-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 13: Transportation and Logistics

Chapter 13 provides benchmarks for the transportation and logistics sector. The 31 respondents in this sample range in size from a minimum of $55 million to over $100 billion. The category includes organizations that operate buses, trucks, railways, airlines, barges, and ships. The sector also includes logistics companies that transport goods, transportation companies, and regional transportation authorities that move people.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 42: Government Agencies

Chapter 42 provides benchmarks for federal, state, and regional government agencies. This category includes public health agencies, courts and law enforcement agencies, and organizations that provide IT services to government agencies, social service agencies, state parks, and other federal, state, and regional government units. The 15 respondents in the sample have operating budgets that range in size from about $62 million to about $40 billion.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 4: Process Manufacturing

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. This sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 96 respondents in the sample range in size from a minimum of about $50 million to a maximum of around $70 billion in annual revenue

September, 2024

-

A New Era of AI: From Hidden Tool to Consumer Staple

Artificial intelligence (AI) adoption has been traditionally difficult to track, as AI was mostly embedded in software. As such, end users did not typically perceive it as AI as much as a function of the product. However, a recent round of consumerization of AI tools has changed the landscape and use of AI in the enterprise. This Research Byte summarizes our full report on AI technology trends.

January, 2025

-

Business and Data Analytics Adoption Trends and Customer Experience 2024

Business and data analytics have long been indispensable tools for organizations across industries. The widespread adoption and increasing investment underscore their critical role in driving business growth and decision-making. This year, 82% of organizations have adopted business and data analytics. The adoption rate is accompanied by an investment rate of 88%, indicating a strong commitment to leveraging data-driven insights.

February, 2025

-

IT Quality Assurance and Testing Staffing Ratios 2025

As Agile and other types of software development permeate the enterprise, it is becoming increasingly difficult to measure the quality assurance testing (QA) staffing role. Fewer development roles are discretely QA-focused, and most modern software operations rely on spreading the QA role throughout the process. However, the role of QA is still vital.

May, 2025

-

Residual Value Forecast August 2025

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 9: Wholesale Distribution

Chapter 9 provides benchmarks for wholesale distributors. This category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 53 respondents in the sample range in size from a minimum of about $50 million to over $200 billion in revenue.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 30: Commercial Banking Subsector Benchmarks

Chapter 30 provides benchmarks for commercial banks. This subsector includes credit unions and community, regional, international, and national banks. The 26 respondents in this sample have annual revenues ranging from a minimum of about $50 million to about $175 billion.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 46: IT Services and Consulting Subsector Benchmarks

Chapter 46 provides IT spending and staffing statistics for the IT services and consulting sector. This category includes systems integrators, IT solution providers, business process outsourcing firms, managed services companies, IT consultants, and other providers of IT services and solutions. There are 20 organizations in the sample, ranging in size from around $50 million to over $20 billion in annual revenue.

August, 2025

-

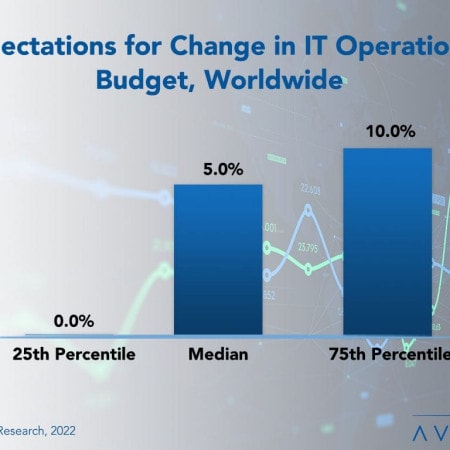

Worldwide IT Spending And Staffing Outlook 2023

Despite most of our survey respondents agreeing that the economy will be worse in 2023 than in 2022, IT spending increases are broad and strong. However, in this annual report of the IT spending and staffing outlook for 2023, we believe there is another major factor at play. We find that IT is no longer seen as a cost center but as a strategic driver of growth. Because of this, business leaders are giving their IT departments greater resources to help plan for the coming recession rather than asking them to tighten their belts.

February, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 9: Wholesale Distribution Sector Benchmarks

Chapter 9 provides benchmarks for wholesale distributors. The category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 31 respondents in the sample range in size from a minimum of about $50 million to $10 billion in revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 36: Government Agencies Subsector Benchmarks

Chapter 36 provides benchmarks for federal, state, and regional government agencies. The category includes public health agencies, courts and law enforcement agencies, organizations that provide IT services to government agencies, social service agencies, state parks, and other federal, state, and regional government units. The 21 respondents in the sample have operating budgets that range in size from about $62 million to about $40 billion.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 1: Executive Summary

The Computer Economics IT Spending and Staffing Benchmarks study (the "ISS"), published annually since 1990, is the definitive source for IT spending and staffing benchmarks and IT performance statistics across multiple industries and government sectors. Download a free copy of the 60+ pages Executive Summary (Chapter 1), which includes a detailed analysis of our major findings of this year's report. It also includes important, high-level IT spending and staffing ratios and trends, including metrics on IT spending as a percentage of revenue, IT spending per user, IT spending growth, IT capital budgets, IT spending priorities, and IT staff count changes.

July, 2023

-

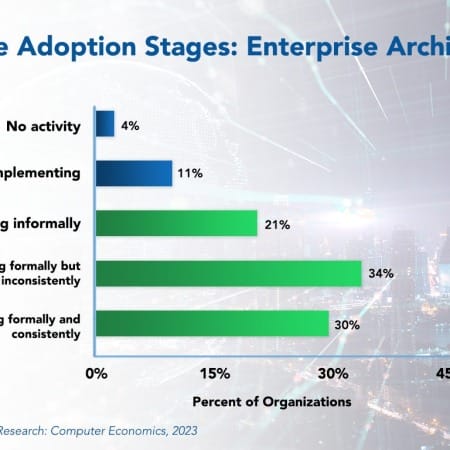

Enterprise Architecture Adoption and Best Practices 2023

While large IT project failures generate headlines, an even larger risk may be the incoherence that comes from developing new systems and capabilities without an overall plan. Enterprise architecture is an IT best practice that provides a description of the organization in its desired state. This allows developers to build an infrastructure, data model, systems, and process that are aligned with that organizational architecture.

October, 2023

Grid View

Grid View List View

List View