-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 16: IT Services and Solutions

Chapter 16 provides IT spending and staffing statistics for the IT services and solutions sector. This category includes software companies, SaaS providers, systems integrators, IT solution providers, business process outsourcing firms, and other providers of IT services and solutions. There are 43 organizations in the sample, ranging in size from around $50 million to over $60 billion in annual revenue.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 39: Hospital Subsector Benchmarks

Chapter 39 provides benchmarks for hospitals. The 34 respondents in this subsector range in size from $50 million to over $80 billion in annual revenue. This category includes community hospitals, university hospitals, nonprofit hospitals, health clinics, healthcare systems, and regional healthcare providers.

August, 2025

-

Vendor Discount Report October 2025

The largest and best discounts are often only offered to the vendors’ best customers, and buyers may find it difficult to determine whether the discount offered is typical or whether a better deal can be negotiated. The Vendor Discounts Report is designed to give procurement personnel, lessors, lessees, and departmental manager’s insight and guidance regarding current discount structures on a variety of categories of equipment in the marketplace.

October, 2025

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 2: Composite Benchmarks

The IT spending and staffing outlook for 2023 can best be described with the old British slogan, “keep calm and carry on.” As we mentioned in last year’s study, IT budgets are increasingly divorced from economic conditions. As enterprises continue their digital transformation, the IT department is increasingly valuable. Much of that can be attributed to IT’s new seat at the strategic table and the growing perception that technology can drive revenue growth. Despite economic headwinds, we see only a slight pullback in IT spending.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 18: Education Sector Benchmarks

Chapter 18 provides benchmarks for the education sector. The sector includes public and private colleges and universities, business and medical schools, for-profit educational institutions, school districts, and foundations. The 28 respondents in the sample have annual revenues ranging in size from a minimum of about $50 million to around $8 billion.

July, 2023

-

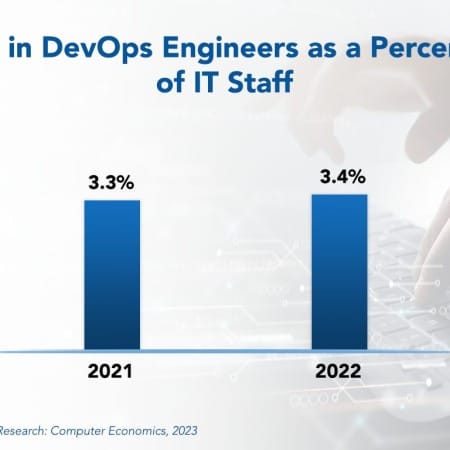

DevOps Engineer Staffing Ratios 2023

DevOps promises to optimize application development and maintenance processes, improving software quality and reducing development time and cost. As a result, IT organizations will be better able to meet the rapidly evolving needs of a business and achieve other strategic goals. Although DevOps engineers today represent a small portion of the total IT staff at most businesses, we anticipate that companies, especially those that develop much of their own software, will continue to expand their DevOps engineering staff.

September, 2023

-

Residual Value Forecast December 2023

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

December, 2023

-

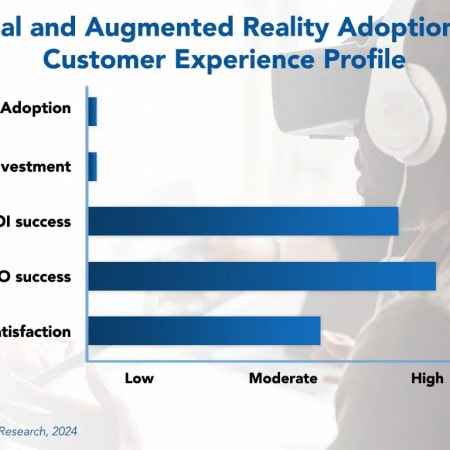

Virtual and Augmented Reality Adoption Trends and Customer Experience 2024

Businesses are currently in the early stages of adopting virtual reality and augmented reality (VR/AR) solutions. While widespread adoption of VR/AR has not yet fully materialized, businesses are actively experimenting with these technologies.

February, 2024

-

Residual Value Forecast March 2024

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

March, 2024

-

IT Spending Trends in Commercial Real Estate 2024

The commercial real estate industry is a vital sector of the global economy that provides spaces for businesses of all types. However, the industry has faced significant challenges over the past three years. The demands on their IT organizations are significant. What is it about the CRE sector that makes it unique? In this report, we analyze the ways in which this sector differs from other sectors in terms of their IT spending characteristics. We conclude with recommendations for optimizing the IT budget within this sector.

May, 2024

-

Desktop Support Outsourcing Trends and Customer Experience 2024

The question of whether to turn over the desktop support function to a service provider is a critical and surprisingly complicated one. Our research shows a strong cost advantage to outsourcing the desktop support function, but other factors, including increased automation and self-service assistance, can change the equation, potentially making it less cost-effective.

June, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 6: Banking and Finance

Chapter 6 provides benchmarks for banking and financial services companies. The firms in this sector include commercial banks, investment banks, credit unions, mortgage lenders, consumer finance lenders, and other types of lenders and financial services providers. The 48 respondents in this sector range in size from a minimum of about $50 million to over $75 billion in annual sales.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 39: Software and Technology

Chapter 39 provides IT spending and staffing statistics for the software and technology subsector. This category includes software companies, SaaS providers, and technology solutions companies. There are 22 organizations in the sample, ranging in size from around $50 million to over $100 billion in annual revenue.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 27: Commercial Banking

Chapter 27 provides benchmarks for commercial banks. This subsector includes credit unions and community, regional, international, and national banks. The 30 respondents in this sample have annual revenues ranging from a minimum of about $50 million to over $60 billion.

September, 2024

-

Residual Value Forecast November 2024

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

November, 2024

Grid View

Grid View List View

List View