-

Digital Enterprise Maturity 3.0: Boosting Business Resilience through Technology

The pandemic disrupted the technology adoption curve, as most enterprises had to skip the trial or pilot phase to get ahead. As companies graduate in their digital journey, their focus shifts from tangible benefits, such as revenue growth and employee productivity, to intangible aspects, for example, sustainable business practices and employee wellness. The Digital Enterprise Maturity 3.0: Boosting Business Resilience through Technology report allows businesses to benchmark their digital strategy and ongoing initiatives against their peers using NASSCOM and Avasant’s digital maturity framework, which identifies performance gaps and prospects that lie ahead.

July, 2022

-

IT Vendor Governance Best Practices

IT vendor management is a function and set of practices that guide the selection, management, and assessment of IT suppliers to ensure that all parties comply with the terms of their contracts. IT supplier management has been a best practice for many years, but the disciplines have evolved. Traditional IT vendor governance practices are now inadequate to navigate the changing business ecosystem. The upshot is that most organizations need to transform their vendor governance programs. This Research Byte summarizes our full report on IT Vendor Governance Best Practices.

August, 2022

-

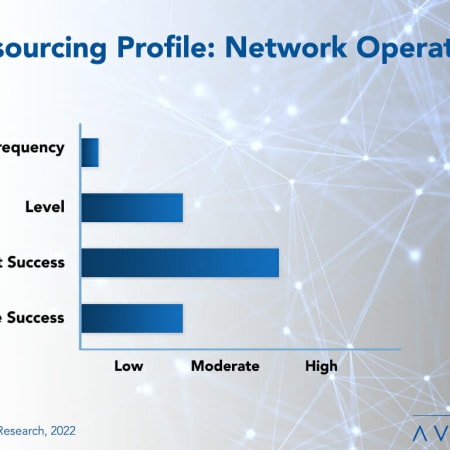

Network Operations Outsourcing Trends and Customer Experience 2022

Network operations is a mature but evolving outsourcing category with a wide assortment of top IT and telecom industry service providers competing with regional providers for market share. In addition, large equipment vendors are transforming their businesses beyond being manufacturing producers to delivering value-added network services. In doing so, they provide the network backbone to enterprise organizations as well as a growing variety of network services, including network design and planning, and even network support operations.

July, 2022

-

An Innovator’s Story: Creating a Business for Lasting Success

Ring, the first provider of video doorbells, is an interesting case study in innovation. Jamie Siminoff founded the firm in 2013, and, despite walking away from an episode of Shark Tank with no money, grew it to disrupt the home security industry. He eventually sold Ring to Amazon in 2018 for over $1 billion. This Research Byte provides a summary of Siminoff’s keynote and fireside chat at Avasant’s Empowering Beyond Summit earlier this year.

July, 2022

-

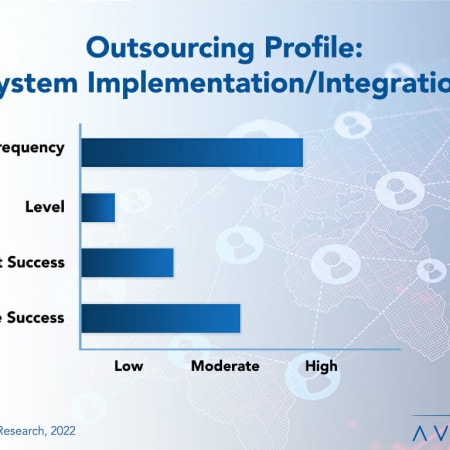

System Implementation/ Integration Outsourcing Trends and Customer Experience 2022

The outsourcing of system implementation/integration is on the rise. Our report examines adoption trends and customer experience with system implementation/integration outsourcing. We report on the percentage of organizations outsourcing it (frequency) and the average amount of work outsourced (level). We also present data on the cost and service experience and how these trends differ by organization size and sector. We conclude with guidelines to consider when outsourcing this function.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 1: Executive Summary

This chapter provides an overview of the key findings from the full study and describes the contents of the subsequent chapters. It also includes information on the study participants and the survey methodology.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 2: Composite Benchmarks

This chapter provides composite metrics for all of the organizations surveyed, across all industry sectors and organization sizes. The key metrics provided in this chapter are listed in the Key Metrics Descriptions section above.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 3A: Benchmarks for Small Organizations

Chapter 3A provides benchmarks for small organizations, across all sectors. Small organizations are defined as those having IT operational budgets of less than $5 million. For a complete description of all metrics, please see the full study description. There are 79 respondents in the small-company sample.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 3B: Benchmarks for Midsize Organizations

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 56 respondents in the sample range in size from a minimum of about $50 million to a maximum $60 billion in annual revenue.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 3C: Benchmarks for Large Organizations

Chapter 3C provides benchmarks for large organizations, across all sectors. Large organizations are defined as those having IT operational budgets of more than $20 million. For a complete description of all metrics, please see the full study description. There are 78 respondents in the large-company sample.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 4: Process Manufacturing Sector Benchmarks

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 56 respondents in the sample range in size from a minimum of about $50 million to a maximum $60 billion in annual revenue.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 5: Discrete Manufacturing Sector Benchmarks

Chapter 5 provides benchmarks for discrete manufacturing organizations. Discrete manufacturers are defined as those where the production process adds value by fabricating or assembling individual (discrete) unit production. The category includes manufacturers of consumer products, athletic equipment, industrial equipment, telecommunications equipment, aerospace products, furniture, auto parts, electrical parts, medical devices, and electronic devices, among other products. The 56 respondents in this sample range in size from a minimum of about $50 million to over $100 billion in annual revenue.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 6: Banking and Finance Sector Benchmarks

Chapter 6 provides benchmarks for banking and financial services companies. The firms in this sector include commercial banks, investment banks, credit unions, mortgage lenders, consumer finance lenders, and other types of lenders and financial services providers. The 24 respondents in this sector range in size from a minimum of about $50 million to over $40 billion in annual sales.

July, 2022

-

IT Spending and Staffing Benchmarks 2022/2023: Chapter 7: Insurance Sector Benchmarks

Chapter 7 provides benchmarks for insurance companies. The firms in this sector include companies that sell medical and dental insurance, life insurance, property and casualty insurance, auto insurance, disability insurance, and other types of insurance. The 17 respondents in this sector range in size from a minimum of $100 million to over $100 billion in annual revenue.

July, 2022

Grid View

Grid View List View

List View