-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 34: Software and Technology

Chapter 34 provides IT spending and staffing statistics for the software and technology subsector. This category includes software companies, SaaS providers, and technology solutions companies. There are 16 organizations in the sample, ranging in size from around €50 million to over €30 billion in annual revenue.

September, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 19: High-Tech Manufacturing

Chapter 19 provides benchmarks for high-tech companies. This category includes computer products manufacturers, telecommunications equipment manufacturers, semiconductor manufacturers, aerospace and defense manufacturers,

September, 2025

-

Navigating SAP S/4HANA Modernization: Evaluating RISE with SAP versus Private Cloud

As SAP phases out mainstream support for SAP ERP 6.0 by 2027, enterprises are confronted with a strategic decision with regard to modernizing to SAP S/4HANA. This article compares two key transformation paths: RISE with SAP, a bundled, SAP-managed offering, and self-managed deployments on hyperscaler clouds. It explores trade-offs in control, complexity, cost transparency, and customization, supported by real-world examples such as embecta’s rapid ERP separation. While RISE with SAP simplifies operations and accelerates time to value, private cloud offers greater flexibility. The analysis helps CIOs assess which model aligns best with their digital maturity, operational priorities, and long-term transformation goals.

June, 2025

-

Engineering and Construction Digital Services 2025 Market Insights™

The Engineering and Construction Digital Services 2025 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the engineering and construction industry. The report also highlights key challenges that enterprises face today.

August, 2025

-

AR/VR/XR Services 2024 RadarView™

The AR/VR/XR Services 2024 RadarView™ assists organizations in identifying strategic partners for AR/VR/XR by offering detailed capability and experience analyses of service providers. It provides a 360-degree view of key AR/VR/XR service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right AR/VR/XR services partner. The 48-page report also highlights top market trends in the AR/VR/XR space and Avasant’s viewpoint on them.

June, 2024

-

Blockchain Services 2025 RadarView™

The Blockchain Services 2025 RadarView™ helps enterprises identify key use cases and develop a strategy for blockchain adoption. The report highlights service providers who can accelerate business transformation and offers detailed analyses of leading providers’ capabilities to help select the right partners. The 61-page report also covers key industry trends and Avasant’s insights on the blockchain space.

October, 2025

-

Internet of Things Services 2023 Market Insights™

The Internet of Things Services 2023 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact in the future for any IoT projects. The report also highlights key IoT challenges that enterprises face today.

May, 2023

-

Capitalizing on Generative AI: The Next Big Leap for Service Providers

This article sheds light on how service providers are navigating the generative AI landscape and increasing investments to maximize revenue monetization opportunities. This has resulted in many service providers launching a dedicated suite of generative AI services, forming partnerships with generative AI vendors and hyperscalers, and setting up dedicated CoEs to support clients in their generative AI implementation journeys. Yet, before we witness its full-scale integration, there is a pressing need to establish best practices and guidelines, especially concerning ethics, bias, data privacy, and security.

August, 2023

-

IT and Apps Managed Services Provider Trends: Quarterly Report for Q3 2023

In this quarterly report (calendar quarter 3, 2023), Avasant provides key information on IT and apps managed services provider trends. The report covers key information on the IT services industry and the provider ecosystem. It covers the service provider facts and figures (including revenue and resource trends), macro trends, and executive sentiment from the service provider community. The report covers trends across a gamut of IT services, including but not limited to IT infrastructure, application, and end-user services. The geographic coverage for the report is global. It builds on insights gathered through ongoing market research, data collection, and proprietary databases. It includes market data from providers accessed through multiple sources such as public disclosures, market interactions, and deals data.

November, 2023

-

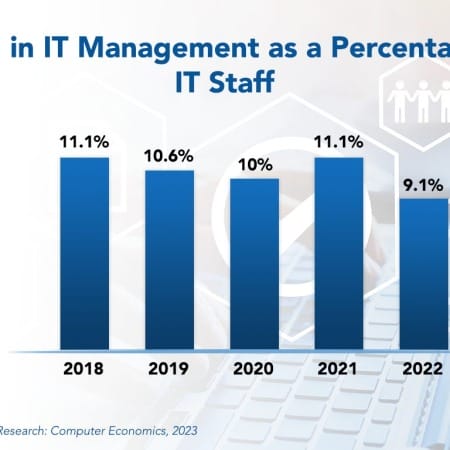

IT Management and Administration Staffing Ratios 2023

When it comes to IT managers, it is important to find the “sweet spot.” Too many managers and the IT group can become top-heavy and bureaucratic; too few and IT staff members may feel unsupported and without direction. Overworked managers may be pulled in too many directions, and insufficient management resources may push management tasks on to workers who are ill-equipped to take on those roles.

June, 2023

-

Life Sciences Digital Services 2024 Market Insights™

The Life Sciences Digital Services 2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the life sciences industry. The report also highlights key challenges that enterprises face today.

February, 2024

Grid View

Grid View List View

List View