-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 6: Banking and Finance

Chapter 6 provides benchmarks for banking and financial services companies. The firms in this sector include commercial banks, investment banks, credit unions, mortgage lenders, consumer finance lenders, and other types of lenders and financial services providers. The 25 respondents in this sector range in size from a minimum of about €75 million to around €40 billion in annual sales.

September, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 24: Aerospace and Defense

Chapter 24 provides benchmarks for aerospace and defense companies. This category includes airplane and aerospace manufacturers, makers of weapons systems, aerospace and defense research, and other defense companies. The 15 respondents in this sample range in size from a minimum of about €85 million to over €60 billion in revenue.

September, 2025

-

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 7: Professional Services Sector Benchmarks

This chapter provides generative AI metrics for the professional services sector. It features a sample of 11 professional services companies including consulting firms, business solutions companies, real estate brokerages, and data analysis firms. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

Finance and Accounting Budgets, Staffing, and Process Metrics 2024/2025: Chapter 3A: Metrics by Organization Size: Small/Midsize

This chapter provides procurement business process metrics for small and midsize organizations across all industries.

January, 2025

-

Human Resources Budgets, Staffing, and Process Metrics 2024/2025: Chapter 6: Healthcare Payor

Chapter 6 provides benchmarks for health insurance companies. The firms in this sector include companies that sell medical and dental insurance along with healthcare providers that also offer health insurance plans and function as healthcare payors.

March, 2025

-

Procurement Budgets, Staffing, and Process Metrics 2025/2026: Chapter 11: Process Manufacturing Sector Benchmarks

Chapter 11 provides comprehensive benchmarks for procurement staffing and spending within the process manufacturing industry. This sector encompasses a wide array of organizations, including chemical producers, food and beverage manufacturers, pharmaceutical companies, and oil and gas refineries. The 29 respondents from this sector vary in size, with annual sales ranging from approximately $600 million to over $20 billion.

November, 2025

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 4: Process Manufacturing Sector Benchmarks

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 76 respondents in the sample range in size from a minimum of about $50 million to a maximum of $50 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 3A: Small Organization Benchmarks

The IT spending and staffing outlook for small organizations in 2023 can best be described with the old British slogan, “keep calm and carry on.” As we mentioned in last year’s study, IT budgets are increasingly divorced from economic conditions. As enterprises continue their digital transformation, the IT department is increasingly valuable. Much of that can be attributed to IT’s new seat at the strategic table and the growing perception that technology can drive revenue growth. Despite economic headwinds, we see only a slight pullback in IT spending.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 19: Commercial Real Estate Sector Benchmarks

Chapter 19 provides benchmarks for commercial real estate organizations. The 36 respondents in the sample range in size from about $50 million to over $4 billion in annual revenue. The sector includes retail, office, industrial, multifamily, and other property management companies, commercial real estate developers, real estate investment firms, and real estate brokers, consultants, and advisors.

July, 2023

-

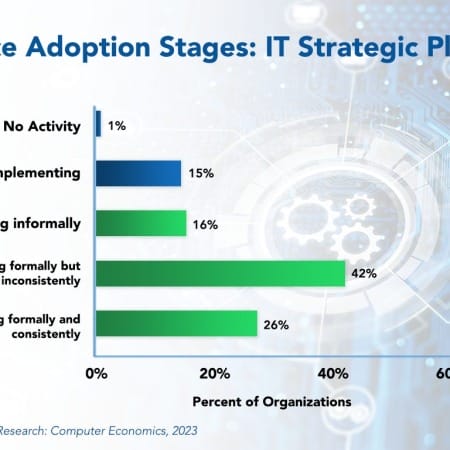

IT Strategic Planning Best Practices 2023

With digital transformation well underway, organizations of all sizes and across multiple industry sectors are increasingly viewing information technology as essential in supporting business strategy. Organizations in these sectors face digital disruption, and it is difficult to see how they can respond without an IT strategic plan.

September, 2023

-

Current Fair Market Values December 2023

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

December, 2023

-

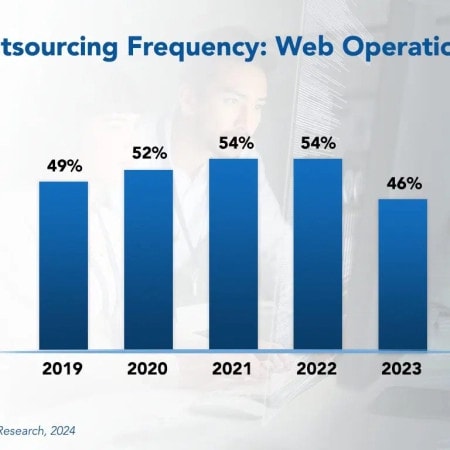

Web Operations Outsourcing Trends and Customer Experience 2024

Web operations outsourcing is one of the most popular types of managed services. Organizations of all kinds continue to expand their efforts in online marketing, website management, and e-commerce. This shift toward web-enabled business processes and e-commerce has prompted many companies to reassess their online strategies. In doing so, many have turned to managed service providers that can provide the needed expertise and a flexible, scalable infrastructure to deliver highly available and reliable web and e-commerce systems.

February, 2024

-

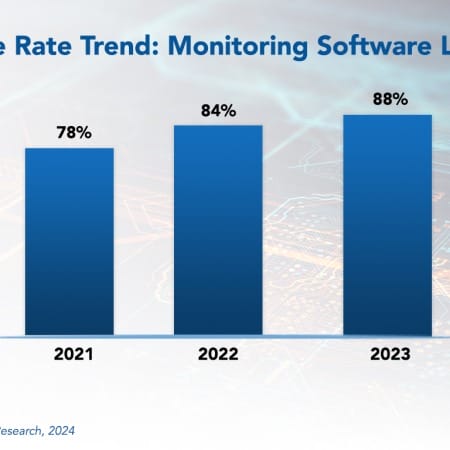

Monitoring Software Licenses Best Practices 2024

The art of monitoring software licenses is crucial in today’s software-driven world. Enterprises that depend on software must engage in effective license management for cost optimization, compliance assurance, and gaining a competitive edge. It is no longer just a box that needs to be checked.

March, 2024

-

Current Fair Market Values May 2024

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

May, 2024

-

IT Security, Cybersecurity, and Compliance Spending Benchmarks 2024

We live in an era where we are surrounded by devices that connect us to enterprise data and allow us to do our jobs from anywhere. However, connected devices are vulnerable, so it is not surprising that cybersecurity attacks are increasing as the number and type of such devices increase. Daily, organizations are subjected to phishing emails, social engineering, malware, ransomware, trojans, viruses, and worms. And new attack vectors are constantly emerging. This creates an expensive and constantly shifting security landscape.

June, 2024

Grid View

Grid View List View

List View