-

Procurement Alchemy: Turning Compliance into Human Rights Gold

Human rights due diligence in procurement is not just a moral imperative but a legal necessity. Companies are increasingly held accountable for ensuring their supply chains are free from human rights abuses. This growing awareness is driven by international standards and local laws that mandate businesses to take proactive steps in identifying, preventing, and mitigating human rights risks within their supply chains. The importance of human rights due diligence cannot be overstated, as it safeguards the dignity and rights of individuals while protecting companies from reputational and legal risks.

May, 2025

-

Getting CRM Right Is Harder Than It Looks

CRM systems are one of the most widely adopted categories of enterprise applications. However, despite being a mature technology, businesses often struggle to realize its full potential, leading to low-value outcomes compared to other technologies. This Research Byte summarizes our full report, CRM Adoption Trends and Customer Experience.

June, 2025

-

Typical IT Budget Increases Disguise Major Transformation in IT Departments

Many of the top line IT metrics from Avasant’s latest IT Spending and Staffing Benchmarks 2025/2026 study may look roughly the same as they have been for much of the last decade. On the surface, it is easy to say that this is another ho-hum, predictable year for IT departments. But a deeper dive shows significant transformation that’s underway. This Research Byte is a brief description of some of the findings in our IT Spending and Staffing Benchmarks 2025/2026 study.

August, 2025

-

Breaking the Chains: Managing Long-Term Vendor Lock-In Risk in CRM Virtualization Executive Perspective

Customer Relationship Management (CRM) virtualization is now a strategic imperative for modern enterprises. It offers the promise of scalability, enhanced customer engagement, and operational efficiency. Yet beneath these gains lies an often-underestimated threat: vendor lock-in. As CRM platforms, such as Salesforce, become more deeply embedded into business processes, organizations can find themselves increasingly constrained technically, financially, and operationally by the very platforms intended to drive their AI evolution.

September, 2025

-

Harnessing AI, Data Analytics, and Employer Branding for a Long-term Talent Attraction Strategy

With rising macroeconomic challenges, including wage inflation, talent shortages, and labor market competition, as well as increasingly demanding candidate expectations, talent executives are prioritizing the development of a robust talent pipeline and enhancing employer branding and candidate experience to foster long-term workforce sustainability. They are focusing on leveraging data-driven technologies, such as talent intelligence, predictive analytics, AI, ML, and candidate relationship management platforms, to optimize hiring strategies. Service providers are also enhancing their service and delivery capabilities across talent insights, candidate sourcing, experience, and upskilling through partnerships. They are investing in workflow automation and generative AI solutions to enhance recruiter productivity, as well as frameworks and services to support enterprises’ technology and AI investments. Both demand-side and supply-side trends are covered in our Talent Acquisition Business Process Transformation 2025–2026 Market Insights™ and Talent Acquisition Business Process Transformation 2025–2026 RadarView™, respectively.

December, 2025

-

Open Innovation – The Catalyst for Transforming India’s Technology Ecosystem

This report, developed in collaboration with nasscom, assesses the status of Open Innovation (OI) in India and its global context. It explores investments and initiatives by the Indian government, industry bodies, and the private sector to promote OI. The report identifies India’s potential to rank in the top 10 for global innovation, emphasizing OI’s role in addressing local needs, fostering inclusivity, and supporting innovative ventures. It provides recommendations for advancing OI and highlights opportunities for collaboration across sectors, including corporates, academia, and government agencies.

November, 2023

-

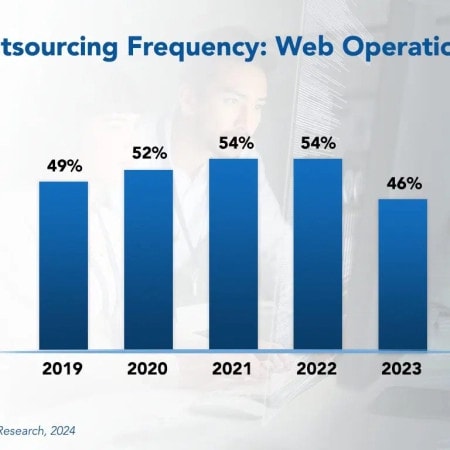

Web Operations Outsourcing Trends and Customer Experience 2024

Web operations outsourcing is one of the most popular types of managed services. Organizations of all kinds continue to expand their efforts in online marketing, website management, and e-commerce. This shift toward web-enabled business processes and e-commerce has prompted many companies to reassess their online strategies. In doing so, many have turned to managed service providers that can provide the needed expertise and a flexible, scalable infrastructure to deliver highly available and reliable web and e-commerce systems.

February, 2024

-

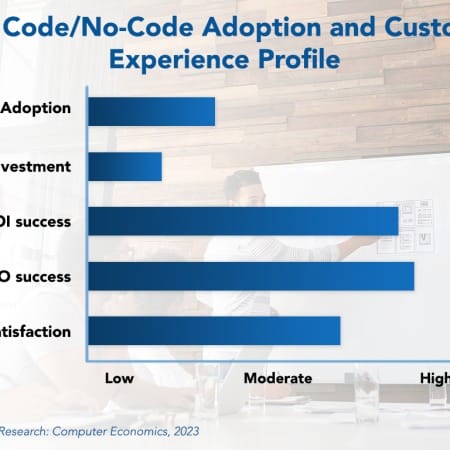

Low-Code/No-Code Adoption Trends and Customer Experience 2024

Low-Code/No-Code (LC/NC) platforms are becoming increasingly popular in enterprise software development. LC/NC enables non-technical users and citizen developers to quickly create software applications with little to no manual coding. Using a visual drag-and-drop interface, pre-built components, and templates, LC/NC platforms allow users to create applications without requiring a high level of coding knowledge. This capability is invaluable for companies of all sizes because it lowers development costs, speeds up development, and improves agility.

January, 2024

-

CRM Adoption Trends and Customer Experience 2025

Customer relationship management (CRM) systems are one of the most widely adopted categories of enterprise applications, and investment in new CRM capabilities continues to grow. Although cloud-based CRM offerings have allowed the capabilities to move down-market to smaller companies, the need to adopt a CRM system signals that a company has reached a milestone in building its application portfolio, similar to when a company first moves from spreadsheets to a real accounting system. Modern CRM systems are essential for companies looking to improve their productivity and effectiveness in sales, marketing, and customer service.

June, 2025

-

Agile Development Best Practices 2024

SaaS and packaged solutions are incredibly valuable. They help save time and resources in developing and maintaining applications for common back-office processes such as payroll, accounting, ERP, and CRM.

February, 2024

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 9: Wholesale Distribution Sector Benchmarks

Chapter 9 provides benchmarks for wholesale distributors. The category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 31 respondents in the sample range in size from a minimum of about $50 million to $10 billion in revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 36: Government Agencies Subsector Benchmarks

Chapter 36 provides benchmarks for federal, state, and regional government agencies. The category includes public health agencies, courts and law enforcement agencies, organizations that provide IT services to government agencies, social service agencies, state parks, and other federal, state, and regional government units. The 21 respondents in the sample have operating budgets that range in size from about $62 million to about $40 billion.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 33: Professional Services Subsector Benchmarks

Chapter 33 provides benchmarks for professional services organizations. The 20 respondents in the sample range in size from a minimum of about $50 million to about $2 billion in annual revenue. The sector includes firms that provide professional services, including legal, accounting, financial advice, consulting, marketing, and other services.

July, 2023

-

Blockchain Services 2024 RadarView™

The Blockchain Services 2024 RadarView™ helps enterprises identify key use cases and develop a strategy for blockchain adoption. The report highlights service providers who can accelerate business transformation and offers detailed analyses of leading providers’ capabilities to help select the right partners. The 66-page report also covers key industry trends and Avasant’s insights on the blockchain space.

December, 2024

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 12: Professional and Technical Services Sector Benchmarks

Chapter 12 provides benchmarks for professional and technical services organizations. The 45 respondents in the sample range in size from a minimum of about €50 million to about €80 billion in annual revenue. The sector includes firms that provide professional and technical services, including engineering, legal, accounting, financial advice, consulting, marketing, research, and other services.

September, 2023

Grid View

Grid View List View

List View