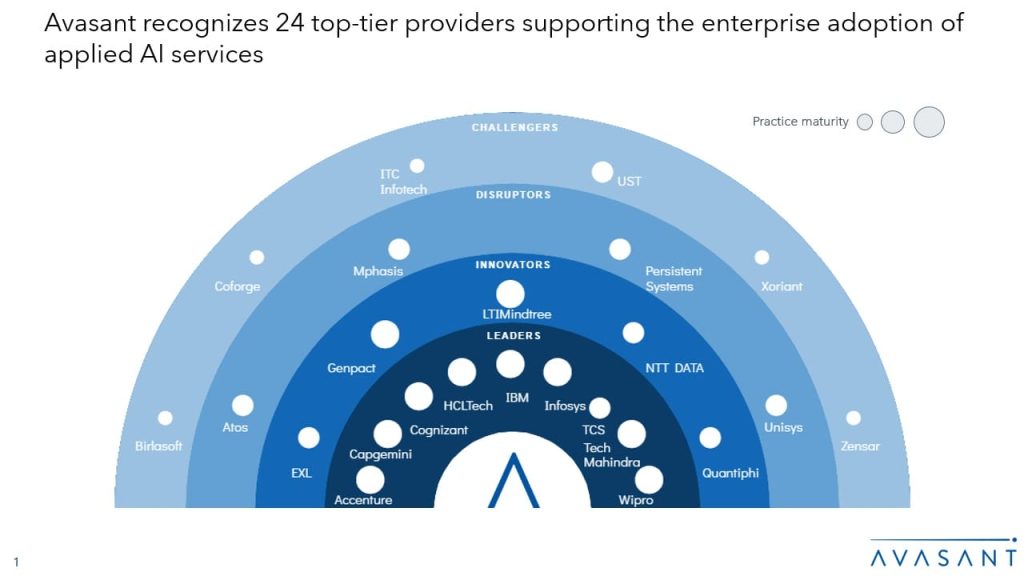

Enterprise AI adoption is gaining momentum, with banking, manufacturing, telecom, and media driving nearly half of all initiatives. Organizations are primarily leveraging generative AI (Gen AI) to optimize business functions such as software development and customer engagement. About 80% of firms are pivoting toward a platform-based integration model, leveraging Gen AI through trusted ERP, CRM, and HCM systems. While interest in agentic AI is growing, production deployments remain limited, primarily due to unresolved governance and decision-making challenges. Both demand-side and supply-side trends are covered in Avasant’s Applied AI Services 2024–2025 Market Insights™ and Applied AI Services 2024–2025 RadarView™, respectively.