-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 43: Construction and General Contracting Subsector Benchmarks

Chapter 43 provides benchmarks for construction and general contracting companies. The 22 respondents in the sample range in size from about $150 million to over $80 billion in annual revenue. This subsector includes commercial, residential, and industrial construction contractors, as well as engineering and infrastructure development companies.

August, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 33: Technical Services

Chapter 33 provides benchmarks for technical services organizations. The 18 respondents in the sample range in size from a minimum of about €110 million to about €70 billion in annual revenue. This subsector includes firms that provide technical services, such as engineering, architectural, scientific, research, and other services.

September, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 18: Media and Information Services

Chapter 18 provides benchmarks for the media and information services sector. This sector includes publishing, broadcasting, entertainment, and digital media organizations, as well as other media and information services companies. The 17 respondents in the sample have annual revenues ranging from about €50 million to around €10 billion.

September, 2025

-

Digital Engineering Services 2025–2026 RadarView™

The Digital Engineering Services 2025–2026 RadarView™ can help enterprises identify the right partners and service providers to implement their digital engineering strategy by providing detailed capability and experience analysis for leading service providers. The report provides a 360-degree view of key providers for digital engineering services across practice maturity, partner ecosystem, and investments and innovations. The 70-page report also highlights top supply-side trends in the digital engineering space and Avasant’s viewpoint.

November, 2025

-

State and Local Government Digital Services 2024 Market Insights™

The State and Local Government Digital Services 2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the state and local government space. The report also highlights key challenges that enterprises face today.

July, 2024

-

Banking Process Transformation 2023 RadarView™

The Banking Process Transformation 2023 RadarView™ assists banks and financial companies in identifying strategic partners for banking process transformation by featuring detailed capability and experience analyses of service providers in this space. It provides a 360-degree view of the service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right partner in the banking process transformation space. The 68-page report highlights top supply-side trends in the banking process transformation arena and Avasant’s viewpoint on them.

May, 2023

-

Digital CX Services 2023 Market Insights™

The Digital CX Services 2023 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital CX services project. The report also highlights key challenges that enterprises face today.

August, 2023

-

United Kingdom (UK) Digital Services 2023–2024 RadarView™

The United Kingdom (UK) Digital Services 2023–2024 RadarView can help enterprises based in the UK to craft a robust strategy based on regional outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 102-page report also highlights top market trends in the UK region and Avasant’s viewpoint.

December, 2023

-

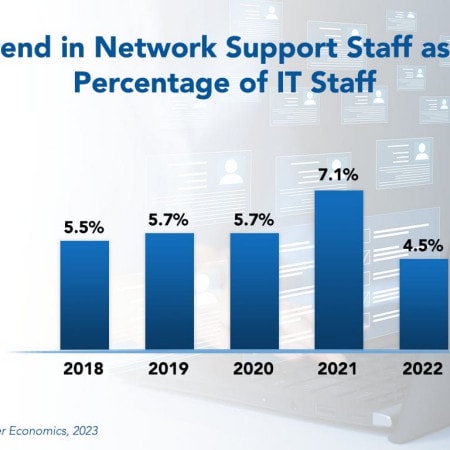

Network Support Staffing Ratios 2023

The COVID-19 pandemic increased the number of employees working from home. This accelerated an already increasing demand for network support staff brought on by cloud transformation and caused the number of network support personnel to spike in 2021. However, 2022 trends show a decrease in network support staffing to below pre-pandemic levels. This may be due to businesses reverting to “normal” operations, an increase in automation, a growth in other IT areas, or a combination of these and other factors.

May, 2023

Grid View

Grid View List View

List View