-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 4: Process Manufacturing Sector Benchmarks

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 47 respondents in the sample range in size from a minimum of about €65 million to a maximum of about €40 billion in annual revenue.

September, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 20: Industrial and Automotive Subsector Benchmarks

Chapter 20 provides benchmarks for industrial and automotive manufacturers. The 20 respondents in this subsector make auto parts, material handling equipment, engines, machinery, vehicles, and similar capital goods. The manufacturers in the sample range in size from €120 million to over €250 billion in annual revenue.

September, 2023

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 10: Energy and Utilities Sector Benchmarks

Chapter 10 provides benchmarks for public utilities, oil and gas producers, service companies, and midstream distributors across all organization sizes. The 31 respondents in this sector include public utilities (water, gas, and electric), integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utilities companies. The companies in our sample range in size from a minimum of about €50 million to more than €100 billion in annual revenue.

October, 2024

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 26: Hospitals Subsector Benchmarks

Chapter 26 provides benchmarks for hospitals. The 15 respondents in this subsector range in size from €50 million to around €15 billion in annual revenue. This category includes community hospitals, university hospitals, nonprofit hospitals, health clinics, healthcare systems, and regional healthcare providers.

October, 2024

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 4: Process Manufacturing

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. This sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 54 respondents in the sample range in size from a minimum of about €60 million to a maximum of around €50 billion in annual revenue.

September, 2025

-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 22: Chemicals

Chapter 22 provides benchmarks for chemical manufacturers. Chemical manufacturers are, by definition, process manufacturers that produce chemical products. This subsector includes manufacturers of chemicals, petrochemicals, and other chemical products. The 19 respondents in the sample range in size from a minimum of about €135 million to around €40 billion in annual revenue.

September, 2025

-

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 5: BFSI Sector Benchmarks

This chapter provides generative AI metrics for the banking, financial services, and insurance (BFSI) sector. It features a sample of 34 such firms, ranging from commercials and investment banks to brokerages, financial advisors, and wealth management firms. They also include regional and national insurance including health insurance and property and casualty. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

Finance and Accounting Budgets, Staffing, and Process Metrics 2024/2025: Chapter 2: Composite Metrics

This chapter provides composite metrics for all of the organizations surveyed, across all industry sectors and organization sizes.

January, 2025

-

Human Resources Budgets, Staffing, and Process Metrics 2024/2025: Chapter 5: Energy and Utilities

Chapter 5 provides benchmarks for public utilities, oil and gas producers, service companies, and midstream distributors across all organization sizes. The respondents in this sector include public utilities (water, gas, and electric), integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utilities companies.

March, 2025

-

Procurement Budgets, Staffing, and Process Metrics 2025/2026: Chapter 10: Discrete Manufacturing

Chapter 10 provides comprehensive benchmarks for procurement staffing and spending within the discrete manufacturing industry. This sector encompasses a wide array of organizations, including automotive manufacturers, aerospace and defense companies, electronics producers, machinery manufacturers, and other producers of distinct products. The 25 respondents from this sector vary in size, ranging from companies with annual sales of approximately $600 million to those exceeding $120 billion.

November, 2025

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 2: Composite Benchmarks

The IT spending and staffing outlook for 2023 can best be described with the old British slogan, “keep calm and carry on.” As we mentioned in last year’s study, IT budgets are increasingly divorced from economic conditions. As enterprises continue their digital transformation, the IT department is increasingly valuable. Much of that can be attributed to IT’s new seat at the strategic table and the growing perception that technology can drive revenue growth. Despite economic headwinds, we see only a slight pullback in IT spending.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 18: Education Sector Benchmarks

Chapter 18 provides benchmarks for the education sector. The sector includes public and private colleges and universities, business and medical schools, for-profit educational institutions, school districts, and foundations. The 28 respondents in the sample have annual revenues ranging in size from a minimum of about $50 million to around $8 billion.

July, 2023

-

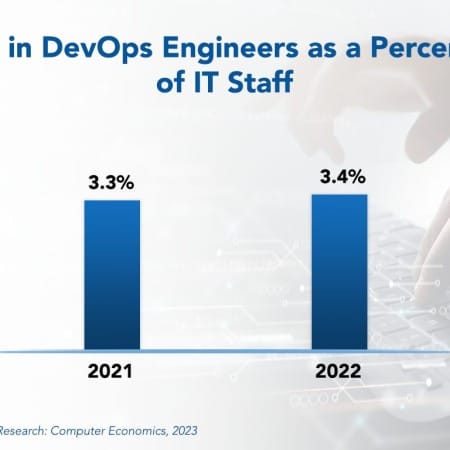

DevOps Engineer Staffing Ratios 2023

DevOps promises to optimize application development and maintenance processes, improving software quality and reducing development time and cost. As a result, IT organizations will be better able to meet the rapidly evolving needs of a business and achieve other strategic goals. Although DevOps engineers today represent a small portion of the total IT staff at most businesses, we anticipate that companies, especially those that develop much of their own software, will continue to expand their DevOps engineering staff.

September, 2023

-

Residual Value Forecast December 2023

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

December, 2023

Grid View

Grid View List View

List View