-

Salesforce Services 2025 RadarView™

The Salesforce Services 2025 RadarView™ assists organizations in identifying strategic partners for Salesforce adoption by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key Salesforce service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right Salesforce services partner. The 81-page report highlights top supply-side trends in the Salesforce space and Avasant’s viewpoint.

September, 2025

-

Canada Digital Services 2025–2026 RadarView™

The Canada Digital Services 2025–2026 RadarView™ can help enterprises based in Canada craft a robust strategy based on regional outlook, best practices, and digital transformation. The report can also help them identify the right partners and service providers to accelerate their digital transformation. The 88-page report also highlights top market trends in Canada and Avasant’s viewpoint on them.

November, 2025

-

SAP S/4HANA Services 2025–2026 RadarView™

The SAP S/4HANA Services 2025–2026 RadarView™ assists organizations in identifying strategic partners for SAP S/4HANA adoption by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key SAP S/4HANA service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right SAP S/4HANA services partner. The 74-page report highlights top supply-side trends in the SAP S/4HANA space and Avasant’s viewpoint.

December, 2025

-

IT and Apps Managed Services Market Trends: Quarterly Report for Q4 2022

In this quarterly report (Calendar Qtr 4, 2022), Avasant provides key information on IT Services Solution and Pricing Trends. The report covers market (buyer) perspective, macro trends from service provider community and finally, the pricing, solution and staffing trends in the space. The report covers trends across services including Infrastructure and Cloud Services, Application Services, and Digital Services. The geographic coverage is global, with a larger share of data points from North America. The report builds on insights gathered through our enterprise interactions, ongoing market research and data collection, as well as AvaMark Price Benchmarking database.

February, 2023

-

Strategy Consulting and Big Four Partnerships: Mapping strategic alliances and collaborations across industries and regions

The Strategy Consulting and Big Four Partnerships report presents an overview of the strategic partnerships done by the Big Four firms and strategy consulting companies as they make a bigger push in the Tech and tech Enabled Services. It reflects their efforts to expand their capabilities, reach new markets, and deliver value to their clients in the digital era. Generative AI is a prominent area of focus for these firms as they seek to leverage its potential to automate tasks, enhance creativity, and generate insights across multiple domains and industries.

April, 2024

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 8: Retail Sector Benchmarks

Chapter 8 provides benchmarks for retailers. This sector includes retailers of clothing, jewelry, hardware, furniture, electronics, sports equipment, groceries, pharmaceuticals, and general merchandise. They include restaurant chains, department stores, luxury retail stores, electronics stores, furniture stores, pharmacies, sporting goods stores, and specialty retailers. We also include hospitality and consumer services in this sector. The 43 respondents in the sample range in size from about €90 million to over €30 billion in annual revenue.

September, 2023

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 1: Executive Summary

Chapter 1 provides an overview of the key findings from the full study and describes the contents of the subsequent chapters. It also includes information on the study participants and the survey methodology.

October, 2024

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 14: Construction and Trade Services Sector Benchmarks

Chapter 14 provides benchmarks for construction and trade services companies. The 23 respondents in the sample range in size from about €60 million to around €35 billion in annual revenue. This category includes engineering and construction companies, commercial, residential, and industrial construction contractors, specialty contractors, firms that provide oil field services, mining services, environmental services, and other construction and trade services firms.

October, 2024

-

European CIOs Making Investments with Strong Budget Increases

Despite some economic turbulence, persistent nearby conflicts, and tech layoffs, end-user companies are showing relatively strong IT spending increases. CIOs are investing in a series of new technologies designed to transform the enterprise including AI, data analytics, and even the metaverse. Hiring is also keeping pace, and, for the most part, CIOs have the budget they need to make meet their mission of continued strategic transformation. This Research Byte is a brief description of some of the findings in our European IT Spending and Staffing Benchmarks 2024/2025 study.

October, 2024

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 8: Retail

Chapter 8 provides benchmarks for retailers. This sector includes retailers of clothing, jewelry, hardware, furniture, sports equipment, groceries, pharmaceuticals, and general merchandise. It includes department stores, fashion stores, furniture stores, pharmacies, convenience stores, sporting goods stores, and specialty retailers. We also include hospitality and consumer services in this sector. The 33 respondents in the sample range in size from about €55 million to over €80 billion in annual revenue.

September, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 1: Executive Summary

This chapter provides an overview of the key findings from the full study and describes the contents of the subsequent chapters. It also includes information on the study participants and the survey methodology.

September, 2025

-

Microsoft Revs Up Copilot in Dynamics 365: Will it Fly with Customers?

To capitalize on the generative AI frenzy sweeping the business world, Microsoft has been rapidly launching versions of its Copilot solutions throughout its various products. The software giant has also announced many new use cases for Copilots in individual Dynamics 365 modules. But are customers ready and willing to let Gen AI play such an important role in their core ERP processes? And are they willing to pay for it? We examine the Copilot state of play.

February, 2024

-

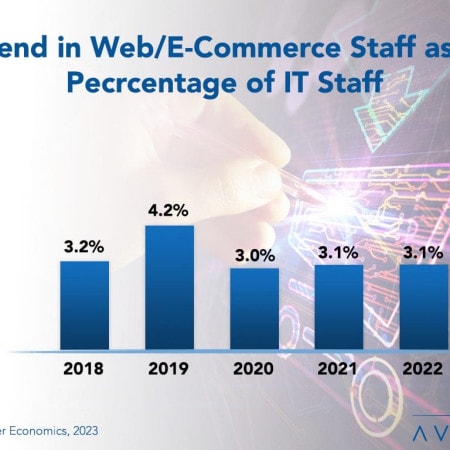

Web/E-Commerce Staffing Ratios 2023

Social media, mobile devices, multimedia, and even the prospects of the metaverse, are increasing the ways customers and suppliers interact. The omnichannel experience will pressure organizations to build larger web and e-commerce footprints. With that increasing pressure, we expect web/e-commerce staffing to also increase. The Research Byte summarizes the five-year trend in web/e-commerce staffing ratios.

February, 2023

Grid View

Grid View List View

List View