-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 6: Banking and Finance Sector Benchmarks

Chapter 6 provides benchmarks for banking and financial services companies. The firms in this sector include commercial banks, investment banks, credit unions, mortgage lenders, consumer finance lenders, and other types of lenders and financial services providers. The 30 respondents in this sector range in size from a minimum of about $50 million to over $40 billion in annual sales.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 3C: Large Organization Benchmarks

The IT spending and staffing outlook for large organizations in 2023 can best be described with the old British slogan, “keep calm and carry on.” As we mentioned in last year’s study, IT budgets are increasingly divorced from economic conditions. As enterprises continue their digital transformation, the IT department is increasingly valuable. Much of that can be attributed to IT’s new seat at the strategic table and the growing perception that technology can drive revenue growth. Despite economic headwinds, we see only a slight pullback in IT spending.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 22: Life Sciences Subsector Benchmarks

Chapter 22 provides benchmarks for life sciences organizations. The category includes pharmaceutical makers, biotechnology product companies, and medical device manufacturers. The 16 respondents in this sample range in size from a minimum of about $50 million to over $40 billion in revenue.

July, 2023

-

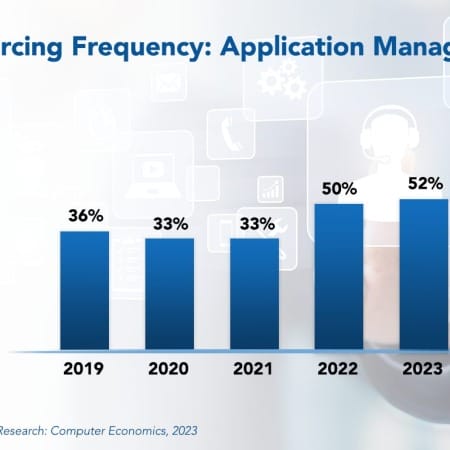

Application Management Outsourcing Trends and Customer Experience 2023

As the application portfolio of an enterprise grows, the ongoing support for those systems can become a burden on the IT organization, leaving little time for developing and implementing new applications. In response, some organizations see outsourcing application management as an attractive option.

December, 2023

-

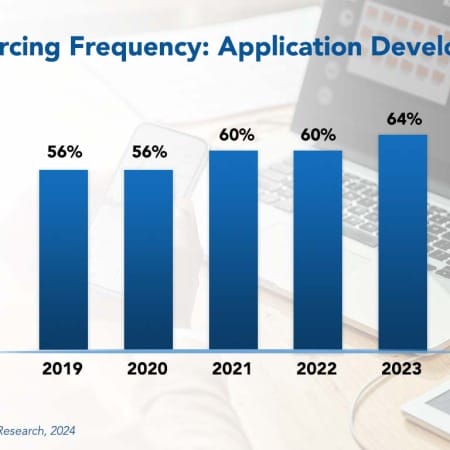

Application Development Outsourcing Trends and Customer Experience 2024

The demand for applications is constantly increasing due to digital transformation, changing business needs, and the surge in generative AI.

February, 2024

-

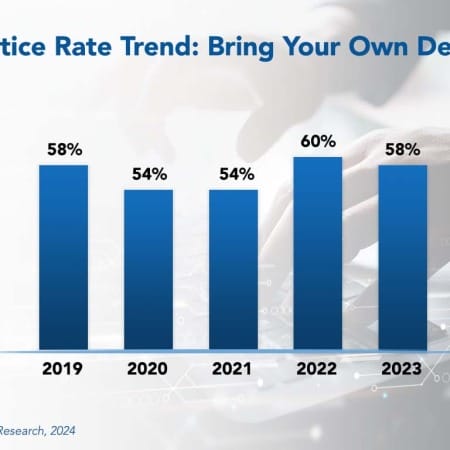

Bring Your Own Device Best Practices 2024

When iOS and Android smartphones were widely available in the late 2000s, bringing your own device for work-related tasks became popular. Employees generally favored their devices over those issued by the company, because it was simpler not to carry two devices. This trend drove companies to develop rules and regulations to control the practice.

March, 2024

-

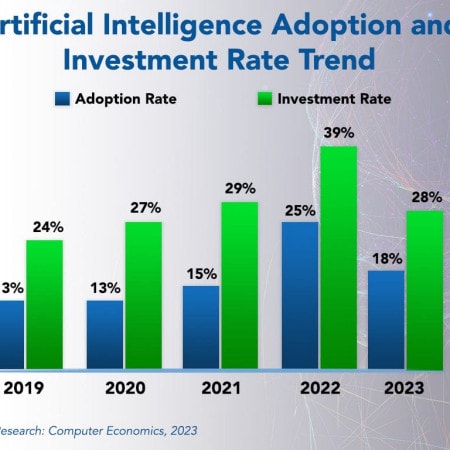

AI Adoption Trends and Customer Experience 2023

The recent frenzy of interest in generative AI has changed the perception of artificial intelligence (AI). Once locked inside other processes, AI was often forgotten, as it powered everything from Internet of Things (IoT) devices, automation, and security. But generative AI shined a light on AI, not as an embedded technology, but as a driver of efficiency and creativity.

May, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 7: Insurance Sector Benchmarks

Chapter 7 provides benchmarks for insurance companies. The firms in this sector include companies that sell medical and dental insurance, life insurance, property and casualty insurance, auto insurance, disability insurance, and other types of insurance. The 25 respondents in this sector range in size from a minimum of $100 million to over $100 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 10: Energy and Utilities Sector Benchmarks

Chapter 10 provides benchmarks for public utilities, oil and gas producers, service companies, and midstream distributors across all organization sizes. The 28 respondents in this sector include public utilities (water, gas, and electric), integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utilities companies. The companies in our sample range in size from a minimum of about $50 million to more than $60 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 27: Commercial Banking Subsector Benchmarks

Chapter 27 provides benchmarks for commercial banks. This subsector includes credit unions and community, regional, international, and national banks. The 20 respondents in this sample have annual revenue ranging from a minimum of about $50 million to over $40 billion.

July, 2023

-

Residual Value Forecast October 2023

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

October, 2023

-

Ciklum: Shaping the Future of Custom Product Development

Software and smart sensors are being used increasingly in products and services today. And not just in high-tech products. Even low-tech products are becoming smart products. And organizations in all industries are increasingly leveraging technology to better reach and serve customers, whether it be through e-commerce, mobile apps, or connected devices. As a result, product design, hardware design, and software development must all be done in coordination and collaboration. Ciklum is a leading provider in this custom product development space and is a Tech Innovator to watch.

November, 2023

-

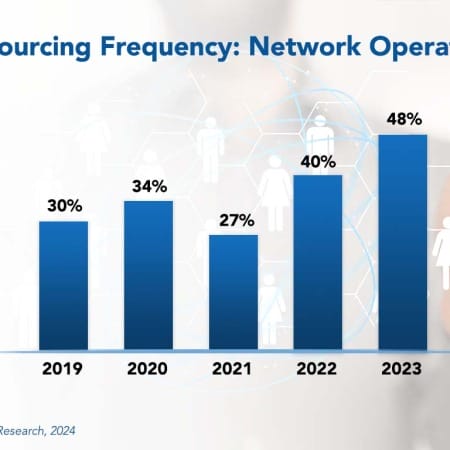

Network Operations Outsourcing Trends and Customer Experience 2024

Network operations outsourcing is an established market. Today, major IT and telecom industry service providers and even disruptive newcomers are competing with regional providers for market share. In the past, large equipment vendors only provided the hardware that serves as the network's backbone. However, these giants are beginning to recognize the potential of value-added network services. Businesses can now obtain dependable infrastructure, along with expert network design, planning, and even network support operations from a single source.

February, 2024

-

Worldwide IT Spending and Staffing Outlook for 2024

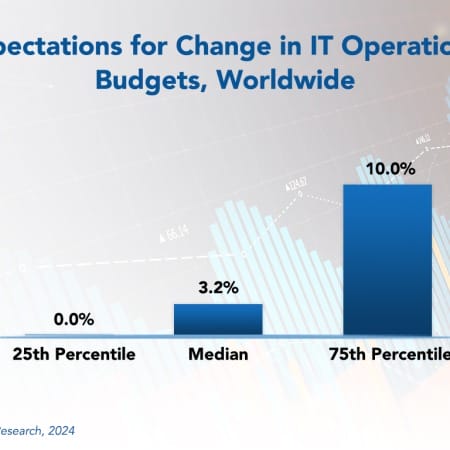

Our forecast for enterprise IT spending in 2024 is partly sunny, with a chance of strong headwinds. With stronger-than-expected economic data in the US and Europe and easing inflation, the world economy in most regions looks poised for the soft landing that central banks were aiming for. Our survey shows that IT budgets will continue to grow, and enterprises expect a slightly better 2024 than 2023. The worldwide outlook is cautiously optimistic.

March, 2024

-

IT Staffing Ratios: Benchmarking Metrics and Analysis for 16 Key IT Job Functions

The analysis of IT staffing data has been a core competency of Computer Economics since we began publishing our annual IT Spending and Staffing Benchmarks study in 1990. Each year, we survey more than 200 IT organizations across 10 major industry sectors, based on our sampling model, to obtain data on IT staffing levels, server counts, network infrastructure, outsourcing, and spending, among other information pertinent to the assessment of IT staffing.

March, 2024

Grid View

Grid View List View

List View