-

Residual Value Forecast October 2023

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

October, 2023

-

SAP S/4HANA Services 2025–2026 Market Insights™

The SAP S/4HANA Services 2025–2026 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any SAP S/4HANA services project. The report also highlights key challenges that enterprises face today.

December, 2025

-

Residual Value Forecast August 2024

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

August, 2024

-

Fair Market Value August 2025

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

August, 2025

-

Payroll Business Process Transformation 2023–2024 Market Insights™

The Payroll Business Process Transformation 2023–2024 Market Insights assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any payroll transformation project. The report also highlights the evolution of the payroll function and emerging priorities of payroll professionals.

November, 2023

-

Conversational AI Platforms 2024 RadarView™

The Conversational AI Platforms 2024 RadarView™ assists enterprises in evaluating key vendors providing conversational AI platforms. It provides a 360-degree view of key conversational AI platform providers across the dimensions of product maturity, enterprise adaptability, and future readiness, thereby supporting enterprises in identifying the right platform partners. The 31-page report highlights top supply-side trends in the conversational AI space and Avasant’s viewpoint on them.

June, 2024

-

Intelligent Document Processing Platforms 2024–2025 Market Insights™

The Intelligent Document Processing Platforms 2024–2025 Market Insights™ assists organizations in identifying important demand-side trends for navigating the document processing landscape and achieving operational efficiency. The report also highlights the key challenges enterprises face today in this space.

December, 2024

-

Healthcare Payer Business Process Transformation 2025 RadarView™

The Healthcare Payer Business Process Transformation 2025 RadarView™ assists organizations in identifying strategic partners for healthcare payer business process transformation by offering detailed capabilities and experience analyses for service providers. It provides a 360-degree view of key healthcare payer business process transformation service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right service partner. The 66-page report highlights top supply-side trends in the healthcare payer business process transformation space and Avasant’s viewpoint on them.

May, 2025

-

Global Competency Center (GCC) Services 2025 Market Insights™

The Global Competency Center (GCC) Services 2025 Market Insights™ equips stakeholders with a deep understanding of the current landscape and future trajectory of the GCC market, serving as a valuable tool for strategic planning and decision-making.

August, 2025

-

Nividous: Unlocking the Potential of Intelligent Automation

Traditional RPA systems are at a crossroads. They are too often siloed and difficult to manage. Nividous Software Solutions is an example of a company that is unlocking the potential of RPA with its comprehensive, integrated, and scalable business automation platform—a practical approach to implementing intelligent automation.

October, 2023

-

Artificial Intelligence a Major Focus of Empowering Beyond Summit

Generative AI has caught everyone’s imagination as ChatGPT became the fastest adopted technology in history. In light of this, artificial intelligence will be one of the focuses of Avasant’s Empowering Beyond Summit 2023 (EBS23), which will feature inspiring keynotes, interactive panels, innovative demos, and more.

April, 2023

-

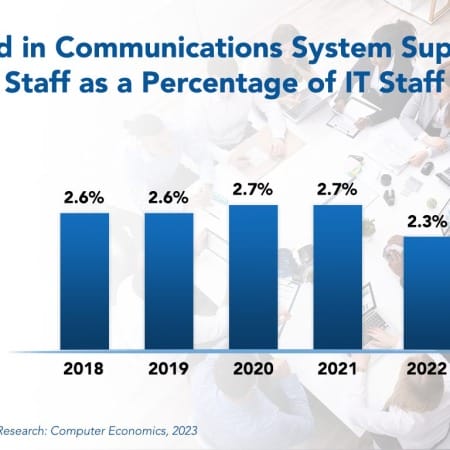

Communications Staffing Ratio Falls Despite Growing Complexity

Hybrid work is making corporate communications systems more complicated as cloud-based communications solutions and the advancing presence of AI reshape the role of communications support staff members. Nevertheless, IT organizations have been able to manage this growing complexity without adding to communications systems support staffing. This Research Byte provides a summary of our full report on communications support staffing ratios.

June, 2023

-

Empowering Canada’s Innovation Nexus Through Digital Transformation

Canadian enterprises are embracing digital technologies to cater to the surging consumer demand in leisure, retail, and recreational industries while improving operational efficiency to achieve sustainability targets. They are increasingly integrating AI, automation, and cloud technologies to develop new solution offerings and have accelerated their digital transformation programs. The pandemic further pushed the integration of digital technologies. Additionally, there is a concerted effort to establish Canada as the upcoming hub for digital talent by fostering investments and strategic partnerships with technology companies and government entities. Both demand-side and supply-side trends are covered in our Canada Digital and IT Services 2023–2024 Market Insights™ and Canada Digital and IT Services 2023–2024 RadarView™, respectively.

August, 2023

-

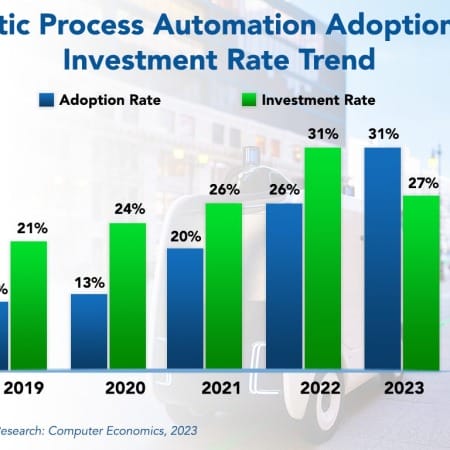

RPA Adoption Increases as Robots Get Smarter

Two years of inflation and rising labor costs have increased enterprise interest in automation. As technology has advanced and corporate stakeholders have successfully delegated tasks to robots, trust in RPA has grown over time. This Research Byte provides a summary of our full report on RPA Adoption Trends and Customer Experience.

October, 2023

-

Maneuvering Turbulent Times with AI-driven IT Services and Operations

In the current challenging economic environment, leading IT services providers are focusing on innovation, adaptation, and AI to ensure their future success. With the advent of generative AI, global IT services companies are investing in upskilling and reskilling the workforce and sharpening their focus by leveraging cloud and AI solutions to enhance service efficiencies. Some providers are investing heavily in AI research and development and focusing on platform-based operations to help enterprises reduce costs, improve efficiency, and accelerate innovation. We highlight the efforts of one such service provider, TCS, focusing on the TCS Analyst Day 2023 event held in October.

December, 2023

Grid View

Grid View List View

List View