-

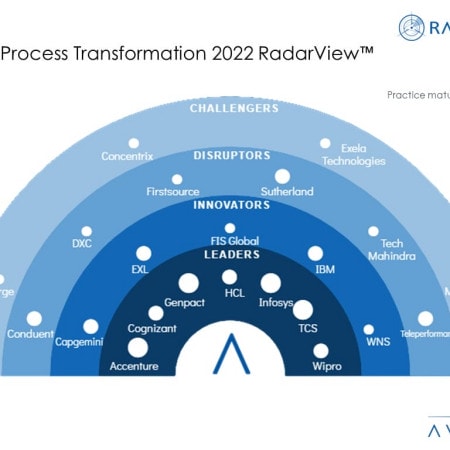

Banking Process Transformation 2022 RadarView™

The Banking Process Transformation 2022 RadarView™ assists banks and financial companies in identifying strategic partners for banking process transformation by featuring detailed capability and experience analyses of leading service providers. It provides a 360-degree view of key banking service providers across practice maturity, domain ecosystem, and investments and innovations, thus helping enterprises in evaluating leading players in the banking process transformation space. The 78-page report also highlights top market trends in the banking process transformation arena and Avasant’s viewpoint on them.

June, 2022

-

Transforming Operations for Customer-centric Banking

Banking regulators are imposing stringent compliance directives. This has required banks to undertake time-consuming due diligence processes such as Know Your Customer (KYC). As a result, customers are experiencing longer processing times across banking services such as account opening and loan approvals. In addition, neobanks and fintechs are competing with traditional banks by offering more personalized products and add-on services. Customers now expect similar offerings from traditional banks as well, requiring them to reimagine their processes. Due to changing customer expectations and regulatory pressures, banks are seeking support from service providers to transform their operations. This has led to a 23% growth in services provider banking process transformation revenue between December 2020 and December 2021. These trends and others are covered in our new Banking Process Transformation 2022 RadarView™ .

June, 2022

Grid View

Grid View List View

List View