-

![Trust and Safety Business Process Transformation 2023–2024 Market Insights™ Primary Image Trust and Safety Business Process Transformation 2023–2024 Market Insights™ - Trust and Safety Business Process Transformation 2023–2024 Market Insights™]()

Trust and Safety Business Process Transformation 2023–2024 Market Insights™

The Trust and Safety Business Process Transformation 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any trust and safety services project. The report also highlights key challenges that enterprises face today.

November, 2023

-

![Trust and Safety Business Process Transformation 2023–2024 RadarView™ PrimaryImage Trust and Safety Business Process Transformation 2023–2024 RadarView - Trust and Safety Business Process Transformation 2023–2024 RadarView™]()

Trust and Safety Business Process Transformation 2023–2024 RadarView™

The Trust and Safety Business Process Transformation 2023–2024 RadarView™ assists organizations in identifying strategic partners for trust and safety services by offering detailed capability and experience analyses of service providers in this space. It provides a 360-degree view of the service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right trust and safety services partner. The 56-page report highlights top supply-side trends in the trust and safety services space and Avasant’s viewpoint.

November, 2023

-

![Process Transformation for Compliant, Cost-Efficient, and Employee-Centered Payroll Moneyshot Payroll Business Process Transformation 2023–2024 - Process Transformation for Compliant, Cost-Efficient, and Employee-Centered Payroll]()

Process Transformation for Compliant, Cost-Efficient, and Employee-Centered Payroll

Payroll is a backend, internal business function with the sole objective of paying people in an accurate and timely manner. Hence, process transformation has never been the topmost priority for payroll professionals. Lately, businesses are transforming their people, processes, and technology to improve compliance and costs and manage ancillary priorities such as unifying global payroll operations, generating payroll insights, improving employee experience, and facilitating seamless employee mobility. Companies are increasingly partnering with payroll service providers to consolidate their vendor base, improve digital adoption, and offer on-demand payroll. As a result, the number of active clients of payroll business process transformation service providers has increased by 21% between June 2022–June 2023. Both demand- and supply-side trends are covered in Avasant’s Payroll Business Process Transformation 2023–2024 Market Insights™ and Payroll Business Process Transformation 2023–2024 RadarView™, respectively.

November, 2023

-

![Payroll Business Process Transformation 2023–2024 Market Insights™ Payroll BPT 2023 - Payroll Business Process Transformation 2023–2024 Market Insights™]()

Payroll Business Process Transformation 2023–2024 Market Insights™

The Payroll Business Process Transformation 2023–2024 Market Insights assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any payroll transformation project. The report also highlights the evolution of the payroll function and emerging priorities of payroll professionals.

November, 2023

-

![Payroll Business Process Transformation 2023–2024 RadarView™ PrimaryImage Payroll BPT 2023 2024 - Payroll Business Process Transformation 2023–2024 RadarView™]()

Payroll Business Process Transformation 2023–2024 RadarView™

The Payroll Business Process Transformation 2023–2024 RadarView™ assists organizations in identifying strategic partners for payroll business process transformation by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key payroll business process transformation service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right services partner. The 62-page report highlights top supply-side trends in the payroll space and Avasant’s viewpoint on them.

November, 2023

-

![Digital Talent Capability: Gearing Up for a Skills-based Talent Strategy MoneyShot Digital Talent Capability 2023–2024 - Digital Talent Capability: Gearing Up for a Skills-based Talent Strategy]()

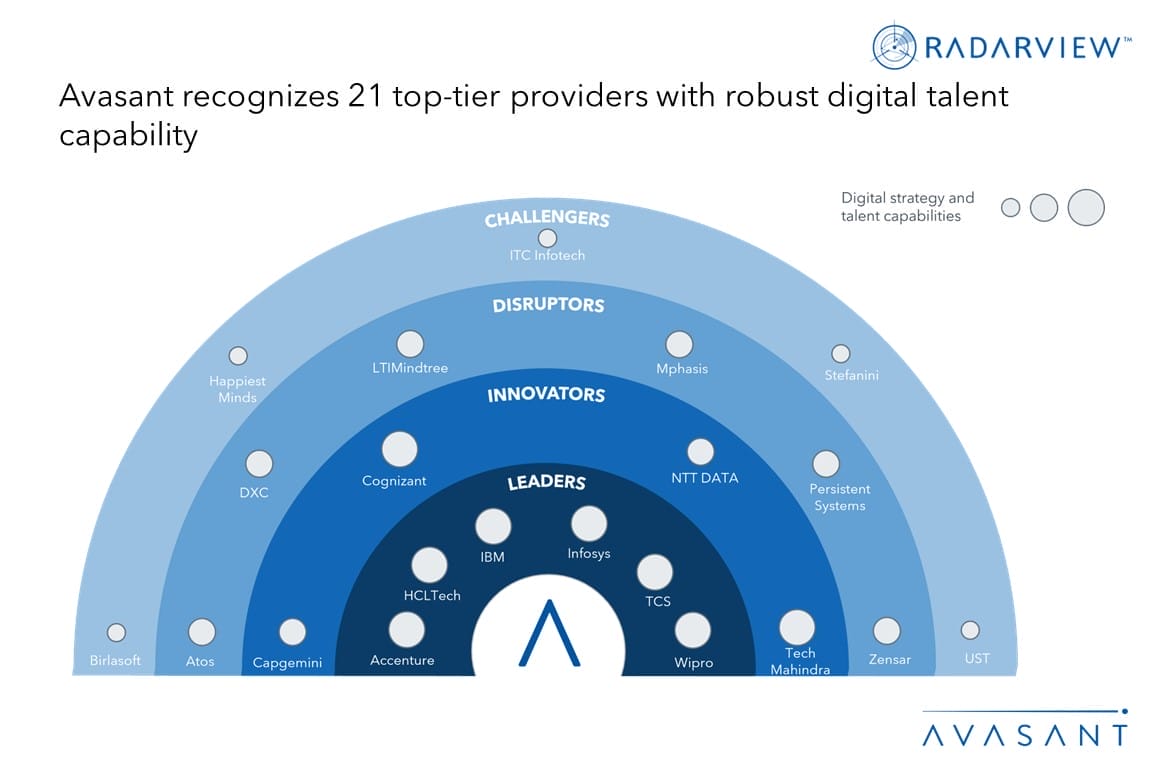

Digital Talent Capability: Gearing Up for a Skills-based Talent Strategy

With rapid digitalization, enterprises are creating a high demand for digital skills. Advances in generative AI and the adoption of large language models (LLMs) are disrupting the talent landscape, with current roles being reshaped and new job roles such as prompt engineers, LLM architects, and data curators and trainers seeing high demand. The gig work model is seeing long-term adoption, with the demand for gig workers increasing by 41% during 2016–2022, driven by access to specialized skills and cost benefits. The demand is further enhanced by global capability centers (GCCs) ramping up hiring to access skilled talent in locations like India. As a result, finding and retaining the right digital talent has become increasingly difficult for organizations. To address the challenges of the competitive talent landscape, enterprises pivot toward skills-based models of talent recruitment and development. Both demand-side and supply-side trends are covered in Avasant’s Digital Talent Capability 2023–2024 Market Insights™ and Digital Talent Capability 2023–2024 RadarView™, respectively.

November, 2023

-

![Digital Talent Capability 2023–2024 Market Insights™ Digital Talent Capability scaled - Digital Talent Capability 2023–2024 Market Insights™]()

Digital Talent Capability 2023–2024 Market Insights™

The Digital Talent Capability 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that can aid in building a digital talent strategy and help them chart out an action plan for filling the digital talent gap. The report also highlights Avasant’s viewpoint on key technology and talent-related trends that are expected to have a long-term impact on any digital transformation project.

November, 2023

-

![Digital Talent Capability 2023–2024 RadarView™ PrimaryImage Digital Talent Capability 2023–2024 RadarView - Digital Talent Capability 2023–2024 RadarView™]()

Digital Talent Capability 2023–2024 RadarView™

The Digital Talent Capability 2023–2024 RadarView assists enterprises in identifying strategic partners that bring in the right digital talent expertise to help accelerate digital transformation by offering detailed capabilities and experience analyses of service providers. It provides a 360-degree view of key service providers across digital strategy and talent capabilities, talent transformation, and talent investments and innovation. The 64-page report highlights top supply-side trends in the digital talent space and Avasant’s viewpoint on them.

November, 2023

-

![Residual Value Forecast November 2023 Value Forecast Format November 1 - Residual Value Forecast November 2023]()

Residual Value Forecast November 2023

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

November, 2023

-

![Open Innovation - The Catalyst for Transforming India’s Technology Ecosystem Product image 1 - Open Innovation - The Catalyst for Transforming India’s Technology Ecosystem]()

Open Innovation – The Catalyst for Transforming India’s Technology Ecosystem

This report, developed in collaboration with nasscom, assesses the status of Open Innovation (OI) in India and its global context. It explores investments and initiatives by the Indian government, industry bodies, and the private sector to promote OI. The report identifies India’s potential to rank in the top 10 for global innovation, emphasizing OI’s role in addressing local needs, fostering inclusivity, and supporting innovative ventures. It provides recommendations for advancing OI and highlights opportunities for collaboration across sectors, including corporates, academia, and government agencies.

November, 2023

-

![GAVS and Its AIOps Platform Tackle the IT Quagmire RB Featured Image Tech Innovator - GAVS and Its AIOps Platform Tackle the IT Quagmire]()

GAVS and Its AIOps Platform Tackle the IT Quagmire

The enterprise computing environment today is more heterogenous and complex than ever. There are multiple computing platforms, combinations of cloud and on-premises infrastructure, and even multiple clouds. This IT quagmire causes many problems and represents a security risk. Into this breach has stepped a discipline known as AIOps. A leading provider of AIOps solutions and a Tech Innovator is GAVS Technologies.

November, 2023

-

![Service Success a Priority Over Cost for System Integration Outsourcing Featured Image Outsourcing Services v1 - Service Success a Priority Over Cost for System Integration Outsourcing]()

Service Success a Priority Over Cost for System Integration Outsourcing

While many outsourcing decisions are influenced by the need to save money, system implementation/integration outsourcing differs. There are some instances where businesses are willing to pay extra for the expertise or operational flexibility that a service provider can deliver. However, in the case of system implementation/integration, the primary motivation is to ensure project success. This Research Byte summarizes our full report on System Implementation/Integration Outsourcing Trends and Customer Experience.

November, 2023