-

Streamlining and Minimizing Vendor Management Complexity

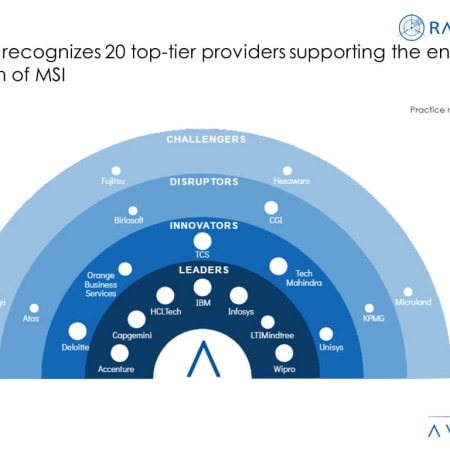

The growing enterprise demand for multisourcing service integration (MSI) is mainly driven by complexities in multivendor environments and the need for optimizing IT costs and enhancing service outcomes and quality. Service providers offer multiple end-to-end services to help organizations streamline service delivery processes, enhance supplier management, mitigate risks, and improve vendor collaboration. Additionally, service providers invest in advanced technologies such as AI/ML, automation, and proprietary IT service management tools to optimize service delivery and improve overall outcomes. This rising demand for MSI has also led to a 46% increase in the number of full-time employees working in this field. Both demand-side and supply-side trends are covered in our Multisourcing Service Integration 2022–2023 Market Insights™ and Multisourcing Service Integration 2022–2023 RadarView™, respectively.

April, 2023

-

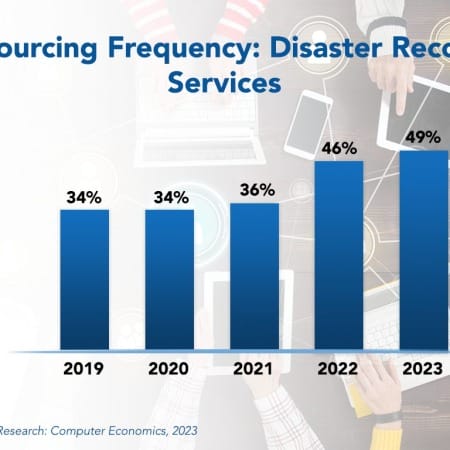

Disaster Recovery Outsourcing Makes Up for Scarcity of Skills

If there were any doubts about the need for disaster recovery planning, these were dispelled over the past few years. A worldwide pandemic, power outages, wars, and cyberattacks exposed organizations that were not fully prepared. But what if the IT organization does not have the resources or the capability to do it all in-house? For this reason, many organizations are turning to disaster recovery providers to fill the gap. This Research Byte analyzes the five-year trend in disaster recovery outsourcing.

June, 2023

-

Moving from Cost Optimization to Value Generation Through Procurement Transformation

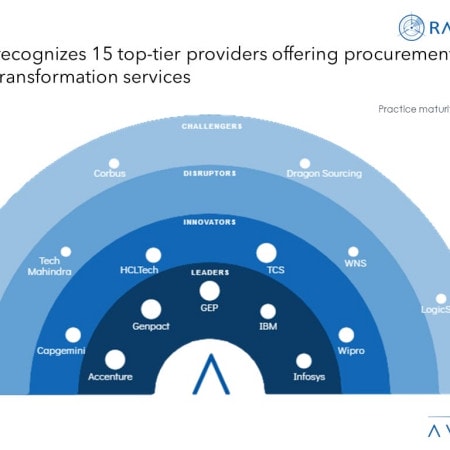

Traditionally, procurement was considered a cost center but, of late, procurement has become a strategic business function within enterprises. As a result, the role of a Chief Procurement Officer (CPO) is evolving from reducing costs to maintaining supply chain resilience in addition to deriving higher value from their sourcing and procurement function. The priority is not new; however, varied supply chain disruptions are bringing it to the forefront. Further, organizations are engaging domain experts and investing in AI, automation, and analytics to generate higher value from the procurement function. They are increasingly leveraging service provider support to parallelly transform people, processes, and technology. As a result, procurement business process transformation deals have grown by over 15% between March 2022 and March 2023. Both demand- and supply-side trends are covered in Avasant’s Procurement Business Process Transformation 2023 Market Insights™ and Procurement Business Process Transformation 2023 RadarView™, respectively.

August, 2023

-

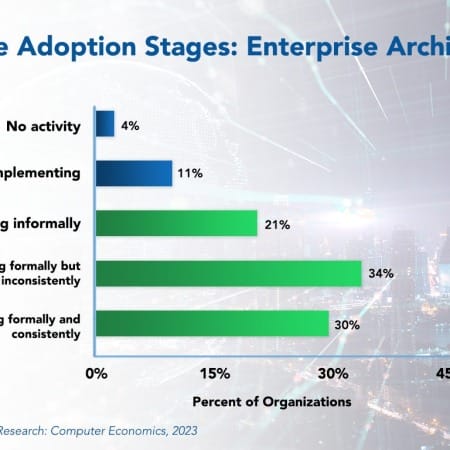

Enterprise Architecture Popular but Inconsistently Practiced

Enterprise architecture is an IT best practice that has been around since the 1980s. It provides a description of the organization in its desired state. With the obvious benefits of this approach, you would think more enterprises would make heavy use of it. However, while it is one of the most adopted practices in our study, most organizations practice it inconsistently, availing only a portion of its benefits. This Research Byte discusses the importance of enterprise architecture and its adoption trends.

October, 2023

-

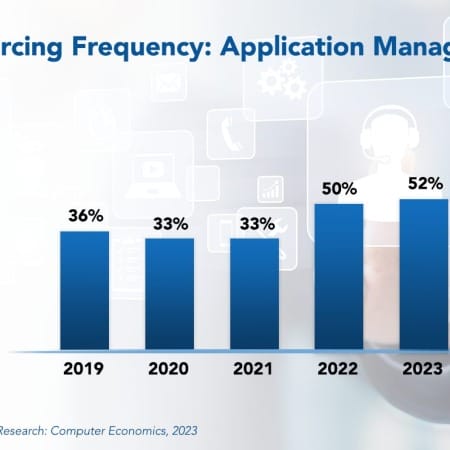

Application Management Outsourcing Booming Despite SaaS

As the application portfolio of an enterprise grows, the ongoing support for those systems can become a burden on the IT organization, leaving little time for developing and implementing new applications. In response, some organizations see outsourcing application management as an attractive option. Although SaaS and the cloud have taken over many application management responsibilities, businesses continue to outsource this function. This Research Byte explores this trend, based on our full report, Application Management Outsourcing Trends and Customer Experience.

December, 2023

-

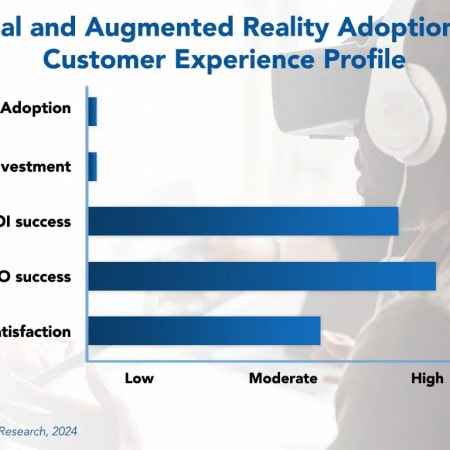

VR/AR Adoption Low, For Now

Businesses are in the early stages of adopting virtual reality and augmented reality (VR/AR) solutions. While widespread adoption of VR/AR has not yet fully materialized, businesses are actively experimenting with these technologies. However, the ROI and TCO are favorable for early adopters. This Research Byte summarizes our full report, Virtual and Augmented Reality Adoption Trends and Customer Experience.

February, 2024

-

Hybrid Enterprise Cloud Services: Gen AI and Industry-specific Cloud Solutions Drive Next Wave of Growth

As businesses delve into the possibilities that generative AI presents, cloud migration, data modernization, security, and privacy take center stage as crucial priorities. Service providers are directing investments toward integrating generative AI with traditional automation methodologies to enhance productivity within IT operations. This integration aims to reinforce hybrid cloud systems, ensuring they remain robust, secure, and sustainable. Both demand-side and supply-side trends are covered in Avasant’s Hybrid Enterprise Cloud Services 2023–2024 Market Insights™ and Hybrid Enterprise Cloud Services 2023–2024 RadarView™, respectively.

February, 2024

-

Network Managed Services: Optimizing Network Operations Effectively

Enterprises encounter several challenges in managing their network infrastructure, such as scalability issues, security vulnerabilities, and resource limitations. In today’s dynamic digital environment, it is crucial for businesses to overcome these challenges to adapt to evolving demands and remain competitive and resilient. This requires comprehensive assessments, strategic planning, and tailored technology implementation. Furthermore, effective network monitoring, maintenance, and troubleshooting are vital to ensuring seamless operations and minimizing downtime. Additionally, service providers are helping enterprises with proactive security measures, compliance adherence, and efficient resource utilization, empowering enterprises to focus on core objectives while effectively managing network complexities.

April, 2024

-

Deloitte’s Global Restructuring – Streamlining for the Future

Deloitte’s decision to undertake its most significant restructuring in a decade reflects the challenges faced by major consultancy firms amid an expected market slowdown. The goal of the restructuring is to reduce the number of Deloitte’s primary business units from five to four, streamlining its operations. The largest Big Four professional services firm is planning to reorganize its global structure and streamline its advisory businesses to reduce the organizational complexity and free up more partners to work with clients, driven by the need to cut costs and simplify operations amid anticipated market challenges.

May, 2024

-

Incorporating Technology Levers and Digital Expertise to Meet Evolving Supply Chain Needs

The supply chain landscape is undergoing a transformative shift, propelled by the convergence of pandemic-induced disruptions, shipping challenges, geopolitical instabilities, and inflationary pressures. Traditionally linear and siloed supply chain operations, from sourcing and procurement to manufacturing, distribution, and disposition, are now being reimagined. Digitalization is the linchpin in this evolution, streamlining decision-making and optimizing processes to mitigate costs. Where cost-minimization in sourcing and distribution once reigned, the focus has pivoted to resilience, adaptability, and visibility have become critical priorities in navigating the complexities of today’s supply chain dynamics.

June, 2024

-

Intelligent Process Mining Platforms: Delivering Intuitive Business Intelligence and Process Transparency

The emergence of generative AI has transformed the landscape of process mining. Platform providers have expanded their capabilities to extract unstructured data from enterprise environments and deliver insights through natural language queries. Enterprises are increasingly prioritizing rapid process optimization with personalized recommendations. Moreover, they utilize what-if scenario simulations and digital twin technology to forecast and evaluate business impacts early. To capitalize on market opportunities, platform providers are augmenting process mining offerings through product enhancements, strategic partnerships, and acquisitions.

July, 2024

-

Transforming the Future of Organizations: Insights from Industry Leaders on Digital Operating Models

The current tech landscape is characterized by surging technologies such as artificial intelligence, machine learning, cloud computing, and the Internet of Things. But though technological advancements and digital operating models promise significant benefits, challenges exist. These obstacles affect organizations' efforts in achieving true agility and digital transformation. How then can businesses effectively navigate them to achieve their desired outcomes? This article delves into the key points from a panel discussion at Avasant’s recent Empowering Beyond Summit (EBS) 2024.

July, 2024

-

Data Center Managed Services: Evaluating Cloud Strategies Amid the Surge in On-Premises Repatriation

Enterprises are reconsidering their cloud strategies due to rising costs, security concerns, and regulatory requirements. To address these challenges, they are implementing cloud repatriation to regain control and enhance performance by moving their workloads to on-premises data centers. On the other hand, service providers are using generative AI to optimize costs with automated infrastructure provisioning, enhance security by predicting threats, and improve compliance through real-time observability and control. Both demand-side and supply-side trends are covered in our Data Center Managed Services 2024 Market Insights™ and Data Center Managed Services 2024 RadarView™, respectively.

September, 2024

-

United Kingdom (UK) Digital Services: Driving Regional Growth through Innovative Solutions for a Digital Future

The digital services sector in the UK is rapidly evolving due to technological advancements and policy frameworks that are shaping the region’s digital landscape. There has been significant growth in the adoption of digital services across various sectors, driven by increased market competition from digital natives and changing consumer preferences. The UK government is also prioritizing digital transformation projects to enhance service delivery while addressing cybersecurity threats and regulatory compliance. This adoption aims to forge a digital ecosystem and foster innovation, shaping the future of digital services in the UK.

September, 2024

-

Embracing Turbulent Markets by Enabling New Investment Avenues and Driving Down Costs

In today’s turbulent financial markets, the business landscape is rapidly evolving, driven by multiple factors, including the Great Wealth Transfer from older generations to younger, tech-savvy investors. This shift drives demand for smart advisory services facilitated by advanced analytics and personalized strategies. Additionally, there is a growing appetite for alternative investments and digital assets as investors diversify portfolios and new asset classes necessitate novel trade life cycles. Amid this evolution, the financial landscape is seeing a decline in M&As and initial public offerings (IPOs), focusing on reducing operational costs. Regulatory changes, such as the shift toward T+1 settlement cycles and the rise of ESG scores as an investment criterion, open new avenues as firms leverage digital technologies, including generative AI, to navigate these challenging times. Both demand-side and supply-side trends are covered in our Financial Services Digital Services 2024 Market Insights™ and Financial Services Digital Services 2024 RadarView™, respectively.

October, 2024

Grid View

Grid View List View

List View