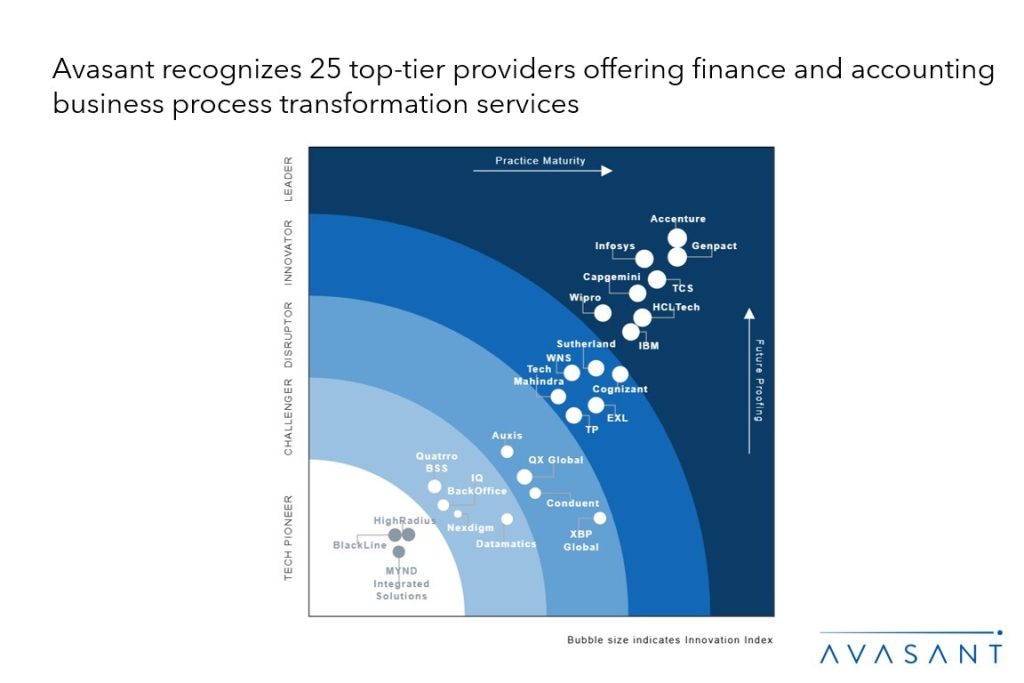

The finance and accounting (F&A) outsourcing industry is now in a phase defined by the widespread operational deployment of advanced technologies, with providers moving beyond early-stage pilots to embed AI, Gen AI, ML, and intelligent automation into live delivery environments, driving measurable impact in efficiency, accuracy, and insights. This shift toward AI-native automation and analytics is reducing manual effort, accelerating reporting, and supporting more informed and strategic decision-making. Talent shortages and skills gaps are prompting organizations to partner with service providers for access to both technology and specialized finance expertise, while nearshoring and diversified delivery models are gaining traction, enabling enterprises to balance cost, agility, and collaboration. Both state of the market and supply-side trends are covered in Avasant’s Finance and Accounting Business Process Transformation 2025–2026 Market Insights™ and Finance and Accounting Business Process Transformation 2025–2026 RadarView™, respectively.