-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 43: Logistics

Chapter 43 provides benchmarks for logistics providers. The 21 respondents in this sample range in size from $52 million to about $100 billion. This subsector is comprised of logistics companies that transport goods, including refined petroleum distributors, national moving or courier companies, freight transportation companies, supply chain logistics providers, and other logistics companies.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 5: Discrete Manufacturing

Chapter 5 provides benchmarks for discrete manufacturing organizations. Discrete manufacturers are defined as those where the production process adds value by fabricating or assembling individual (discrete) unit production. This category includes manufacturers of consumer products, athletic equipment, industrial equipment, telecommunications equipment, aerospace products, furniture, auto parts, electrical parts, medical devices, and electronic devices, among other products. The 79 respondents in this sample range in size from a minimum of about $50 million to over $300 billion in annual revenue.

September, 2024

-

IaaS Tech Trends and Customer Experience 2024

Infrastructure as a Service (IaaS) continues to be a cornerstone of efficient operations. Our latest research reveals an uptick in IaaS adoption, with 72% of organizations now leveraging this technology. This surge is driven by the increasing demand for scalable, flexible, and cost-effective IT solutions.

January, 2025

-

Business and Data Analytics Continues Its Upward Trajectory

Business and data analytics cemented its position as a top priority for organizations, with adoption rates and investment levels reaching an all-time high. This appetite for data-driven decision-making signifies a fundamental shift in how businesses operate, recognizing data as a strategic asset paramount to success in today's competitive landscape. This Research Byte discusses these challenges and summarizes our full report on business and data analytics technologies.

February, 2025

-

Fair Market Value June 2025

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

June, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 18: Nonprofits and Charitable Organizations Sector Benchmarks

Chapter 18 provides benchmarks for nonprofits and charitable organizations. This sector includes local and national charity organizations, conservation groups, youth development organizations, organizing bodies, and other nonprofit organizations. We do not include organizations where the nonprofit status only reflects the entity type. Nonprofit hospitals are an example. They operate from an IT perspective in a way that is not significantly different from for-profit hospitals. The 14 respondents in the sample range in size from a minimum of about $50 million to over $300 million in annual revenue.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 10: Energy and Utilities

Chapter 10 provides benchmarks for public utilities, oil and gas producers, service companies, and midstream distributors across all organization sizes. The 39 respondents in this sector include public utilities (water, gas, and electric), integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utility companies. The companies in our sample range in size from a minimum of about $50 million to more than $300 billion in annual revenue.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 31: Investment Banking and Wealth Management Subsector Benchmarks

Chapter 31 provides benchmarks for investment banking and wealth management firms. This subsector includes companies offering services such as portfolio management, financial advisory, private banking, asset management, and retirement planning. The 24 respondents in this sample have annual revenues ranging from about $50 million to about $200 billion.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 47: City and County Government Subsector Benchmarks

Chapter 47 provides benchmarks for city and county governments. This chapter concerns the IT workings of city or county governments and not individual agencies within larger governments (which can be found in Chapter 48). The 15 respondents in this subsector have annual operating budgets ranging from $50 million to around $5 billion.

August, 2025

-

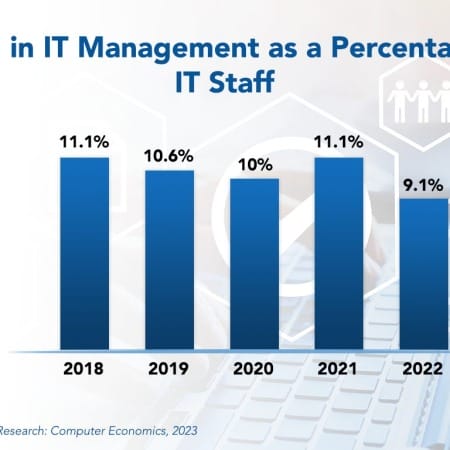

IT Management and Administration Staffing Ratios 2023

When it comes to IT managers, it is important to find the “sweet spot.” Too many managers and the IT group can become top-heavy and bureaucratic; too few and IT staff members may feel unsupported and without direction. Overworked managers may be pulled in too many directions, and insufficient management resources may push management tasks on to workers who are ill-equipped to take on those roles.

June, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 12: Professional and Technical Services Sector Benchmarks

Chapter 12 provides benchmarks for professional and technical services organizations. The 48 respondents in the sample range in size from a minimum of about $50 million to about $40 billion in annual revenue. The sector includes firms that provide professional and technical services, including engineering, legal, accounting, financial advice, consulting, marketing, research, and other services.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 38: Higher Education Subsector Benchmarks

Chapter 38 provides benchmarks for higher-education institutions. The sector includes public and private colleges and universities, research universities, business and medical schools, and for-profit institutions. The 20 respondents in the sample have annual revenues ranging in size from about $50 million to about $8 billion.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 26: Industrial and Automotive Subsector Benchmarks

Chapter 26 provides benchmarks for industrial and automotive manufacturers. The 32 respondents in this subsector make auto parts, material handling equipment, engines, machinery, vehicles, and similar durable goods. The manufacturers in the sample range in size from about $50 million to over $100 billion in annual revenue.

July, 2023

-

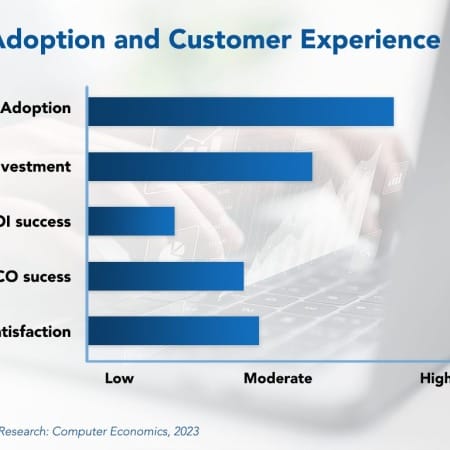

CRM Adoption Trends and Customer Experience 2023

Customer relationship management systems are one of the most widely adopted categories of enterprise applications, and investment in new CRM capabilities continues to grow. Although cloud-based CRM offerings have allowed the capabilities to move down-market to smaller companies, the need to adopt a CRM system signals that a company has reached a milestone in the building of its application portfolio, similar to when a company first moves from spreadsheets to a real accounting system. Modern CRM systems are essential for companies looking to improve their productivity and effectiveness in sales, marketing, and customer service.

October, 2023

-

Fair Market Values January 2024

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

December, 2023

Grid View

Grid View List View

List View