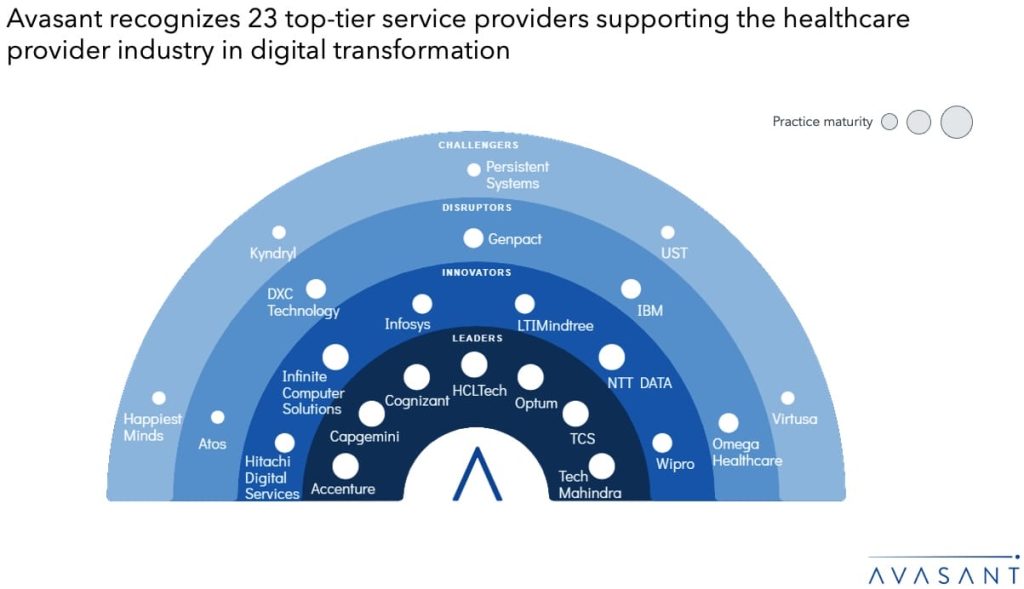

Healthcare providers face growing challenges, including workforce shortages, clinician burnout, and shrinking margins, which strain operational efficiency and patient care coordination. The need for seamless data exchange across systems and regulatory compliance compounds these pressures. To overcome these issues, providers are accelerating their digital transformation through the use of AI, predictive analytics, and intelligent automation to streamline workflows, manage denials, and enhance financial resilience. Adoption of Fast Healthcare Interoperability Resources (FHIR)-based APIs, remote monitoring, and telehealth expands access to care and enables proactive health management beyond traditional settings. At the same time, healthcare global competency centers (GCCs) are evolving into innovation hubs focused on AI, data interoperability, and digital maturity, driving sustainable growth and innovation. Providers are also strengthening their cybersecurity and consent management systems to protect patient data while ensuring control, compliance, and trust in an increasingly digital healthcare environment. Both demand-side and supply-side trends are covered in our Healthcare Provider Digital Services 2025 Market Insights™ and Healthcare Provider Digital Services 2025 RadarView™, respectively.