-

Digital Enterprise 5.0: Digital Readiness in the Era of AI

The Digital Enterprise 5.0: Digital Readiness in the Era of AI report explores the evolving digital transformation landscape for end-user enterprises. It covers numerous aspects, such as digital enterprise shifts, sectoral digital maturity, digital technology spending, generative AI strategy, digital talent approach, outsourcing decisions, and business strategy. The report offers insights into how enterprises are focusing on competition differentiation rather than cost management while increasing digital spending. It provides valuable findings for enterprises of varying sizes across sectors and geographies, enabling them to make informed decisions and successfully navigate the complexities of digital transformation in an ever-changing business environment.

April, 2024

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 10: Energy and Utilities Sector Benchmarks

Chapter 10 provides benchmarks for public utilities, oil and gas producers, service companies, and midstream distributors across all organization sizes. The 18 respondents in this sector include public utilities (water, gas, and electric), regional utilities, integrated energy companies, natural gas companies, pipeline operators, and other energy and utilities companies. The companies in our sample range in size from a minimum of about €150 million to more than €100 billion in annual revenue.

September, 2023

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 3A: Benchmarks by Organization Size

In these chapters, we provide a complete set of benchmarks for organizations within the specified size classification. Small organizations benchmarks are in Chapter 3A, midsize organizations in Chapter 3B, large organizations in Chapter 3C, and very large organizations in Chapter 3D. These chapters use a three-year sample. There are 98 respondents in the small organization sample, 102 in the midsize sample, 65 in the large sample, and 40 in the very large sample.

October, 2024

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 16: Media and Information Services Sector Benchmarks

Chapter 16 provides benchmarks for the media and information services sector. This sector includes publishing, broadcasting, entertainment, and digital media organizations, as well as other media and information services companies. The 15 respondents in the sample have annual revenues ranging from about €50 million to around €13 billion.

October, 2024

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 27: Brick-and-Mortar Retail

Chapter 27 provides benchmarks for brick-and-mortar retailers. This subsector includes department stores, clothing stores, convenience stores, pet stores, pharmacies, hardware stores, nonprofit retailers, furniture retailers, agricultural retailers, and other retailers. The 33 respondents in this sample have annual revenues ranging from about €80 million to over €85 billion.

September, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 10: Energy and Utilities

Chapter 10 provides benchmarks for public utilities, oil and gas producers, service companies, and midstream distributors across all organization sizes. The 22 respondents in this sector include public utilities (water, gas, and electric), integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utilities companies. The companies in our sample range in size from a minimum of about €120 million to more than €130 billion in annual revenue.

September, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 3A: Benchmarks by Organization Size: Small

In these chapters, we provide a complete set of benchmarks for organizations within the specified size classification. Small organizations benchmarks are in Chapter 3A, midsize organizations in Chapter 3B, large organizations in Chapter 3C, and very large organizations in Chapter 3D. These chapters use a three-year sample. There are 76 respondents in the small organization sample, 108 in the midsize sample, 79 in the large sample, and 73 in the very large sample.

September, 2025

-

Procurement Budgets, Staffing, and Process Metrics 2024/2025: Chapter 2: Composite Metrics

This chapter provides composite metrics for all of the organizations surveyed, across all industry sectors and organization sizes. The 157 organizations in this sample range from $300 million to over $85 billion in annual revenue.

September, 2024

-

Finance and Accounting Budgets, Staffing, and Process Metrics 2024/2025: Chapter 6: Healthcare Payors

Chapter 6 provides benchmarks for health insurance companies. The firms in this sector include companies that sell medical and dental insurance along with healthcare providers that also offer health insurance plans and function as healthcare payors.

January, 2025

-

Human Resources Budgets, Staffing, and Process Metrics 2024/2025: Chapter 10: Process Manufacturing

Chapter 10 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods.

March, 2025

-

Procurement Budgets, Staffing, and Process Metrics 2025/2026: Chapter 15: Transportation and Logistics Sector Benchmarks

Chapter 15 provides comprehensive benchmarks for procurement staffing and spending within the transportation and logistics industry. This sector includes freight and shipping companies, airlines, rail operators, trucking firms, warehouse providers, and third-party logistics (3PL) service providers. The 15 respondents from this sector vary in size, ranging from companies with annual sales of approximately $500 million to those exceeding $20 billion.

November, 2025

-

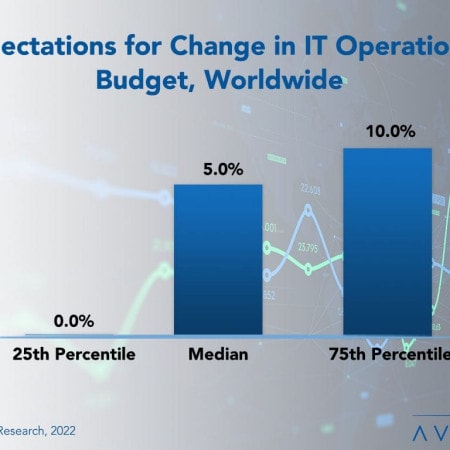

Worldwide IT Spending And Staffing Outlook 2023

Despite most of our survey respondents agreeing that the economy will be worse in 2023 than in 2022, IT spending increases are broad and strong. However, in this annual report of the IT spending and staffing outlook for 2023, we believe there is another major factor at play. We find that IT is no longer seen as a cost center but as a strategic driver of growth. Because of this, business leaders are giving their IT departments greater resources to help plan for the coming recession rather than asking them to tighten their belts.

February, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 9: Wholesale Distribution Sector Benchmarks

Chapter 9 provides benchmarks for wholesale distributors. The category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 31 respondents in the sample range in size from a minimum of about $50 million to $10 billion in revenue.

July, 2023

Grid View

Grid View List View

List View