-

The Changing Role of Consulting: How Gen AI is Transforming Organizations Success

The consulting industry is undergoing a fundamental transformation, driven by the integration of advanced technologies such as Generative AI. This article explores how consulting firms are shifting from traditional advisory roles to becoming agents of change, delivering tech-driven solutions that produce tangible business results. Using a case study of a global vaccine funding organization, where Gen AI was implemented to streamline proposal assessments, the article highlights the evolving skills required of consultants. As organizations demand faster and more impactful solutions, consulting firms must adapt to this new reality.

January, 2025

-

Manufacturing in the Era of Tariff Uncertainties

The manufacturing industry is heavily impacted by international trade as most major enterprises have complex, multi-country supply chains. With a swathe of new tariffs being declared by the US in early 2025, and the subsequent retaliatory steps taken by countries impacted by the tariffs, manufacturers are dealing with a significantly more volatile environment than they have seen in the past This research byte explores the nature of these tariffs, and the associated trade wars, and how they are different from previous trade disputes. It also examines what manufacturers can do to enable supply chain resilience and mitigate the tariff risks. It also explores the need to invest in strong data management and technology adoption to create future-proof operations.

March, 2025

-

Cybersecurity Services: Enhancing Security through Streamlined Detection and Response with Gen AI

Between 2024 and 2025, a surge in cyberattacks impacted millions globally, targeting critical sectors such as healthcare, education, and telecom. These incidents highlight the growing threats posed by data extortion and state-sponsored espionage. In response, governments and regulators are strengthening their cyber defense through increased funding, stricter telecom requirements, and the introduction of regulations such as the Digital Operational Resilience Act (DORA). At the same time, leading service providers are exploring generative AI-driven tools to enhance threat detection, automate response actions, and improve vulnerability management. Both demand-side and supply-side trends are covered in our Cybersecurity Services 2025 Market Insights™ and Cybersecurity Services 2025 RadarView™, respectively.

April, 2025

-

Retail Digital Services: Embedding Intelligent Solutions That Autonomously Optimize Business Intelligence

Retail enterprises are reimagining operational intelligence by integrating generative and agentic AI that can autonomously generate insights, make context-aware decisions, and take adaptive actions across the retail value chain. They are using geofencing, embracing avatars and immersive technologies to deliver hyper-personalized engagement, and modernizing physical stores into intelligent, experience-led environments. As consumer expectations shift toward more relevant and personalized advertising, retailers are scaling retail media networks (RMNs) to harness first-party data, enabling brands to deliver targeted campaigns that maximize ROI and drive deeper shopper engagement.

June, 2025

-

Generative AI Platforms: Powering the Shift to Autonomous Intelligence

As enterprises move from pilots to scaled generative AI (Gen AI) deployments, platforms are evolving to support production readiness, regulatory alignment, and performance optimization. Vendors are integrating capabilities such as multimodal processing, edge inferencing, and governance toolkits to meet operational demands. To accelerate adoption across industries, they are building comprehensive partner ecosystems that include hyperscalers, infrastructure providers, service firms, and OEMs. These partners bring industry-specific expertise, enable edge deployment of LLMs, support Gen AI-native application and data integration, and provide access to scalable, production-ready infrastructure. The supply-side trends are covered in Avasant’s Generative AI Platforms 2025 RadarView™.

July, 2025

-

European CIOs Making Investments for the Future

Despite nearby conflicts and lower budget increases than their North American colleagues, European CIOs are making strong investments toward a more resilient, flexible, and revenue-generating IT department. Median budget increases in Europe are only 2.0% at the median compared to 3.0% in our main study, but it is perhaps more important to see what CIOs are investing in than how much their budgets are growing. This Research Byte is a brief description of some of the findings in our European IT Spending and Staffing Benchmarks 2025/2026 study.

September, 2025

-

New Healthcare Benchmark Study Highlights Digital Transformation Imperative

Regulatory complexities and governance hurdles have long slowed technology adoption in healthcare. Today, however, organizations are gaining momentum in their digital transformation efforts. This acceleration is driven by mounting pressures that demand greater efficiency, better outcomes, and stronger competitiveness. The traditional time-and-materials model is giving way to value-based care, and hospitals are under more pressure now than ever to transform. This Research Byte provides a brief description of some of the findings from our new Healthcare Provider Performance Benchmarks 2025/2026 study.

November, 2025

-

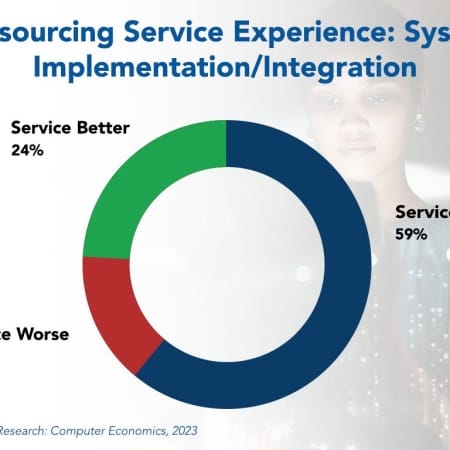

System Implementation/Integration Outsourcing Trends and Customer Experience 2023

System implementation/integration outsourcing is the use of an external service provider to assist in implementing new systems, which often includes integration with other new or existing systems. A systems integration (SI) firm can help or be responsible for some or all of the following: identifying system requirements, understanding and redesigning business processes, selecting a new system, and deploying the system.

November, 2023

-

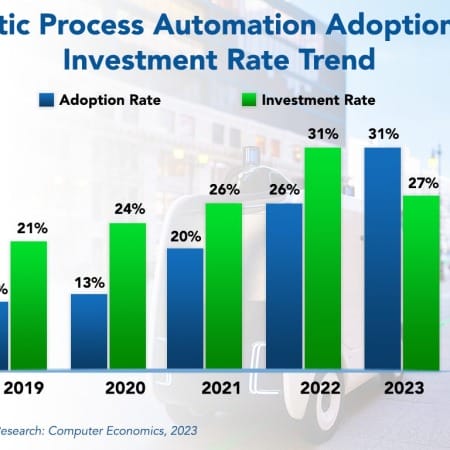

Robotic Process Automation Adoption Trends and Customer Experience 2023

Rising personnel costs and two years of high inflation have put automation in the spotlight. IT leaders are being asked to digitally transform their organizations while also keeping an eye on costs. Automation allows for increased productivity and allows experienced personnel to work on high-value projects and innovation.

October, 2023

-

Business and Data Analytics Adoption Trends and Customer Experience 2024

Business and data analytics have long been indispensable tools for organizations across industries. The widespread adoption and increasing investment underscore their critical role in driving business growth and decision-making. This year, 82% of organizations have adopted business and data analytics. The adoption rate is accompanied by an investment rate of 88%, indicating a strong commitment to leveraging data-driven insights.

February, 2025

-

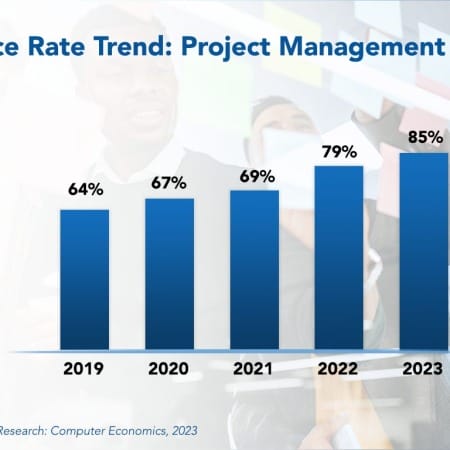

Project Management Office Best Practices 2023

To improve project success, companies often establish a formal project management office (PMO) as a center of excellence for project management disciplines. In some organizations, the PMO operates as an advisory group to project managers, who report directly to business units. In other organizations, project managers report directly to the PMO and are assigned to projects as needed. However, in recent years, the use of PMOs has grown significantly, especially for organizations that use them for all projects.

December, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 5: Discrete Manufacturing Sector Benchmarks

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 76 respondents in the sample range in size from a minimum of about $50 million to a maximum of $50 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 3B: Midsize Organization Benchmarks

The IT spending and staffing outlook for midsize organizations in 2023 can best be described with the old British slogan, “keep calm and carry on.” As we mentioned in last year’s study, IT budgets are increasingly divorced from economic conditions. As enterprises continue their digital transformation, the IT department is increasingly valuable. Much of that can be attributed to IT’s new seat at the strategic table and the growing perception that technology can drive revenue growth. Despite economic headwinds, we see only a slight pullback in IT spending.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 21: High-Tech Subsector Benchmarks

Chapter 21 provides benchmarks for high-tech companies. The category includes computer products manufacturers, telecommunications equipment manufacturers, semiconductor manufacturers, aerospace and defense manufacturers, pharmaceutical makers, biotechnology product makers, software developers, software-as-a-service providers, and other high-tech companies. The 26 respondents in this sample range in size from a minimum of about $50 million to over $30 billion in revenue.

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 8: Retail Sector Benchmarks

Chapter 8 provides benchmarks for retailers. This sector includes retailers of clothing, jewelry, hardware, furniture, electronics, sports equipment, groceries, pharmaceuticals, and general merchandise. They include restaurant chains, department stores, luxury retail stores, electronics stores, furniture stores, pharmacies, sporting goods stores, and specialty retailers. We also include hospitality and consumer services in this sector. The 43 respondents in the sample range in size from about €90 million to over €30 billion in annual revenue.

September, 2023

Grid View

Grid View List View

List View