-

![Application Management Outsourcing Booming Despite SaaS Outsourcing Frequency 2 - Application Management Outsourcing Booming Despite SaaS]()

Application Management Outsourcing Booming Despite SaaS

As the application portfolio of an enterprise grows, the ongoing support for those systems can become a burden on the IT organization, leaving little time for developing and implementing new applications. In response, some organizations see outsourcing application management as an attractive option. Although SaaS and the cloud have taken over many application management responsibilities, businesses continue to outsource this function. This Research Byte explores this trend, based on our full report, Application Management Outsourcing Trends and Customer Experience.

December, 2023

-

![Application Management Outsourcing Trends and Customer Experience 2023 Outsourcing Frequency 2 - Application Management Outsourcing Trends and Customer Experience 2023]()

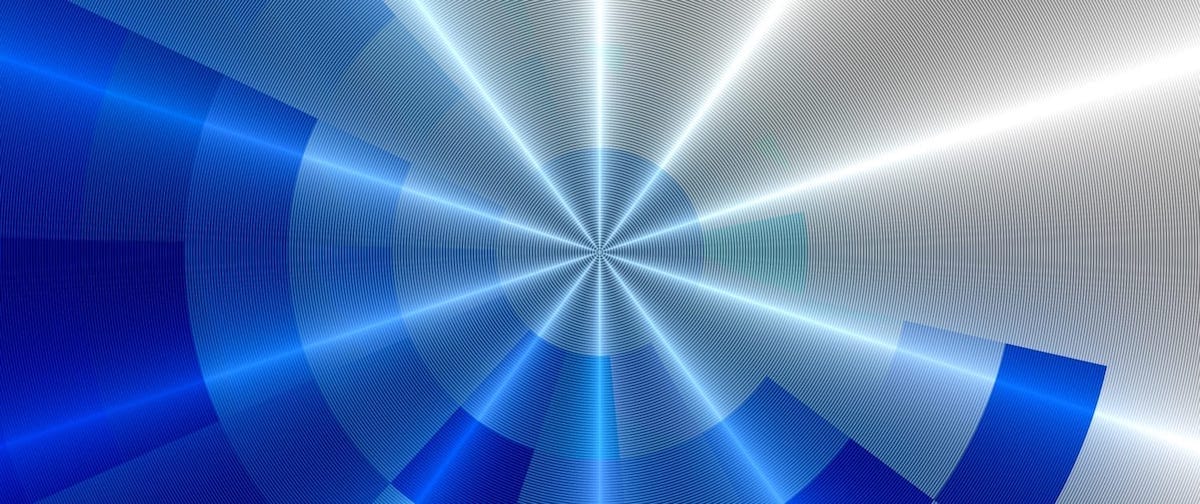

Application Management Outsourcing Trends and Customer Experience 2023

As the application portfolio of an enterprise grows, the ongoing support for those systems can become a burden on the IT organization, leaving little time for developing and implementing new applications. In response, some organizations see outsourcing application management as an attractive option.

December, 2023

-

![Hybrid Work Increasing the Need for PMOs Practice Rate Trend Project Management Office - Hybrid Work Increasing the Need for PMOs]()

Hybrid Work Increasing the Need for PMOs

Over the past five years, the use of project management offices (PMOs) has increased by 20%. According to our study, Project Management Office Adoption Trends, the number of companies making full use of PMOs for every IT project is among the highest-rated best practices in the study. The shift toward hybrid and remote work has put a significant strain on projects as teams must collaborate in hybrid settings and still finish projects on time and within budget. This Research Byte gives an overview of the increasing PMO best practice adoption and provides insights into why this increase might be occurring.

December, 2023

-

![Project Management Office Best Practices 2023 Practice Rate Trend Project Management Office - Project Management Office Best Practices 2023]()

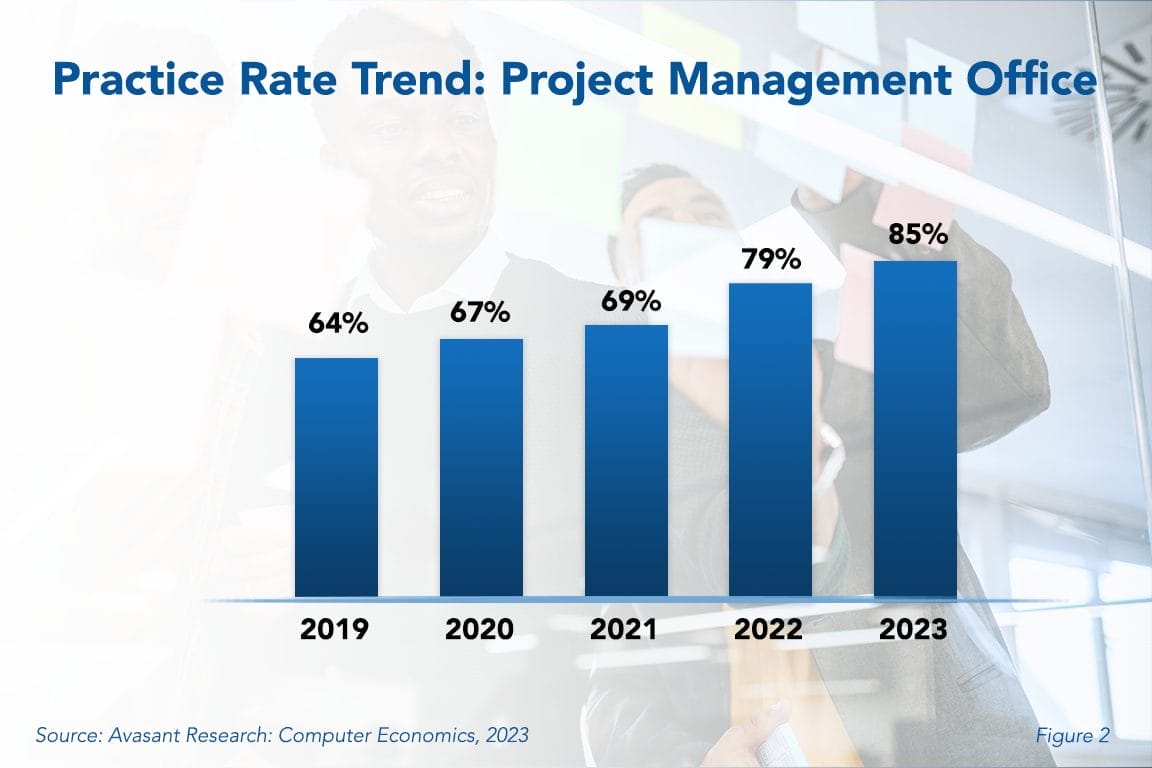

Project Management Office Best Practices 2023

To improve project success, companies often establish a formal project management office (PMO) as a center of excellence for project management disciplines. In some organizations, the PMO operates as an advisory group to project managers, who report directly to business units. In other organizations, project managers report directly to the PMO and are assigned to projects as needed. However, in recent years, the use of PMOs has grown significantly, especially for organizations that use them for all projects.

December, 2023

-

![Maneuvering Turbulent Times with AI-driven IT Services and Operations RB Product Image TCS - Maneuvering Turbulent Times with AI-driven IT Services and Operations]()

Maneuvering Turbulent Times with AI-driven IT Services and Operations

In the current challenging economic environment, leading IT services providers are focusing on innovation, adaptation, and AI to ensure their future success. With the advent of generative AI, global IT services companies are investing in upskilling and reskilling the workforce and sharpening their focus by leveraging cloud and AI solutions to enhance service efficiencies. Some providers are investing heavily in AI research and development and focusing on platform-based operations to help enterprises reduce costs, improve efficiency, and accelerate innovation. We highlight the efforts of one such service provider, TCS, focusing on the TCS Analyst Day 2023 event held in October.

December, 2023

-

![Fostering Resilience in the Aerospace and Defense Sector through Digital Transformation MoneyShot AD Digital Services 2023 2024 - Fostering Resilience in the Aerospace and Defense Sector through Digital Transformation]()

Fostering Resilience in the Aerospace and Defense Sector through Digital Transformation

Aerospace and defense (A&D) enterprises are facing challenges arising from supply chain risks, regulatory compliance, increasing operational costs, heightened security measures, and pressure to meet sustainability goals. To address these critical issues, companies are actively harnessing the power of digital technologies to revolutionize their manufacturing processes, maintenance, repair, and overhaul (MRO) activities, and supply chain operations. Exploring advanced technologies, including generative AI, AR/VR, and digital twins, these organizations aim to enhance productivity and refine operational workflows. As this requires strong technological expertise and delivery capabilities, A&D enterprises are collaborating with service providers for digital transformation. Both demand-side and supply-side trends are covered in our Aerospace and Defense Digital Services 2023–2024 Market Insights™ and Aerospace and Defense Digital Services 2023–2024 RadarView™, respectively.

December, 2023

-

![Aerospace and Defense Digital Services 2023–2024 Market Insights™ PrimaryImage AD 2023 24 - Aerospace and Defense Digital Services 2023–2024 Market Insights™]()

Aerospace and Defense Digital Services 2023–2024 Market Insights™

The Aerospace and Defense Digital Services 2023–2024 Market Insights ™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the aerospace and defense industry. The report also highlights key challenges that enterprises face today.

December, 2023

-

![Aerospace and Defense Digital Services 2023–2024 RadarView™ PrimaryImage Aerospace and Defense Digital Services 2023–2024 - Aerospace and Defense Digital Services 2023–2024 RadarView™]()

Aerospace and Defense Digital Services 2023–2024 RadarView™

The Aerospace and Defense Digital Services 2023–2024 RadarView™ can help aerospace and defense enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 69-page report also highlights top market trends in the aerospace and defense industry and Avasant’s viewpoint.

December, 2023

-

![Can Amazon Q Be to Business Users and Developers What Q Is to Bond? AmazonQ23 - Can Amazon Q Be to Business Users and Developers What Q Is to Bond?]()

Can Amazon Q Be to Business Users and Developers What Q Is to Bond?

Amazon Q, introduced during AWS re:Invent 2023 in Las Vegas, is a corporate chatbot designed to automate content search and creation and provide summaries. It aids in handling enterprise knowledge bases and repositories while automating tasks such as ticket filing and case creation using generative AI and natural language processing, among others. This touches a variety of business user personas, including knowledge workers, data and analytics personnel, and call center managers and employees. It helps developers in debugging and enhancing code for improved performance. By automating alterations to source code, it significantly reduces the workload for developers. Although a late entrant, Amazon Q seems up for the challenge.

December, 2023

-

![Nordics: Accelerating Data-driven Innovation through Technology MoneyShot Nordics 2023 2024 - Nordics: Accelerating Data-driven Innovation through Technology]()

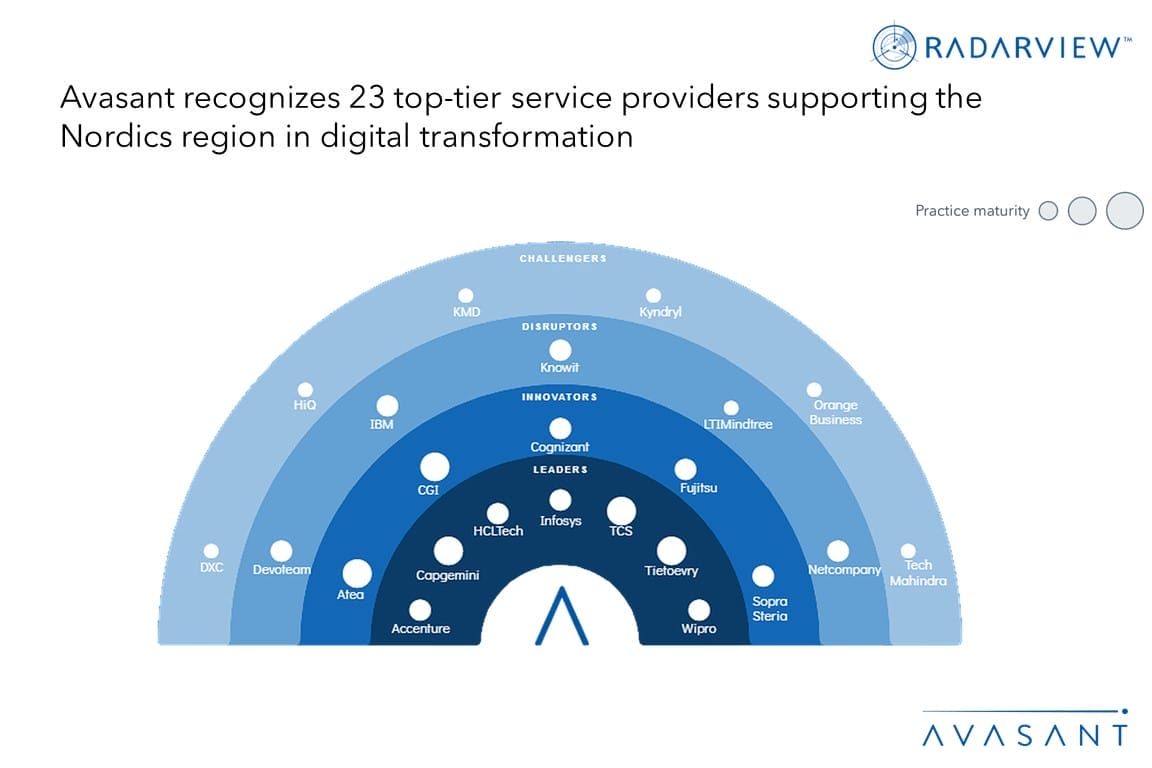

Nordics: Accelerating Data-driven Innovation through Technology

Nordic countries have been at the top of their game when it comes to digital competitiveness and sustainability goals. While governments are looking to further improve citizen services, establish smart cities, and enhance the ease of doing business, they are experiencing critical challenges such as facing digital talent shortages, ensuring cyber resilience, and protecting data sovereignty. Regional enterprises are proactively investing in advanced digital technologies such as AI, analytics, cloud, 5G, IoT, and AR/VR to fuel data-driven innovation, improve customer experience, and solidify their position as global firms while addressing national digitalization objectives. As this requires strong technological expertise and delivery capabilities, Nordic firms are collaborating with service providers for digital transformation. Both demand-side and supply-side trends are covered in our Nordics Digital Services 2023–2024 Market Insights™ and Nordics Digital Services 2023–2024 RadarView™, respectively.

December, 2023

-

![Nordics Digital Services 2023–2024 Market Insights™ Nordics23 e1701683404783 - Nordics Digital Services 2023–2024 Market Insights™]()

Nordics Digital Services 2023–2024 Market Insights™

The Nordics Digital Services 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital projects in the Nordic region. The report also highlights key challenges that enterprises face today.

December, 2023