-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 24: Aerospace and Defense

Chapter 24 provides benchmarks for aerospace and defense companies. This category includes airplane and aerospace manufacturers, makers of weapons systems, aerospace and defense research, and other defense companies. The 15 respondents in this sample range in size from a minimum of about €85 million to over €60 billion in revenue.

September, 2025

-

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 7: Professional Services Sector Benchmarks

This chapter provides generative AI metrics for the professional services sector. It features a sample of 11 professional services companies including consulting firms, business solutions companies, real estate brokerages, and data analysis firms. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

Finance and Accounting Budgets, Staffing, and Process Metrics 2024/2025: Chapter 3A: Metrics by Organization Size: Small/Midsize

This chapter provides procurement business process metrics for small and midsize organizations across all industries.

January, 2025

-

Human Resources Budgets, Staffing, and Process Metrics 2024/2025: Chapter 6: Healthcare Payor

Chapter 6 provides benchmarks for health insurance companies. The firms in this sector include companies that sell medical and dental insurance along with healthcare providers that also offer health insurance plans and function as healthcare payors.

March, 2025

-

Procurement Budgets, Staffing, and Process Metrics 2025/2026: Chapter 11: Process Manufacturing Sector Benchmarks

Chapter 11 provides comprehensive benchmarks for procurement staffing and spending within the process manufacturing industry. This sector encompasses a wide array of organizations, including chemical producers, food and beverage manufacturers, pharmaceutical companies, and oil and gas refineries. The 29 respondents from this sector vary in size, with annual sales ranging from approximately $600 million to over $20 billion.

November, 2025

-

New Technologies for Grab-And-Go Shopping

Autonomous, grab-and-go shopping is on the rise worldwide, with retailers searching for solutions to speed up store visits, increase customer satisfaction, boost sales, optimize store layouts, and deal with labor shortages.

May, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 5: Discrete Manufacturing Sector Benchmarks

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 76 respondents in the sample range in size from a minimum of about $50 million to a maximum of $50 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 3B: Midsize Organization Benchmarks

The IT spending and staffing outlook for midsize organizations in 2023 can best be described with the old British slogan, “keep calm and carry on.” As we mentioned in last year’s study, IT budgets are increasingly divorced from economic conditions. As enterprises continue their digital transformation, the IT department is increasingly valuable. Much of that can be attributed to IT’s new seat at the strategic table and the growing perception that technology can drive revenue growth. Despite economic headwinds, we see only a slight pullback in IT spending.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 21: High-Tech Subsector Benchmarks

Chapter 21 provides benchmarks for high-tech companies. The category includes computer products manufacturers, telecommunications equipment manufacturers, semiconductor manufacturers, aerospace and defense manufacturers, pharmaceutical makers, biotechnology product makers, software developers, software-as-a-service providers, and other high-tech companies. The 26 respondents in this sample range in size from a minimum of about $50 million to over $30 billion in revenue.

-

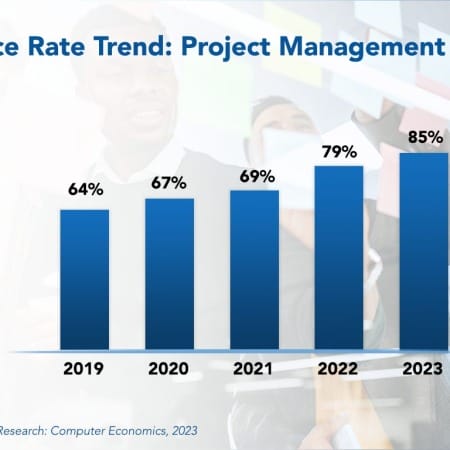

Project Management Office Best Practices 2023

To improve project success, companies often establish a formal project management office (PMO) as a center of excellence for project management disciplines. In some organizations, the PMO operates as an advisory group to project managers, who report directly to business units. In other organizations, project managers report directly to the PMO and are assigned to projects as needed. However, in recent years, the use of PMOs has grown significantly, especially for organizations that use them for all projects.

December, 2023

-

Fair Market Values February 2024

The Computer Economics Market Value Reports provide information on the most commonly traded machines and systems at the time the report is published. The values shown are the composites of a range of quotes acquired from sources within the industry deemed reliable, accuracy of the information presented is not guaranteed. Resources are eBay, Insight, NewEgg, CDW, ETB-Tech, Amazon, Savemyserver, TheServerStore, LoadBalancer, NetworkOutlet, Netsyst-Direct, TigerDirect, and others as well as online sales companies and appraisals.

February, 2024

-

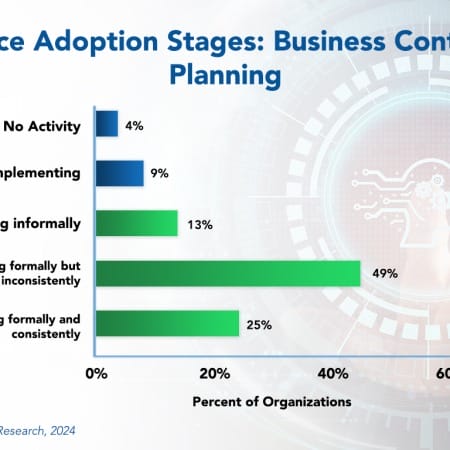

Business Continuity Planning Best Practices 2024

In today’s business landscape, virtually every organization relies heavily on information technology. Therefore, restoring information systems in the event of a disaster is an essential element of risk management, not just IT. At the same time, having IT systems recovered without restoring business operations is of little value. As such, a thorough business continuity plan goes beyond IT recovery, ensuring the overall survival of the business amid disruptions and re-establishing key business functions. Effective continuity planning should also address the potential loss of key individuals, disruption of customer or supplier operations, and failure of logistics providers.

March, 2024

-

IT Spending Trends in Banking and Finance 2024

The banking and finance sector is in a state of rapid change. Amid macroeconomic uncertainties such as inflation and rising interest rates, banking and finance firms are seeking opportunities through digital transformation to stay competitive. What makes this sector unique? This report analyzes the IT characteristics of the banking and finance industry with its various sub-sectors. We conclude with the outlook for increased IT spending and staffing in this sector in the coming years.

May, 2024

-

IT Spending Trends in Healthcare Services 2024

IT spending in the healthcare services industry is rising, driven by the need for digital transformation and advanced technologies such as AI and telehealth. These investments aim to enhance clinical outcomes and streamline administrative processes. However, they also introduce challenges such as cybersecurity risks, data privacy concerns, legacy system integration issues, and a shortage of IT skills. How are organizations ensuring the success and sustainability of their IT initiatives? This report reviews current IT spending trends, key metrics from our benchmarking survey, and the implications for the industry's future, concluding with an overview of the role of IT in improving healthcare quality.

July, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 10: Energy and Utilities

Chapter 9 provides benchmarks for wholesale distributors. This category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 49 respondents in the sample range in size from a minimum of about $50 million to $25 billion in revenue.

September, 2024

Grid View

Grid View List View

List View