-

European IT Spending and Staffing Benchmarks 2025/2026: Chapter 23: Paper and Packaging

Chapter 23 focuses on benchmarks for the paper and packaging subsector, encompassing various organization sizes. As a critical component of the broader process manufacturing sector, respondents in this subsector typically include pulp and paper mills, containerboard and corrugated packaging manufacturers, flexible packaging producers, specialty paper converters, and other companies involved in the production and distribution of paper-based and allied packaging materials. The 16 companies in our sample range in annual revenue from approximately €60 million to well over €15 billion, reflecting the diverse scale of operations within the industry.

September, 2025

-

Worldwide IT Spending And Staffing Outlook 2023

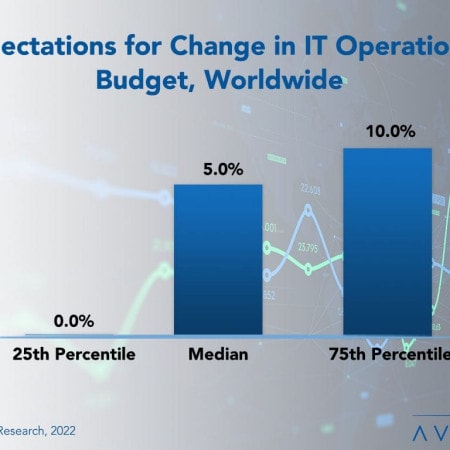

Despite most of our survey respondents agreeing that the economy will be worse in 2023 than in 2022, IT spending increases are broad and strong. However, in this annual report of the IT spending and staffing outlook for 2023, we believe there is another major factor at play. We find that IT is no longer seen as a cost center but as a strategic driver of growth. Because of this, business leaders are giving their IT departments greater resources to help plan for the coming recession rather than asking them to tighten their belts.

February, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 32: Hospitals Subsector Benchmarks

Chapter 32 provides benchmarks for hospitals. The 34 respondents in this subsector range in size from $50 million to around $8 billion in annual revenue. This category includes community hospitals, university hospitals, nonprofit hospitals, health clinics, healthcare systems, and regional healthcare providers.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 23: Food and Beverage Subsector Benchmarks

Chapter 23 provides benchmarks for food and beverage manufacturers. The 31 respondents in the sample range in size from about $65 million to $40 billion in annual revenue. Food and beverage companies produce beverages, snack foods, meat products, seafood products, dairy products, dietary supplements, and other consumable food products. Some are suppliers to other food manufacturers or to the food service industry, while many also distribute consumer products to retailers or direct to consumers. This subsector does not include retailers of food and beverages, such as restaurants, unless they also manufacture their own food and beverage products.

July, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 5: Discrete Manufacturing Sector Benchmarks

Chapter 5 provides benchmarks for discrete manufacturing organizations. Discrete manufacturers are defined as those where the production process adds value by fabricating or assembling individual (discrete) unit production. The category includes manufacturers of consumer products, athletic equipment, industrial equipment, telecommunications equipment, aerospace products, furniture, auto parts, electrical parts, medical devices, and electronic devices, among other products. The 44 respondents in this sample range in size from a minimum of about €75 million to over €200 billion in annual revenue.

September, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 21: Brick and Mortar Retail Subsector Benchmarks

Chapter 21 provides benchmarks for brick-and-mortar retailers. This subsector includes department stores, clothing stores, convenience stores, pet stores, pharmacies, hardware stores, nonprofit retailers, furniture retailers, agricultural retailers, and other retailers. The 34 respondents in this sample have annual revenue ranging from about €95 million to over €25 billion.

September, 2023

-

IT Spending Trends in the Energy and Utilities Sector 2024

It is a challenging time for organizations in the energy and utilities sector, with global conflicts, supply chain issues, government mandates, and environmental concerns churning the waters. The demands on their IT organizations are significant. What is it about the energy and utilities sector that makes it unique? In this report, we analyze the ways in which this sector differs from other sectors in terms of their IT spending characteristics. We conclude with recommendations for optimizing the IT budget within this sector.

May, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 3B: Benchmarks by Organization Size: Midsize

This year, Avasant Research is celebrating the 35th anniversary of the Computer Economics IT Spending and Staffing Benchmarks study. To mark this milestone, we have accumulated the largest sample of companies in our history (over 350 companies in our single-year sample compared to 215 last year), including a significant number of the world’s largest enterprises. For the first time, we not only have small, midsize, and large chapters but also a very large chapter for companies with over $500 million in IT spending.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 36: Healthcare Clinics and Doctors’ Offices

Chapter 36 provides benchmarks for healthcare clinics and doctors’ offices. The 22 respondents in this subsector range in size from $50 million to around $100 billion in annual revenue. This category includes health clinics, urgent care, optometry chains, and even large retailers who have begun some basic healthcare operations.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 24: Chemicals

Chapter 24 provides benchmarks for chemicals manufacturers. Chemicals manufacturers are, by definition, process manufacturers that produce chemical products. This subsector includes manufacturers of chemicals, petrochemicals, and other chemical products. The 20 respondents in the sample range in size from a minimum of about $50 million to around $45 billion in annual revenue.

September, 2024

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 3A: Benchmarks by Organization Size

In these chapters, we provide a complete set of benchmarks for organizations within the specified size classification. Small organizations benchmarks are in Chapter 3A, midsize organizations in Chapter 3B, large organizations in Chapter 3C, and very large organizations in Chapter 3D. These chapters use a three-year sample. There are 98 respondents in the small organization sample, 102 in the midsize sample, 65 in the large sample, and 40 in the very large sample.

October, 2024

-

European IT Spending and Staffing Benchmarks 2024/2025: Chapter 16: Media and Information Services Sector Benchmarks

Chapter 16 provides benchmarks for the media and information services sector. This sector includes publishing, broadcasting, entertainment, and digital media organizations, as well as other media and information services companies. The 15 respondents in the sample have annual revenues ranging from about €50 million to around €13 billion.

October, 2024

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 3A: Benchmarks by Organization Size: Small

In these chapters, we provide a complete set of benchmarks for organizations within the specified size classification. Small organizations benchmarks are in Chapter 3A, midsize organizations in Chapter 3B, large organizations in Chapter 3C, and very large organizations in Chapter 3D. There are 66 respondents in the small organization sample, 73 in the midsize sample, 86 in the large sample, and 84 in the very large sample.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 12: Healthcare Services

Chapter 12 provides benchmarks for healthcare services companies. The 46 respondents in this sector include community hospital groups, multiregional hospital systems, healthcare systems, dental service organizations, university hospitals, long-term care facilities, and other healthcare organizations. These organizations range in size from a minimum of about $50 million to over $75 billion in annual revenue.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 33: Online Retail Subsector Benchmarks

Chapter 33 provides benchmarks for online retailers. This subsector includes online retailers of clothing, home furnishings, dietary supplements and health products, agricultural products, pharmaceuticals, sports equipment, and other products. The 36 respondents in this sample have annual revenue ranging from about $100 million to over $200 billion.

August, 2025

Grid View

Grid View List View

List View