-

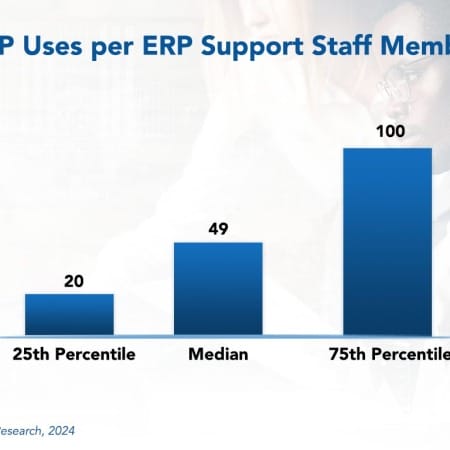

ERP Support Staffing Ratios 2024

Rightsizing the support staff for an ERP system can be difficult. This is because many factors affect the support staffing ratio. These include the type of ERP system, its age, the extent of modification, and the industry sector. Nevertheless, understanding support requirements for ERP systems is vital for IT leaders. This research byte summarizes our full report on ERP support staffing ratios.

January, 2024

-

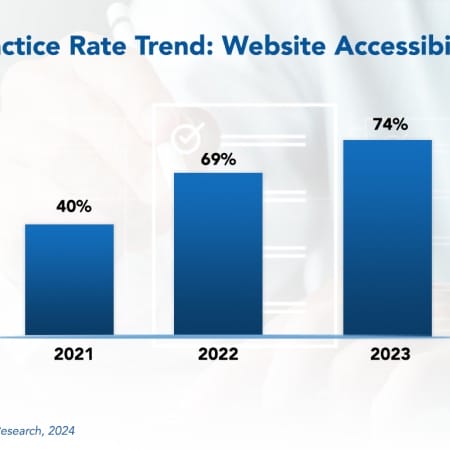

Website Accessibility Best Practices 2024

Website accessibility means building and maintaining websites that anyone can use comfortably and effectively.

February, 2024

-

IT Spending Trends in the Education Sector 2024

The education sector faces many complex and interrelated socio-economic, political, and technological challenges. But the sector is crucial in shaping the future of society, requiring creative solutions to address these multifaceted problems. This report analyzes the unique IT characteristics of the education sector with its various subsectors. We conclude with the outlook for increased IT spending and staffing in the education sector in the coming years.

May, 2024

-

Current Fair Market Values June 2024

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

June, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 3B: Benchmarks by Organization Size: Midsize

This year, Avasant Research is celebrating the 35th anniversary of the Computer Economics IT Spending and Staffing Benchmarks study. To mark this milestone, we have accumulated the largest sample of companies in our history (over 350 companies in our single-year sample compared to 215 last year), including a significant number of the world’s largest enterprises. For the first time, we not only have small, midsize, and large chapters but also a very large chapter for companies with over $500 million in IT spending.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 36: Healthcare Clinics and Doctors’ Offices

Chapter 36 provides benchmarks for healthcare clinics and doctors’ offices. The 22 respondents in this subsector range in size from $50 million to around $100 billion in annual revenue. This category includes health clinics, urgent care, optometry chains, and even large retailers who have begun some basic healthcare operations.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 24: Chemicals

Chapter 24 provides benchmarks for chemicals manufacturers. Chemicals manufacturers are, by definition, process manufacturers that produce chemical products. This subsector includes manufacturers of chemicals, petrochemicals, and other chemical products. The 20 respondents in the sample range in size from a minimum of about $50 million to around $45 billion in annual revenue.

September, 2024

-

IT Spending Trends in the Media and Information Sector 2024

Amid the perpetual evolution of the digital terrain, the media and information sector finds itself undergoing a profound digital transformation. Consumer preferences for personalized, on-demand content alongside relentless technological advancements necessitate adaptation for companies to remain relevant. IT has become the linchpin of the industry’s survival strategy in this fiercely competitive landscape. As audiences increasingly gravitate toward digital channels for news, entertainment, and information consumption, media companies are compelled to reassess their operations.

September, 2024

-

Vendor Discount Report January 2025

The largest and best discounts are often only offered to the vendors’ best customers, and buyers may find it difficult to determine whether the discount offered is typical or whether a better deal can be negotiated. The Vendor Discounts Report is designed to give procurement personnel, lessors, lessees, and departmental manager’s insight and guidance regarding current discount structures on a variety of categories of equipment in the marketplace.

January, 2025

-

IT Management Staffing Making a Comeback

IT management staffing is making a notable comeback, driven by the demands of AI integration, rising cybersecurity threats, and the evolving needs of the modern workforce. At the heart of this trend lies a story of adaptation and opportunity as businesses strive to balance innovation with the growing demands of modern technology. This Research Byte delves further into current IT management and administration staffing trends.

April, 2025

-

CRM Adoption Trends and Customer Experience 2025

Customer relationship management (CRM) systems are one of the most widely adopted categories of enterprise applications, and investment in new CRM capabilities continues to grow. Although cloud-based CRM offerings have allowed the capabilities to move down-market to smaller companies, the need to adopt a CRM system signals that a company has reached a milestone in building its application portfolio, similar to when a company first moves from spreadsheets to a real accounting system. Modern CRM systems are essential for companies looking to improve their productivity and effectiveness in sales, marketing, and customer service.

June, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 21: Media and Information Services Sector Benchmarks

Chapter 21 provides benchmarks for the media and information services sector. This sector includes publishing, broadcasting, entertainment, and digital media organizations, as well as other media and information services companies. The 20 respondents in the sample have annual revenues ranging from about $50 million to around $100 billion. Chapter 20 provides benchmarks for commercial real estate organizations. The 26 respondents in the sample range in size from about $50 million to over $30 billion in annual revenue. The sector includes retail, office, industrial, multifamily, and other property management companies, commercial real estate developers, real estate investment firms, and real estate brokers, consultants, and advisors.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 24: Food and Beverage Subsector Benchmarks

Chapter 24 provides benchmarks for food and beverage manufacturers. The 40 respondents in the sample range in size from about $50 million to around $40 billion in annual revenue. Food and beverage companies produce beverages, snack foods, meat products, seafood products, dairy products, dietary supplements, and other consumable food products. Some are suppliers to other food manufacturers or to the food service industry, while many also distribute consumer products to retailers or directly to consumers. This subsector does not include retailers of food and beverages, such as restaurants, unless they also manufacture their own food and beverage products.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 37: Oil and Gas Subsector Benchmarks

Chapter 37 provides benchmarks for oil and gas producers and midstream distributors across all organization sizes. The 17 respondents in this sector include integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utilities companies. The companies in our sample range in size from a minimum of about $50 million to more than $300 billion in annual revenue.

August, 2025

-

Fair Market Value September 2025

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

August, 2025

Grid View

Grid View List View

List View