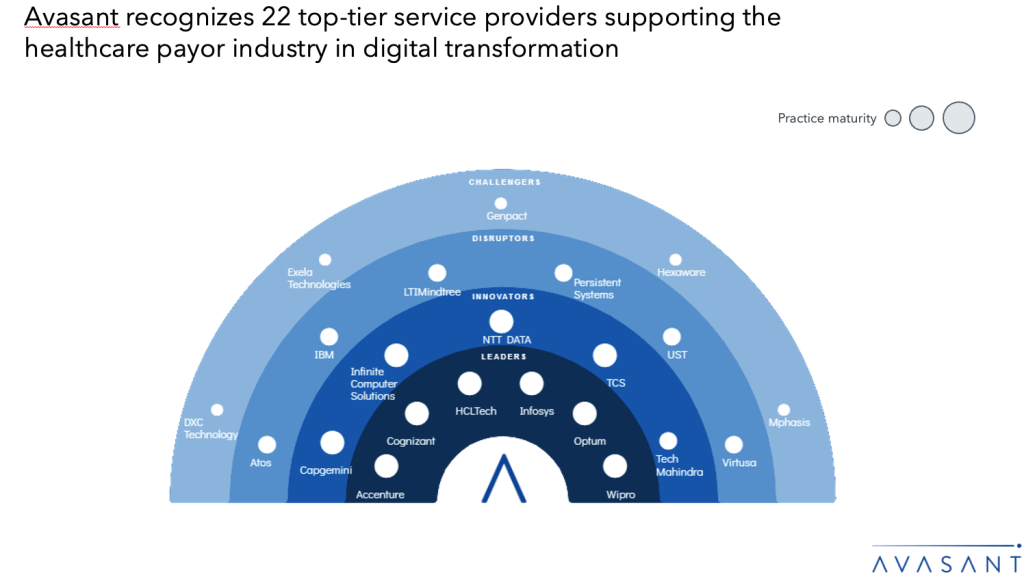

Healthcare payors are rapidly accelerating digital transformation in response to rising costs, regulatory pressures, talent shortage, and the industry’s shift toward value-based care. Central to this transformation is the adoption of AI, automation, and advanced analytics, which streamline administrative workflows, reduce operational costs, and enhance organizational agility. To meet growing interoperability mandates, payors are implementing API-driven architectures and adopting FHIR standards. These efforts are supported by advanced data integration platforms that ensure secure, seamless access to health data across systems. Digital tools are also improving member engagement through AI-powered chatbots, mobile apps, and unified digital portals that deliver personalized experiences and real-time support. Internally, these technologies enable workforce upskilling and foster collaboration, contributing to a more agile, future-ready organization. Meanwhile, collaboration with providers is deepening through the co-design of alternative payment models that align incentives, improve care outcomes, and share financial risk. Together, these digital strategies position payors to thrive in a more connected, value-driven healthcare ecosystem. Both demand-side and supply-side trends are covered in our Healthcare Payor Digital Services 2025 Market Insights™ and Healthcare Payor Digital Services 2025 RadarView™, respectively.