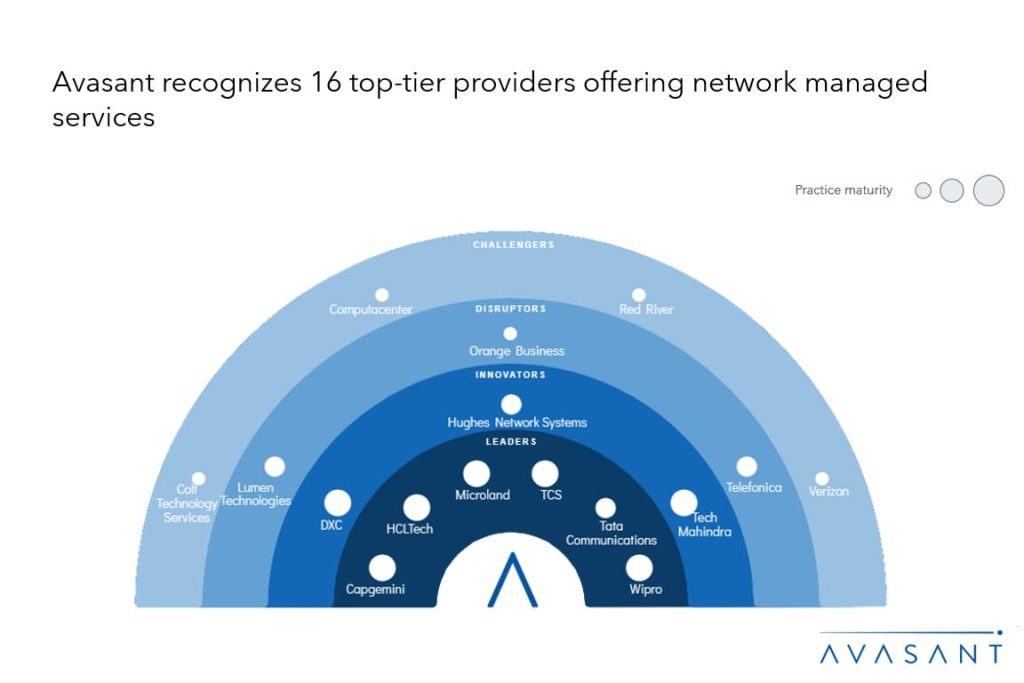

Enterprises encounter several challenges in managing their network infrastructure, such as scalability issues, security vulnerabilities, and resource limitations. In today’s dynamic digital environment, it is crucial for businesses to overcome these challenges to adapt to evolving demands and remain competitive and resilient. This requires comprehensive assessments, strategic planning, and tailored technology implementation. Furthermore, effective network monitoring, maintenance, and troubleshooting are vital to ensuring seamless operations and minimizing downtime. Additionally, service providers are helping enterprises with proactive security measures, compliance adherence, and efficient resource utilization, empowering enterprises to focus on core objectives while effectively managing network complexities.