-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 3B: Midsize Organization Benchmarks

Chapter 3B provides benchmarks for midsize organizations, across all sectors. Midsize organizations are defined as organizations having IT operational budgets of $5 million to less than $20 million. Despite the fact that this is a European study, we determined organization size in US dollars. This was to ensure an apples-to-apples size comparison between our main study and the European companion study. All metrics in the study are reported in euros.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 3A: Small Organization Benchmarks

Chapter 3A provides benchmarks for small organizations, across all sectors in Europe. Small organizations are defined as organizations having IT operational budgets of of of less than $5 million.

September, 2021

-

Digital Transformation Drives Rising IT Staff Head Count

Last year, we reported that a majority of companies planned IT staff head count increases for the first time in years. Then we were hit with a pandemic, global lockdowns, and in some companies, even layoffs. The good news is that much like all of the weddings, celebrations, and vacations that were rescheduled for this year, so is the hiring. In addition, digital transformation is driving a new era in IT staffing growth. This Research Byte is a brief overview of the findings in our IT Spending and Staffing Benchmarks 2021/2022 report.

July, 2021

-

Digital Talent Capability 2021 RadarView™

The Digital Talent Capability 2021 RadarView™ report provides information to assist enterprises in building a digital talent strategy and helps chart out an action plan for filling the digital talent gap. It identifies key global service providers and system integrators that can expedite an organization’s digital transformation journey by leveraging their digital talent capabilities. It also brings out detailed analyses of leading providers to support enterprises in identifying the right strategic partners. The 80-page report also highlights Avasant’s viewpoint on key technology and outsourcing trends reshaping the market.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 1: Executive Summary

This chapter provides an overview of the key findings from the European study and describes the contents of the subsequent chapters. It also includes information on the study participants and the survey methodology.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 3C: Large Organization Benchmarks

Chapter 3C provides benchmarks for large organizations, across all sectors. Large organizations are defined as organizations having IT operational budgets of more than $20 million. Despite the fact that this is a European study, we determined organization size in US dollars. This was to ensure an apples-to-apples size comparison between our main study and the European companion study. All metrics in the study are reported in euros.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 4: Process Manufacturing

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. The sector includes manufacturers of chemicals, petrochemicals, pharmaceuticals, cosmetics, dietary supplements, food and beverage products, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 49 respondents in the sample range in size from a minimum of €90 million to a maximum of above €21 billion in annual revenue.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 11: IT Services and Solutions

Chapter 11 provides IT spending and staffing statistics for the IT services and solutions sector. The category includes software companies, software-as-a-service (SaaS) providers, systems integrators, IT solution providers, business process outsourcing firms, and other providers of technology services and solutions. There are 19 organizations in the sample, ranging in size from around €50 million to about €10 billion in annual revenue.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 5: Discrete Manufacturing

Chapter 5 provides benchmarks for discrete manufacturing organizations. Discrete manufacturers are defined as those where the production process adds value by fabricating or assembling individual (discrete) unit production. The category includes manufacturers of consumer products, industrial equipment, telecommunications equipment, aerospace products, auto parts, electrical parts, medical devices, and electronic devices, among other products. The 32 respondents in this sample range in size from a minimum of €74 million to over €70 billion in annual revenue.

September, 2021

-

Current Fair Market Values September 2021

Our Fair Market Value (FMV) report provides data for the following categories of equipment: (1) IBM mainframe and midrange hardware and IBM peripherals; (2) Workstations, PCs, and servers from Compaq, Dell, HP, IBM/Lenovo, Lexmark, Okidata, Silicon Graphics, Sony, Sun, and Toshiba; (3) Network Communication gear from Cisco, Bay/Nortel, IBM, Intel, Lucent, and others. Fair Market Values are provided for end-user, wholesale, and orderly liquidation values (OLV) prices.

September, 2021

-

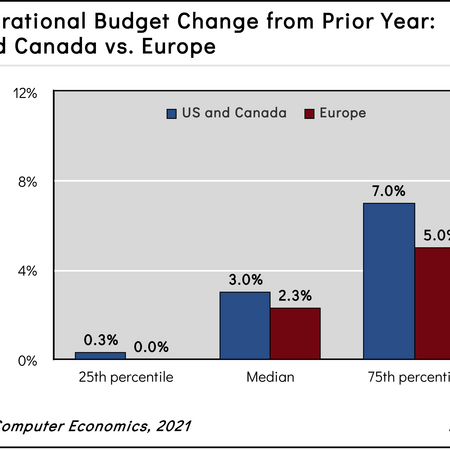

European IT Departments More Cautious Than American Counterparts

The best way to describe the European recovery from the COVID-19 pandemic is cautiously optimistic. Maybe with a little extra emphasis on optimistic. But it is nothing quite like the miracle recovery we described a little over a month ago for IT organizations in the US and Canada. Still, it is not all bad. In Europe, we continue to see expected increases in spending on digital transformation, software as a service (SaaS), and cloud, indicating that IT organizations are not holding back on new investments, and they see a clear path toward a digital future. This research byte is a brief description of some of the findings in our European IT Spending and Staffing Benchmarks 2021/2022 study.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 8: Wholesale Distribution

Chapter 8 provides benchmarks for wholesale distributors. The category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, electronics, food and beverage, and other products. The 15 respondents in the sample range in size from a minimum of about €60 million to about €30 billion in revenue.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 6: Financial Services

Chapter 6 provides benchmarks for banking, insurance, and financial services companies. The firms in this sector include commercial banks, investment banks, credit unions, mortgage lenders, consumer finance lenders, insurance companies, and other types of lenders and financial services providers. The 21 respondents in this sector range in size from a minimum of about €100 million to a maximum of €80 billion in annual sales.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 7: Retail

Chapter 7 provides benchmarks for retailers. This sector includes retailers of clothing, hardware, furniture, sports equipment, groceries, pharmaceuticals, dietary supplements and health products, and general merchandise. They include department stores, furniture stores, pharmacies, sporting goods stores, and specialty retailers, both online and brick-and-mortar. We also include hospitality and consumer services in this sector. The 33 respondents in the sample range in size from €100 million to €27 billion in annual revenue.

September, 2021

-

European IT Spending and Staffing Benchmarks 2021/2022: Chapter 9: Energy and Utilities

Chapter 9 provides benchmarks for public utilities, oil and gas producers, service companies, and midstream distributors across all organization sizes. The 14 respondents in this sector include public utilities (water, gas, and electric), integrated energy companies, upstream exploration and production companies, natural gas companies, pipeline operators, and other energy and utilities companies. The companies in our sample range in size from a minimum of about €100 million to about €14 billion in annual revenue.

September, 2021

Grid View

Grid View List View

List View