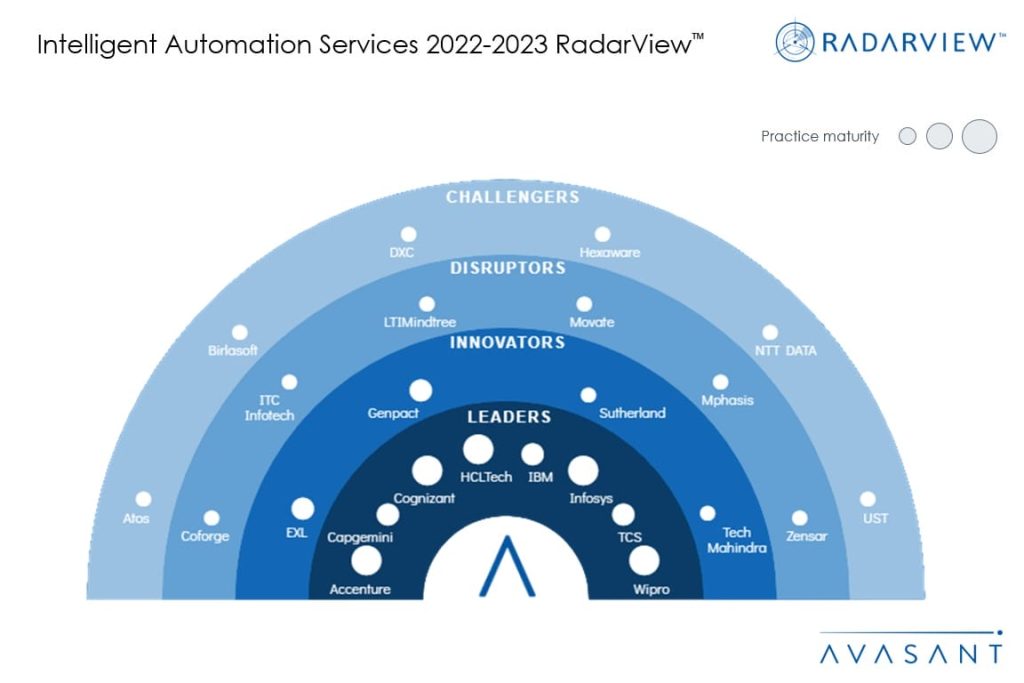

Enterprises face challenges in extracting, organizing, and processing high volumes of unstructured data. However, the advancements in AI have significantly expanded the scope of automation by providing new capabilities such as deep learning and generative AI to automate complex, data-driven tasks with high accuracy. Cognitive bots can now process unstructured data, recognize patterns, and make more informed decisions regarding workflows previously considered too complex for automation. By leveraging automation technologies such as RPA, ML, process mining, and AI, organizations can unlock new levels of productivity, innovation, and growth for increasing customer satisfaction and revenue, and gaining a competitive advantage. These trends, and others, are covered in Avasant’s Intelligent Automation Services 2022–2023 RadarView™.