1008 of 4763 results

-

![Manufacturing Digital Services 2025 Market Insights™ MI Image 1 - Manufacturing Digital Services 2025 Market Insights™]()

Manufacturing Digital Services 2025 Market Insights™

The Manufacturing Digital Services 2025 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the manufacturing industry. The report also highlights key challenges that enterprises face today in this space.

June, 2025

-

![Manufacturing Digital Services 2025 RadarView™ RV Image - Manufacturing Digital Services 2025 RadarView™]()

Manufacturing Digital Services 2025 RadarView™

The Manufacturing Digital Services 2025 RadarView™ can help manufacturing enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid these enterprises in identifying the right partners and service providers to accelerate their digital transformation in this space. The 98-page report also highlights top market trends in the manufacturing industry and Avasant’s viewpoint.

June, 2025

-

![Manufacturing ESG Maturity Benchmark Study 2024–2025 Product Image ESG Report - Manufacturing ESG Maturity Benchmark Study 2024–2025]()

Manufacturing ESG Maturity Benchmark Study 2024–2025

The Manufacturing ESG Maturity Benchmark Study 2024–2025 evaluates the Environmental, Social, and Governance (ESG) performance of 22 leading manufacturing enterprises across global markets. This benchmarking study assesses companies based on more than 80 metrics within four dimensions: environment, social, governance, and ESG disclosure compliance and complexity. It offers actionable insights into industry trends, regulatory compliance, decarbonization efforts, and social responsibility, helping enterprises align their operations with evolving global standards, such as the CSRD and UN SDGs.

November, 2024

-

![Manufacturing ESG Maturity Benchmark Study 2024–2025: Driving Sustainable Sourcing by Engaging with Progressive Partners Product Image ESG Report - Manufacturing ESG Maturity Benchmark Study 2024–2025: Driving Sustainable Sourcing by Engaging with Progressive Partners]()

Manufacturing ESG Maturity Benchmark Study 2024–2025: Driving Sustainable Sourcing by Engaging with Progressive Partners

This is the first edition of the Manufacturing ESG Maturity Benchmark Study 2024–2025, featuring 22 enterprises. The enterprises have been assessed based on their sustainability disclosures, strategy, and transparency and have been classified and benchmarked based on more than 80 metrics spread across four topics: environmental, social, governance, and ESG disclosure compliance and complexity. As the sector faces increased scrutiny due to new regulations, such as the Corporate Sustainability Reporting Directive (CSRD) in the EU, this study offers a critical evaluation of enterprises across abovementioned four key pillars.

November, 2024

-

![Manufacturing in the Era of Tariff Uncertainties Manufacturing in the era of tariff uncertainties content image - Manufacturing in the Era of Tariff Uncertainties]()

Manufacturing in the Era of Tariff Uncertainties

The manufacturing industry is heavily impacted by international trade as most major enterprises have complex, multi-country supply chains. With a swathe of new tariffs being declared by the US in early 2025, and the subsequent retaliatory steps taken by countries impacted by the tariffs, manufacturers are dealing with a significantly more volatile environment than they have seen in the past This research byte explores the nature of these tariffs, and the associated trade wars, and how they are different from previous trade disputes. It also examines what manufacturers can do to enable supply chain resilience and mitigate the tariff risks. It also explores the need to invest in strong data management and technology adoption to create future-proof operations.

March, 2025

-

![Manufacturing Smart Industry Services 2023 Market Insights™ Manufacturing - Manufacturing Smart Industry Services 2023 Market Insights™]()

Manufacturing Smart Industry Services 2023 Market Insights™

The Manufacturing Smart Industry Services 2023 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any smart industry projects. The report also highlights the ER&D domain’s traditional state and its evolution.

May, 2023

-

![Manufacturing Smart Industry Services 2023 RadarView™ PrimaryImage Manufacturing Smart Industry Services 2023 RadarView - Manufacturing Smart Industry Services 2023 RadarView™]()

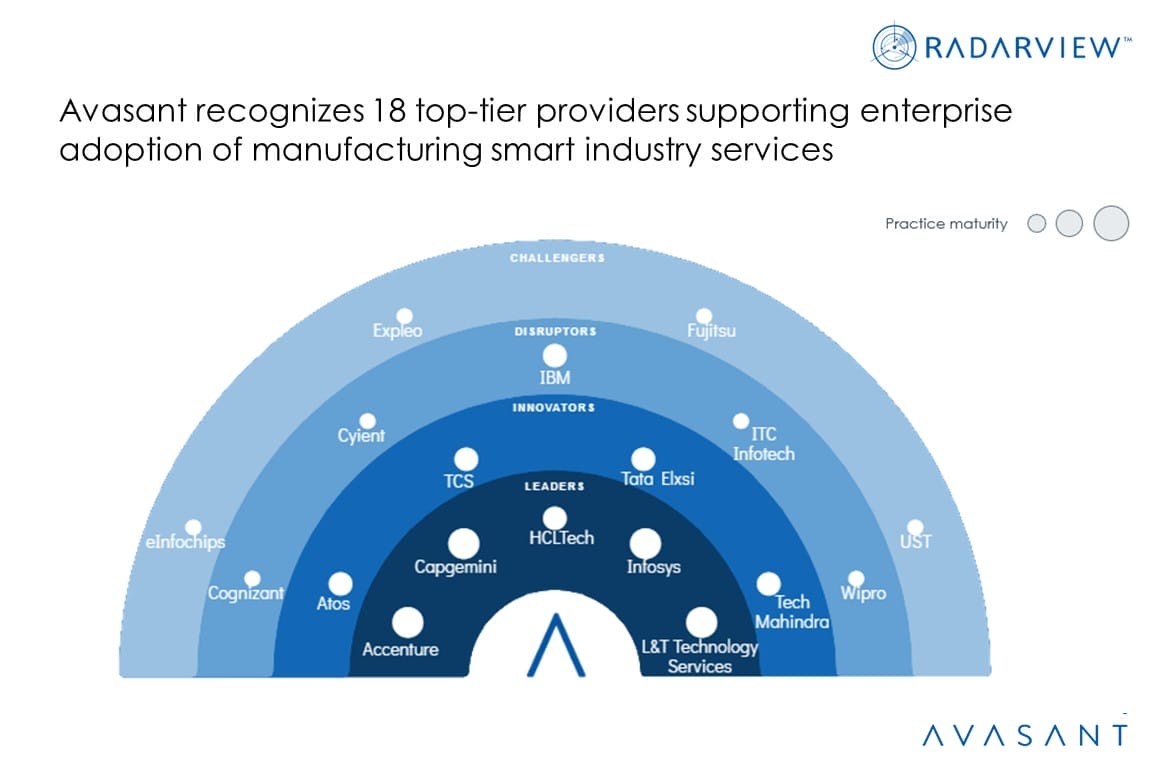

Manufacturing Smart Industry Services 2023 RadarView™

The Manufacturing Smart Industry Services 2023 RadarView™ assists organizations in identifying strategic partners for engineering and manufacturing transformation by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key manufacturing smart industry service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right services partner. The 58-page report highlights top supply-side trends in the manufacturing smart industry space and Avasant’s viewpoint on them.

May, 2023

-

![Manufacturing Smart Industry Services: Empowering ER&D Through Digitalization MoneyShot Manufacturing Smart Industry Services 2023 - Manufacturing Smart Industry Services: Empowering ER&D Through Digitalization]()

Manufacturing Smart Industry Services: Empowering ER&D Through Digitalization

Engineering and manufacturing enterprises have always had complex IT and OT environments and faced integration challenges. Concerns about security, connectivity, and customization hindered their digitalization efforts. However, due to cost pressures, changing customer demands, and rising product complexity, companies are now actively transforming their processes. This requires digitalizing IT and OT operations and investing in product and software engineering skills. To accelerate their digital transformation, enterprises are engaging with digital engineering service providers, leading to a 15% growth in manufacturing smart industry deals between December 2021 and December 2022. Both demand- and supply-side trends are covered in Avasant’s Manufacturing Smart Industry Services 2023 Market Insights™ and Manufacturing Smart Industry Services 2023 RadarView™, respectively.

May, 2023

-

![Market Insights on Strategy Consulting and Big Four: An Analysis of Trends, Revenue, Growth, and Partnerships woocommerce placeholder 300x200 - Market Insights on Strategy Consulting and Big Four: An Analysis of Trends, Revenue, Growth, and Partnerships]()

Market Insights on Strategy Consulting and Big Four: An Analysis of Trends, Revenue, Growth, and Partnerships

This report traces the key business trends among the Big Four and Strategy Consulting firms during the pre-pandemic and post-pandemic periods (FY 2018 to FY 2023) to understand the revenue, head count, and business segment growth within these firms. It also looks at the changing ratios, such as revenue per employee, revenue per partner, and key leadership changes in different sectors. The report also explores in detail the strategic partnerships of different firms by geography, partnerships across different business service lines (ITO, BPO, and Digital), and key technologies in the past 12-18 months to evaluate how these firms are making attempts to focus on growth in the current times. Finally, the report highlights some key developments on the technology front by looking at the progress made in the generative AI (Gen AI) space by some of these organizations to improve their business capabilities and expedite overall growth.

April, 2024

-

![Marvell Continues to Chip Away at Silicon Rivals RB Product Image Marval 1 - Marvell Continues to Chip Away at Silicon Rivals]()

Marvell Continues to Chip Away at Silicon Rivals

Marvell Technology, once a humble manufacturer of chips for storage devices and networking equipment, has undergone a remarkable transformation. We check in with Marvell’s growing market share and new initiatives at an industry analyst day.

December, 2023

-

![Marvell's Silicon Surge Continues Product Image Tech Innovatr - Marvell's Silicon Surge Continues]()

Marvell’s Silicon Surge Continues

SANTA CLARA, Calif.—Semiconductor maker Marvell Technology has experienced a significant surge this year, and it’s due in large part to its focus on making custom silicon for hyperscalers. Founded in 1995, Marvell started with an emphasis on consumer electronics. But it transformed itself into a global semiconductor company that designs, develops, and markets a wide range of integrated circuits. The company’s products are used in data centers, networking, storage, and consumer electronics. We attended Marvell’s Analyst Day this week to learn more about the surge this year and its plans for the future.

December, 2024

-

![Maximizing Value in Multisourcing Environments with Streamlined Governance Slide1 3 3 - Maximizing Value in Multisourcing Environments with Streamlined Governance]()

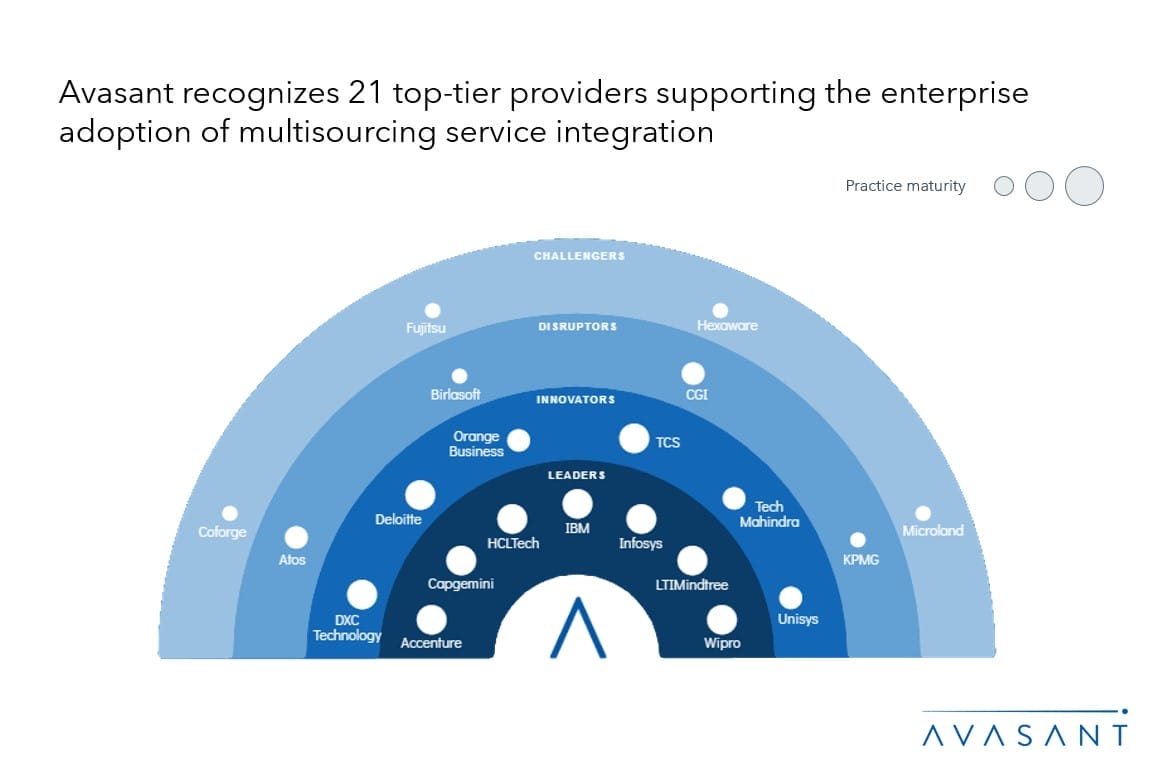

Maximizing Value in Multisourcing Environments with Streamlined Governance

Multisourcing is a strategy that involves outsourcing different services to multiple vendors. However, around 85% of organizations face significant challenges such as ineffective communication and lack of cross-supplier collaboration while executing multisourcing service integration (MSI) services. Service providers take this narrative forward by implementing a comprehensive set of MSI capabilities such as effective risk mitigation strategies, centralized governance, and consistent service level agreements. Additionally, service providers also leverage generative AI for MSI services to streamline workflows, offer data-driven insights, and accelerate process execution.

April, 2024

-

![Media and Entertainment Digital Services 2023–2024 Market Insights™ PrimaryImage Media and Entertainment Digital Services - Media and Entertainment Digital Services 2023–2024 Market Insights™]()

Media and Entertainment Digital Services 2023–2024 Market Insights™

The Media and Entertainment Digital Services 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact in the future for any digital projects in the media and entertainment space. The report also highlights key challenges that enterprises face today.

June, 2023

-

![Media and Entertainment Digital Services 2023–2024 RadarView™ Primary Image Media Entertainment Digital Services 2023 2024 RadarView - Media and Entertainment Digital Services 2023–2024 RadarView™]()

Media and Entertainment Digital Services 2023–2024 RadarView™

The Media and Entertainment Digital Services 2023–2024 RadarView™ helps media and entertainment enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 77-page report also highlights top market trends in the media and entertainment space and Avasant’s viewpoint.

June, 2023