-

Digital Masters Process Transformation 2025 RadarView™

The Digital Masters Process Transformation 2025 RadarView™ assists organizations in identifying strategic partners for their process transformation initiatives by offering detailed profiles for each service provider. It provides a detailed view of the provider’s capabilities across horizontal processes, ability to leverage digital technologies, and readiness for the future. It also offers a list of representative clients and brief client case studies. The 50-page report also provides business forecasts for each Digital Master and Avasant’s viewpoint on them.

June, 2025

-

Global Competency Center (GCC) Services 2025 Market Insights™

The Global Competency Center (GCC) Services 2025 Market Insights™ equips stakeholders with a deep understanding of the current landscape and future trajectory of the GCC market, serving as a valuable tool for strategic planning and decision-making.

August, 2025

-

From Innovation to Impact: LTTS Driving AI-Infused Digital Engineering Across Industries

Digital engineering is undergoing a paradigm shift, fueled by the infusion of AI, cloud, IoT, and edge computing across industries. From transforming vehicles into rolling computers to enabling immersive media experiences and reshaping healthcare delivery, AI is no longer an auxiliary tool; it has become the foundation of innovation. This wave is not just about incremental gains; it is redefining industries, business models, and consumer experiences at scale.

September, 2025

-

AI in Media: Solving the Challenges of Attention and Output

In an age where content is unlimited, but attention is scarce, media companies face a growing paradox: how to deliver stories that capture attention without drowning audiences in noise. At the same time, the pressure to produce content faster has intensified, particularly in journalism where deadlines often cut into depth. Together, these twin challenges—the demand for personalized engagement and the need for speed—have forced the industry to search for new solutions. Increasingly, the answer lies in artificial intelligence. Far from replacing creativity, AI is emerging as a tool to repurpose content, personalize experiences, and streamline production, allowing creators to focus on what matters most: telling stories that resonate. Industry leaders, including those speaking at Avasant’s “Empowering Beyond Summit,” have echoed this view—arguing that AI is becoming not a threat, but an enhancer of creativity (Avasant Summit Video, 2025).

November, 2025

-

Trust and Safety Business Process Transformation 2023–2024 Market Insights™

The Trust and Safety Business Process Transformation 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any trust and safety services project. The report also highlights key challenges that enterprises face today.

November, 2023

-

Travel, Transportation, and Hospitality Digital Services 2025 RadarView™

The Travel, Transportation, and Hospitality Digital Services 2025 RadarView™ helps travel, transportation, and hospitality enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 77-page report also highlights top market trends in the travel, transportation, and hospitality space and Avasant’s viewpoint.

August, 2025

-

Banking Process Transformation 2023 RadarView™

The Banking Process Transformation 2023 RadarView™ assists banks and financial companies in identifying strategic partners for banking process transformation by featuring detailed capability and experience analyses of service providers in this space. It provides a 360-degree view of the service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right partner in the banking process transformation space. The 68-page report highlights top supply-side trends in the banking process transformation arena and Avasant’s viewpoint on them.

May, 2023

-

Middle East Cybersecurity 2024 Market Insights™

The Middle East Cybersecurity 2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any cybersecurity-related digital projects in the Middle East. The report also highlights key challenges that the region’s enterprises face today.

July, 2024

-

Life and Annuities Insurance Digital Services 2024–2025 Market Insights™

The Life and Annuities Insurance Digital Services 2024–2025 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the L&A insurance industry. The report also highlights key challenges that enterprises face today in this space.

December, 2024

-

Workday HCM Services 2025 RadarView™

The Workday HCM Services 2025 RadarView™ assists organizations in identifying strategic partners for Workday HCM adoption by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key Workday HCM service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right Workday HCM services partner. The 49-page report highlights top supply-side trends in the Workday HCM space and Avasant’s viewpoint.

September, 2025

-

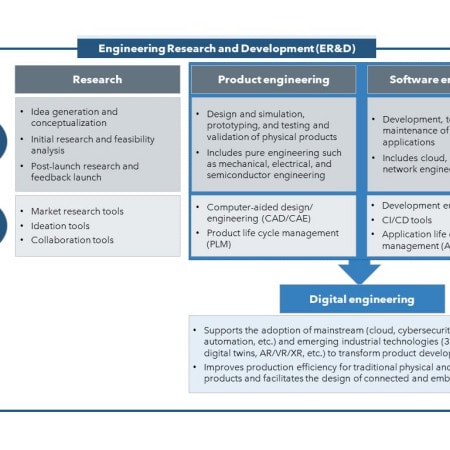

What Exactly is Digital Engineering and Who is a True Digital Engineering Partner?

Both B2B and B2C products have become smarter and more connected, requiring real-time integration and interaction between hardware and software components. To develop connected products and digitize the engineering and manufacturing life cycle, enterprises need an amalgamation of product and software engineering capabilities through digital engineering. While digital engineering is a growing domain, it is crucial that the ecosystem players, especially engineering and manufacturing companies, get the essence of digital engineering right to realize its true potential.

June, 2023

-

Retail Digital Services 2025 RadarView™

The Retail Digital Services 2025 RadarView™ helps retail enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 89-page report also highlights top market trends in the retail space and Avasant’s viewpoint.

June, 2025

Grid View

Grid View List View

List View