-

Freight and Logistics Digital Services 2024 Market Insights™

The Freight and Logistics Digital Services 2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the freight and logistics industry. The report also highlights key challenges that enterprises face today in this space.

August, 2024

-

Business Process Services — Provider Trends Q3 2023

In this quarterly report (calendar quarter 3, 2023), Avasant provides key information on trends in the business process services (BPS) space. It covers facts and figures about service providers (including revenue and resource trends), macro trends, and executive sentiment from the service provider community. The geographic coverage is global, with a larger share of data points from North America. The report builds on insights gathered through ongoing market research, data collection, and proprietary databases. It includes market data from providers accessed through multiple sources, such as public disclosures, market interactions, and sourcing data.

December, 2023

-

Desktop Support Outsourcing Trends and Customer Experience 2024

The question of whether to turn over the desktop support function to a service provider is a critical and surprisingly complicated one. Our research shows a strong cost advantage to outsourcing the desktop support function, but other factors, including increased automation and self-service assistance, can change the equation, potentially making it less cost-effective.

June, 2024

-

IT Security Technology Adoption and Customer Experience 2024

Organizations in all industries and of all sizes require some form of IT security technology. With threats on the rise, companies are continuing to invest in this technology. According to our annual Technology Trends study, while 83% of respondents reported some form of IT security adoption, 72% percent of all organizations stated that they are making new investments.

February, 2024

-

Worldwide Technology Trends 2025

This study is designed to give business leaders insights into the adoption, investment, and customer experience of 15 technologies in each category. It provides a glimpse into how quickly an emerging technology is being adopted, how deeply more established technologies penetrate the market, and how positively customers experience each of them. The study also delves into the specific types of solutions under consideration. By understanding adoption trends, investment activity, and customer experience, decision-makers are in a better position to assess the potential risks and rewards of investing in each of these technologies. They can also gain insights into just how aggressively competitors and peers are investing in them.

November, 2025

-

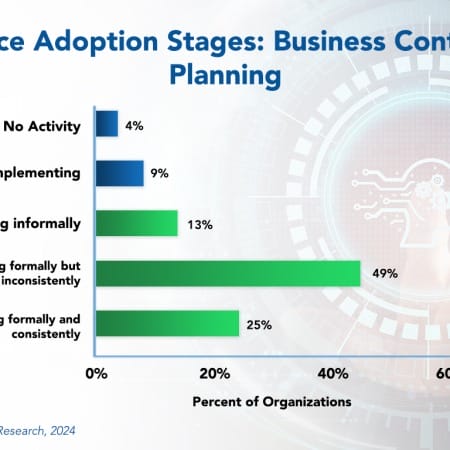

Business Continuity Planning Best Practices 2024

In today’s business landscape, virtually every organization relies heavily on information technology. Therefore, restoring information systems in the event of a disaster is an essential element of risk management, not just IT. At the same time, having IT systems recovered without restoring business operations is of little value. As such, a thorough business continuity plan goes beyond IT recovery, ensuring the overall survival of the business amid disruptions and re-establishing key business functions. Effective continuity planning should also address the potential loss of key individuals, disruption of customer or supplier operations, and failure of logistics providers.

March, 2024

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 14: Construction and Trade Services Sector Benchmarks

Chapter 14 provides benchmarks for construction and trade services companies. The 30 respondents in the sample range in size from about $60 million to over $28 billion in annual revenue. The category includes engineering and construction companies, commercial, residential, and industrial construction contractors, specialty contractors, oil field services firms, firms that provide mining services, environmental services firms, and other construction and trade services firms.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 35: City and County Government Subsector Benchmarks

Chapter 35 provides benchmarks for city and county governments. This chapter is concerned with the IT workings of city or county governments and not individual agencies within larger governments (which can be found in Chapter 36). The 19 respondents in this subsector have annual operating budgets ranging from $50 million to $1.2 billion.

July, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 2: Composite Benchmarks

This chapter provides composite metrics for all survey respondents across all sectors and organization sizes. The sample includes 101 organizations and is stratified by size and sector as described in the section on survey methodology. Respondents must have at least €50 million in annual revenue or IT spending in excess of €1 million and maintain at least some operations in Europe. There is no upper limit on the size of survey respondents.

September, 2023

-

From Reactive to Proactive: The Rise of AI-Powered MSSP Platforms

The increasing sophistication and frequency of cyber threats, coupled with the growing complexity of IT environments, have driven managed security service providers (MSSPs) to evolve their strategies. As organizations demand more tailored and proactive cybersecurity solutions, MSSPs are adopting innovative, platform-led approaches to meet these needs. This evolution reflects a broader industry shift toward integrated, AI-driven platforms that deliver seamless, scalable, and context-aware security operations. This Research Byte explores these trends, focusing on Orange Cyberdefense’s Core Fusion platform as a prime example of how MSSPs are redefining the cybersecurity landscape, as the company shared during its Analyst Day on November 26, 2024.

December, 2024

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 16: High-Tech Subsector Benchmarks

Chapter 16 provides benchmarks for high-tech companies. The category includes computer products manufacturers, telecommunications equipment manufacturers, semiconductor manufacturers, aerospace and defense manufacturers, pharmaceutical makers, biotechnology product makers, software developers, software-as-a-service providers, and other high-tech companies. The 22 respondents in this sample range in size from a minimum of about €50 million to about €20 billion in revenue.

September, 2023

-

IT Spending Trends in the Energy and Utilities Sector 2024

It is a challenging time for organizations in the energy and utilities sector, with global conflicts, supply chain issues, government mandates, and environmental concerns churning the waters. The demands on their IT organizations are significant. What is it about the energy and utilities sector that makes it unique? In this report, we analyze the ways in which this sector differs from other sectors in terms of their IT spending characteristics. We conclude with recommendations for optimizing the IT budget within this sector.

May, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 10: Energy and Utilities

Chapter 9 provides benchmarks for wholesale distributors. This category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 49 respondents in the sample range in size from a minimum of about $50 million to $25 billion in revenue.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 40: IT Services and Consulting

Chapter 40 provides IT spending and staffing statistics for the IT services and consulting sector. This category includes systems integrators, IT solution providers, business process outsourcing firms, managed services companies, IT consultants, and other providers of IT services and solutions. There are 17 organizations in the sample, ranging in size from around $50 million to over $100 billion in annual revenue.

September, 2024

Grid View

Grid View List View

List View