-

Manufacturing Smart Industry Services 2023 RadarView™

The Manufacturing Smart Industry Services 2023 RadarView™ assists organizations in identifying strategic partners for engineering and manufacturing transformation by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key manufacturing smart industry service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right services partner. The 58-page report highlights top supply-side trends in the manufacturing smart industry space and Avasant’s viewpoint on them.

May, 2023

-

Digital Masters 2023 Market Insights™

The Digital Masters 2023 Market Insights™ assists organizations in identifying important trends related to enterprise digital technology adoption and the role of hyperconvergence. It also highlights the current landscape of generative AI, the key players, recent developments, and trends.

August, 2023

-

Trust and Safety Business Process Transformation 2023–2024 RadarView™

The Trust and Safety Business Process Transformation 2023–2024 RadarView™ assists organizations in identifying strategic partners for trust and safety services by offering detailed capability and experience analyses of service providers in this space. It provides a 360-degree view of the service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right trust and safety services partner. The 56-page report highlights top supply-side trends in the trust and safety services space and Avasant’s viewpoint.

November, 2023

-

Airlines and Airports Digital Services 2024 RadarView™

The Airlines and Airports Digital Services 2024 RadarView™ helps airline and airport enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 86-page report also highlights top market trends in the airline and airport space and Avasant’s viewpoint.

February, 2024

-

Network Managed Services 2023–2024 Market Insights™

The Network Managed Services 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any network modernization projects. The report also highlights key network modernization challenges that enterprises face today.

April, 2024

-

Generative AI: The Next Pivotal Point for Productivity and Efficiency

Generative AI is more than a buzzword. It holds genuine transformational potential that resonates with senior executives and employees across industries. It sparks imagination and innovation by promising to automate tasks previously deemed impossible to replicate by machines. From generating human-like text and creative content to assisting in complex decision-making, generative AI drives a paradigm shift in how businesses operate. This transformative technology is not merely hype but a catalyst for redefining productivity and unleashing unprecedented opportunities for growth and efficiency.

October, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 3C: Large Organization Benchmarks

In these chapters, we provide a complete set of benchmarks for organizations within the specified size classification. IT operational budgets €25 million or greater.

September, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 19: Chemicals Subsector Benchmarks

Chapter 19 provides benchmarks for chemicals manufacturers. Chemicals manufacturers are by definition process manufacturers that produce chemical products. The sector includes manufacturers of chemicals, petrochemicals, and other chemical products. The 14 respondents in the sample range in size from a minimum of about €50 million to around €40 billion in annual revenue.

September, 2023

-

New Technologies for Grab-And-Go Shopping

Autonomous, grab-and-go shopping is on the rise worldwide, with retailers searching for solutions to speed up store visits, increase customer satisfaction, boost sales, optimize store layouts, and deal with labor shortages.

May, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 5: Discrete Manufacturing Sector Benchmarks

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 76 respondents in the sample range in size from a minimum of about $50 million to a maximum of $50 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 3B: Midsize Organization Benchmarks

The IT spending and staffing outlook for midsize organizations in 2023 can best be described with the old British slogan, “keep calm and carry on.” As we mentioned in last year’s study, IT budgets are increasingly divorced from economic conditions. As enterprises continue their digital transformation, the IT department is increasingly valuable. Much of that can be attributed to IT’s new seat at the strategic table and the growing perception that technology can drive revenue growth. Despite economic headwinds, we see only a slight pullback in IT spending.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 21: High-Tech Subsector Benchmarks

Chapter 21 provides benchmarks for high-tech companies. The category includes computer products manufacturers, telecommunications equipment manufacturers, semiconductor manufacturers, aerospace and defense manufacturers, pharmaceutical makers, biotechnology product makers, software developers, software-as-a-service providers, and other high-tech companies. The 26 respondents in this sample range in size from a minimum of about $50 million to over $30 billion in revenue.

-

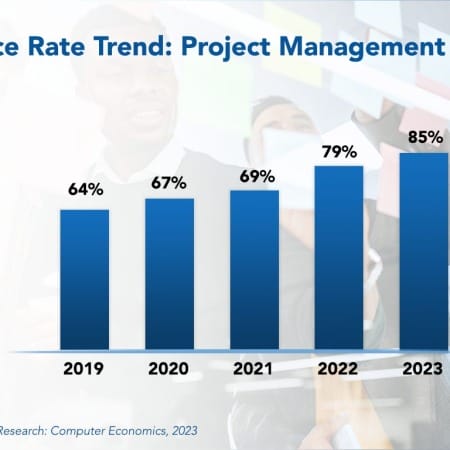

Project Management Office Best Practices 2023

To improve project success, companies often establish a formal project management office (PMO) as a center of excellence for project management disciplines. In some organizations, the PMO operates as an advisory group to project managers, who report directly to business units. In other organizations, project managers report directly to the PMO and are assigned to projects as needed. However, in recent years, the use of PMOs has grown significantly, especially for organizations that use them for all projects.

December, 2023

Grid View

Grid View List View

List View