-

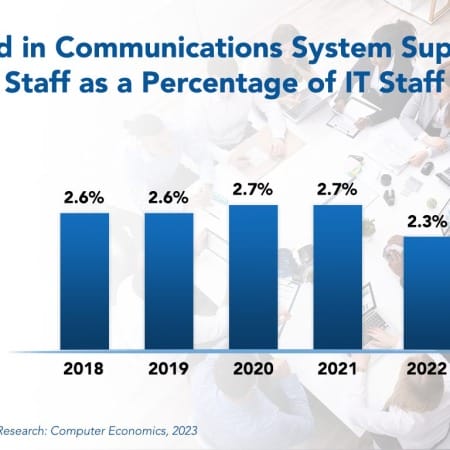

Communications System Support Staffing Ratios 2023

Hybrid work is making communications support more complicated, as workers move beyond email and texting to video conferencing and enterprise social media groups. Because of the rise of consumerization, employees and customers are demanding more immersive experiences, even virtual reality. Cloud-based communication and the rise of artificial intelligence are also changing the role of the communications support staff members. All of this is set to put greater demands on corporate communications in 2023.

June, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 14: Construction and Trade Services Sector Benchmarks

Chapter 14 provides benchmarks for construction and trade services companies. The 30 respondents in the sample range in size from about $60 million to over $28 billion in annual revenue. The category includes engineering and construction companies, commercial, residential, and industrial construction contractors, specialty contractors, oil field services firms, firms that provide mining services, environmental services firms, and other construction and trade services firms.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 35: City and County Government Subsector Benchmarks

Chapter 35 provides benchmarks for city and county governments. This chapter is concerned with the IT workings of city or county governments and not individual agencies within larger governments (which can be found in Chapter 36). The 19 respondents in this subsector have annual operating budgets ranging from $50 million to $1.2 billion.

July, 2023

-

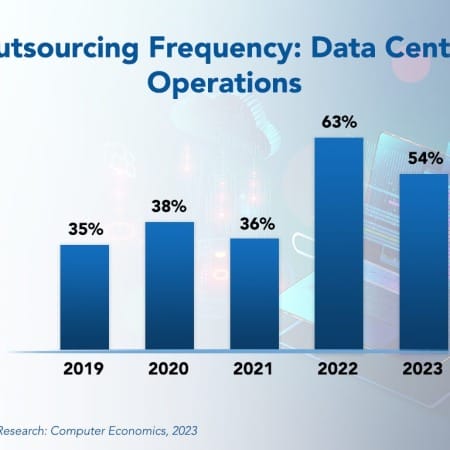

Data Center Operations Outsourcing Trends and Customer Experience 2023

As data centers become larger, more automated, virtualized, and complex, service providers can leverage expertise and economies of scale to provide attractive alternatives to on-premises data centers. On the other hand, turning over data center operations to a service provider or moving applications to a hosting site can entail risk. Making the choice to outsource data center operations can reduce the infrastructure budget, but when managed incorrectly the outcome can be adverse.

July, 2023

-

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 1: Executive Summary

Chapter 1 provides a free executive summary for our first survey-based report on generative AI strategy, spending, and adoption. The full report provides metrics on how much enterprises are spending on this ground-breaking technology, where they are spending it, and how they are governing it. It provides statistics for nearly 200 companies that have already adopted some form of generative AI, providing data ranging from the strategic importance of AI to staffing and budget numbers, to usage data. Metrics are provided for the composite sample along with six industry chapters. [Free Download]

December, 2023

-

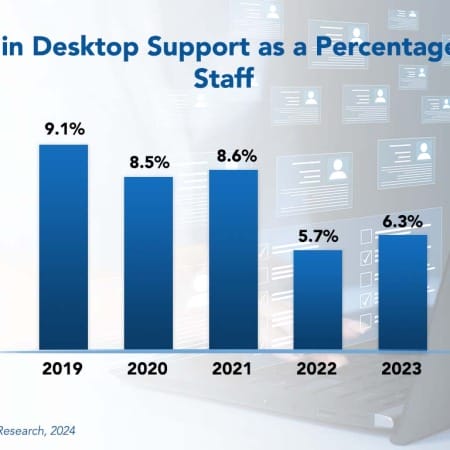

Desktop Support Staffing Ratios 2024

The desktop support function has gone through significant disruption in recent years. The COVID-19 lockdowns and the sudden shift to remote work, combined with the recent return to the office has seismically shifted the location and value of the desktop. Digital workplace technologies and the need to secure employee-owned equipment has put a strain on this function. At the same time, however, automation and other influences have made desktop support more efficient. It is always hard to right-size any IT staff function, but desktop support may be harder than normal at this time.

February, 2024

-

Residual Value Forecast April 2024

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

April, 2024

-

IT Spending Trends in Healthcare Payors Sector 2024

In the ever-evolving healthcare landscape, payors play a crucial role in managing costs and ensuring quality care. As the industry faces growing demands and technological advancements, healthcare payors must balance the need to improve service quality while remaining competitive. How are they achieving this? This report explores the key IT spending trends driving these transformative investments and their impact on the healthcare payor sector. It also draws on our latest benchmarking survey to offer essential metrics, identify major challenges, and present best practices and recommendations for maximizing IT value. Additionally, it analyzes the impact of IT spending on service quality and cost efficiency.

June, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 1: Executive Summary

The Computer Economics IT Spending and Staffing Benchmarks study (the "ISS"), published annually since 1990, is the definitive source for IT spending and staffing benchmarks and IT performance statistics across multiple industries and government sectors.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 33: Oil and Gas

Chapter 33 provides benchmarks for oil and gas producers and midstream distributors across all organization sizes. The 15 respondents in this sector include integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utilities companies. The companies in our sample range in size from a minimum of about $50 million to more than $100 billion in annual revenue.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 22: Life Sciences

Chapter 22 provides benchmarks for life sciences companies. This category includes pharmaceutical makers, biotechnology product companies, and medical device manufacturers. The 31 respondents in this sample range in size from a minimum of about $50 million to over $50 billion in revenue.

September, 2024

-

Application Developer Staffing Ratios 2024

In just five years, application developers as a percentage of IT staff have gone from making up nearly a quarter of the entire IT staff (23.1%) to only 14.2%. This significant drop is not necessarily a sign of mass layoffs of application developers. In fact, we have seen no evidence that there are fewer application developers working in IT departments. However, it does signal a change in the overall makeup of IT departments and the changing role of the application developer.

September, 2024

-

E-commerce Sees Innovation Through Emerging Technologies

E-commerce adoption numbers are more difficult to interpret than other technologies in our Tech Trends reports. Some sectors, such as healthcare and manufacturing, may have fewer e-commerce needs than sectors like retail. As such, adoption and investment numbers have seemed low. This Research Byte provides a summary of our full report on e-commerce adoption trends and customer experience.

January, 2025

-

IT Security Staffing Ratios 2025

Cybersecurity threats are constantly evolving, and it is tempting to throw more bodies and more money at the problem. With the threat of significant financial loss, business disruptions, and damaged reputations, organizations of all sizes face increasing pressure to bolster their security posture. Enterprises have steadily increased their IT security budgets and head count for years. However, many struggle to effectively recruit, retain, and develop the skilled security professionals needed to address these growing threats.

February, 2025

-

Network Support Staffing Ratios 2025

Following a sharp decline in 2022, the demand for network support personnel has increased and they now make up a larger portion of the IT staff than they have since 2021. Network staffing has been highly volatile in recent years due to economic and technological factors, ranging from the COVID-19 pandemic to the growth of AI.

June, 2025

Grid View

Grid View List View

List View