-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 21: High-Tech Subsector Benchmarks

Chapter 21 provides benchmarks for high-tech companies. The category includes computer products manufacturers, telecommunications equipment manufacturers, semiconductor manufacturers, aerospace and defense manufacturers, pharmaceutical makers, biotechnology product makers, software developers, software-as-a-service providers, and other high-tech companies. The 26 respondents in this sample range in size from a minimum of about $50 million to over $30 billion in revenue.

-

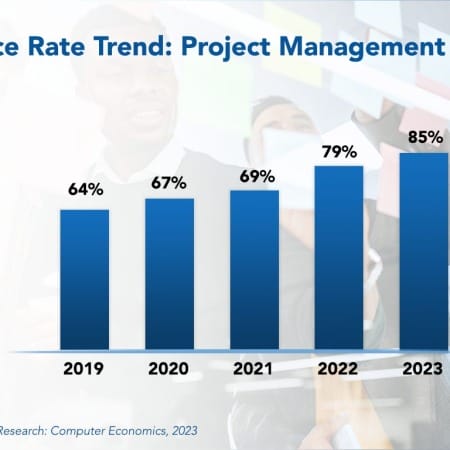

Project Management Office Best Practices 2023

To improve project success, companies often establish a formal project management office (PMO) as a center of excellence for project management disciplines. In some organizations, the PMO operates as an advisory group to project managers, who report directly to business units. In other organizations, project managers report directly to the PMO and are assigned to projects as needed. However, in recent years, the use of PMOs has grown significantly, especially for organizations that use them for all projects.

December, 2023

-

Fair Market Values February 2024

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

February, 2024

-

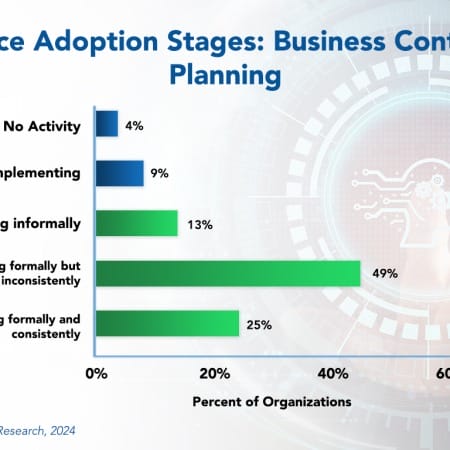

Business Continuity Planning Best Practices 2024

In today’s business landscape, virtually every organization relies heavily on information technology. Therefore, restoring information systems in the event of a disaster is an essential element of risk management, not just IT. At the same time, having IT systems recovered without restoring business operations is of little value. As such, a thorough business continuity plan goes beyond IT recovery, ensuring the overall survival of the business amid disruptions and re-establishing key business functions. Effective continuity planning should also address the potential loss of key individuals, disruption of customer or supplier operations, and failure of logistics providers.

March, 2024

-

IT Spending Trends in Banking and Finance 2024

The banking and finance sector is in a state of rapid change. Amid macroeconomic uncertainties such as inflation and rising interest rates, banking and finance firms are seeking opportunities through digital transformation to stay competitive. What makes this sector unique? This report analyzes the IT characteristics of the banking and finance industry with its various sub-sectors. We conclude with the outlook for increased IT spending and staffing in this sector in the coming years.

May, 2024

-

IT Spending Trends in Healthcare Services 2024

IT spending in the healthcare services industry is rising, driven by the need for digital transformation and advanced technologies such as AI and telehealth. These investments aim to enhance clinical outcomes and streamline administrative processes. However, they also introduce challenges such as cybersecurity risks, data privacy concerns, legacy system integration issues, and a shortage of IT skills. How are organizations ensuring the success and sustainability of their IT initiatives? This report reviews current IT spending trends, key metrics from our benchmarking survey, and the implications for the industry's future, concluding with an overview of the role of IT in improving healthcare quality.

July, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 10: Energy and Utilities

Chapter 9 provides benchmarks for wholesale distributors. This category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 49 respondents in the sample range in size from a minimum of about $50 million to $25 billion in revenue.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 40: IT Services and Consulting

Chapter 40 provides IT spending and staffing statistics for the IT services and consulting sector. This category includes systems integrators, IT solution providers, business process outsourcing firms, managed services companies, IT consultants, and other providers of IT services and solutions. There are 17 organizations in the sample, ranging in size from around $50 million to over $100 billion in annual revenue.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 29: Online Retailers

Chapter 29 provides benchmarks for online retailers. This subsector includes online retailers of clothing, home furnishings, dietary supplements and health products, agricultural products, pharmaceuticals, sports equipment, and other products. The 27 respondents in this sample have annual revenue ranging from about $100 million to over $200 billion.

September, 2024

-

Advanced Networking Adoption Trends and Customer Experience 2024

The adoption of advanced networking technologies is being driven by an insatiable need for more data within the enterprise. Real-time data analytics, generative AI, omnichannel communications, and other digital initiatives mean that data needs to move faster to keep up with the speed of the business. But high initial costs and complex integration may make it difficult for leaner industries, such as manufacturing, or nonprofits, to justify the investment in advanced networking technologies.

December, 2024

-

HR/HCM Adoption Trends and Customer Experience 2024

In the past, human resources (HR) departments were typically seen as cost centers, but there is a growing appreciation for the strategic value that HR can bring to an organization. By embracing HR’s strategic role, organizations may realize the full potential of the function as a value-add that propels business success.

February, 2025

-

Residual Value Forecast May 2025

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

May, 2025

-

Data Management and Business Intelligence Staffing Sees Notable Increase After Years of Stability

In the past four years, organizations have maintained data management and business intelligence (DMBI) head count at about 5.4% of the IT staff. However, our latest data shows a significant increase. Traditionally, productivity gains from cloud-based business analysis and reporting tools mitigated the need for more staff. But there is a new business focus. This Research Byte summarizes our full report on data management and business intelligence staffing.

June, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 22: High-Tech Manufacturing Subsector Benchmarks

Chapter 22 provides benchmarks for high-tech companies. This category includes computer products manufacturers, telecommunications equipment manufacturers, semiconductor manufacturers, aerospace and defense manufacturers, pharmaceutical makers, biotechnology product makers, and other high-tech manufacturers. The 24 respondents in this sample range in size from a minimum of about $100 million to over $60 billion in revenue.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 26: Paper and Packaging Subsector Benchmarks

Chapter 26 focuses on benchmarks for the paper and packaging subsector, encompassing various organization sizes. As a critical component of the broader process manufacturing sector, respondents in this subsector typically include pulp and paper mills, containerboard and corrugated packaging manufacturers, flexible packaging producers, specialty paper converters, and other companies involved in the production and distribution of paper-based and allied packaging materials. The 19 companies in our sample range in annual revenue from approximately $50 million to well over $15 billion, reflecting the diverse scale of operations within the industry.

August, 2025

Grid View

Grid View List View

List View