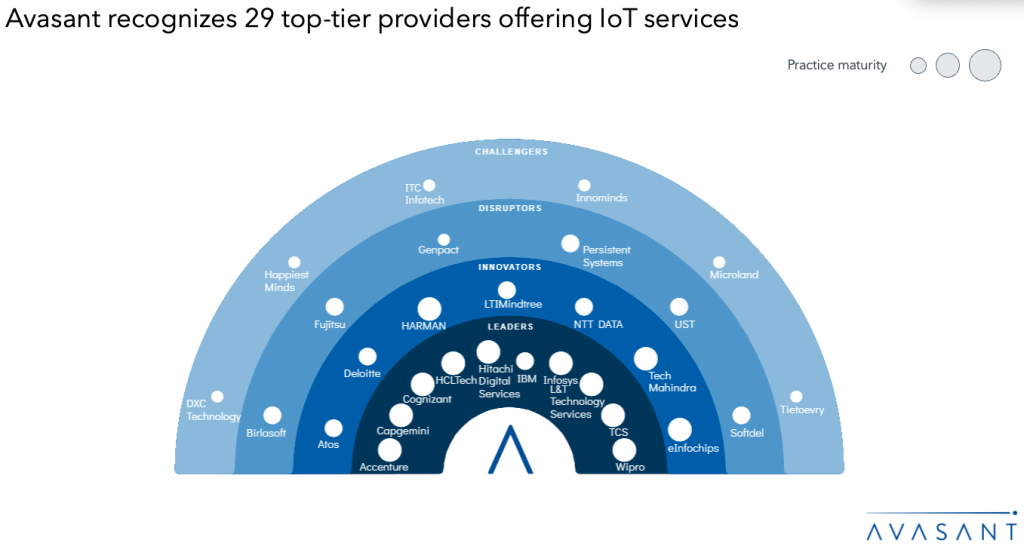

Industrial IoT adoption is accelerating as enterprises transition from Industry 4.0 to Industry 5.0, integrating connected machinery, robotics, and AI-driven automation to enhance efficiency, safety, and sustainability. AIoT convergence with edge and 5G is powering real-time insights, autonomous actions, and early use of agentic AI pilots. As deployments scale, IT–OT cybersecurity has become a critical priority, with providers embedding zero-trust frameworks and AI-driven monitoring. Digital twins are gaining momentum for simulation, disruption testing, and decarbonization modeling. At the same time, IoT is becoming more human-centric, enabling adaptive, personalized experiences through multimodal sensing and emotion-aware analytics.