-

Residual Value Forecast December 2023

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

December, 2023

-

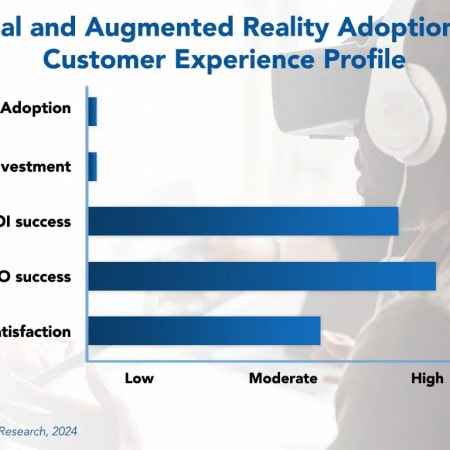

Virtual and Augmented Reality Adoption Trends and Customer Experience 2024

Businesses are currently in the early stages of adopting virtual reality and augmented reality (VR/AR) solutions. While widespread adoption of VR/AR has not yet fully materialized, businesses are actively experimenting with these technologies.

February, 2024

-

Residual Value Forecast March 2024

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

March, 2024

-

IT Spending Trends in Commercial Real Estate 2024

The commercial real estate industry is a vital sector of the global economy that provides spaces for businesses of all types. However, the industry has faced significant challenges over the past three years. The demands on their IT organizations are significant. What is it about the CRE sector that makes it unique? In this report, we analyze the ways in which this sector differs from other sectors in terms of their IT spending characteristics. We conclude with recommendations for optimizing the IT budget within this sector.

May, 2024

-

Desktop Support Outsourcing Trends and Customer Experience 2024

The question of whether to turn over the desktop support function to a service provider is a critical and surprisingly complicated one. Our research shows a strong cost advantage to outsourcing the desktop support function, but other factors, including increased automation and self-service assistance, can change the equation, potentially making it less cost-effective.

June, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 6: Banking and Finance

Chapter 6 provides benchmarks for banking and financial services companies. The firms in this sector include commercial banks, investment banks, credit unions, mortgage lenders, consumer finance lenders, and other types of lenders and financial services providers. The 48 respondents in this sector range in size from a minimum of about $50 million to over $75 billion in annual sales.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 39: Software and Technology

Chapter 39 provides IT spending and staffing statistics for the software and technology subsector. This category includes software companies, SaaS providers, and technology solutions companies. There are 22 organizations in the sample, ranging in size from around $50 million to over $100 billion in annual revenue.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 27: Commercial Banking

Chapter 27 provides benchmarks for commercial banks. This subsector includes credit unions and community, regional, international, and national banks. The 30 respondents in this sample have annual revenues ranging from a minimum of about $50 million to over $60 billion.

September, 2024

-

Residual Value Forecast November 2024

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

November, 2024

-

Embracing Pragmatic AI: How Acumatica is Transforming Cloud ERP Solutions

Acumatica, a cloud-based ERP provider, has been making significant strides in recent years, focusing on delivering innovative solutions for mid-market businesses. Over the past year, the company has expanded its product offerings with regard to AI solutions.

January, 2025

-

Supply Chain Management Adoption Trends and Customer Experience 2025

Supply chain management (SCM) has become a hot topic in recent years. From grocery shelves running out of toilet paper and cleaning supplies during the pandemic, to shortages of semiconductors leading to auto dealers running out of cars to sell, to cargo ships lined up at the ports of Los Angeles and Long Beach, the term “supply chain” was on everyone’s lips. But given the resolution of global supply chain issues over the past year, what does this mean for future adoption and investments of SCM systems?

April, 2025

-

App Developers Make Up a Record Low Percentage of IT Staff

In just five years, the proportion of application developers within IT departments has declined sharply from nearly a quarter of the entire IT staff to just over one-tenth. But this notable shift is not necessarily a sign of mass layoffs among application developers. In fact, we have seen no evidence to suggest that fewer developers are working in IT departments. Rather, it signals a change in the overall composition of IT teams and an evolving role for application developers within the organization. This research byte summarizes our full report on application developer staffing ratios.

June, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 4: Process Manufacturing

Chapter 4 provides benchmarks for process manufacturing organizations. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. This sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 118 respondents in the sample range in size from a minimum of about $50 million to a maximum of around $75 billion in annual revenue.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 17: Government

Chapter 17 provides benchmarks for government organizations. The 28 respondents in the sample range in size from about $50 million to over $30 billion in annual revenue. The category includes city and county governments, federal and state agencies, law enforcement agencies, organizations that provide IT services to government agencies, and other government organizations.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 40: Healthcare Clinics and Doctors’ Offices Subsector Benchmarks

Chapter 40 provides benchmarks for healthcare clinics and doctors’ offices. The 19 respondents in this subsector range in size from $50 million to around $200 billion in annual revenue. This category includes health clinics, urgent care, optometry chains, and even large retailers that have begun some basic healthcare operations.

August, 2025

Grid View

Grid View List View

List View