-

Residual Value Forecast March 2025

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

March, 2025

-

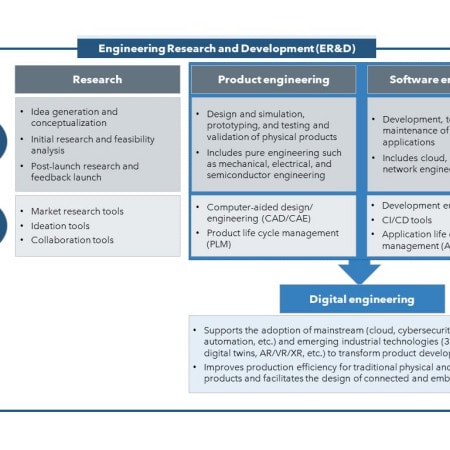

What Exactly is Digital Engineering and Who is a True Digital Engineering Partner?

Both B2B and B2C products have become smarter and more connected, requiring real-time integration and interaction between hardware and software components. To develop connected products and digitize the engineering and manufacturing life cycle, enterprises need an amalgamation of product and software engineering capabilities through digital engineering. While digital engineering is a growing domain, it is crucial that the ecosystem players, especially engineering and manufacturing companies, get the essence of digital engineering right to realize its true potential.

June, 2023

-

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 2: Composite Benchmarks

In this, our first survey-based report on generative AI strategy, spending, and adoption, we provide metrics on how much enterprises are spending on this ground-breaking technology, where they are spending it, and how they are governing it. This chapter provides statistics for nearly 200 companies that have already adopted some form of generative AI. It includes 22 figures providing data ranging from the strategic importance of AI to staffing and budget numbers, to usage data. It also covers the reservations and fears of using Gen AI and provides an understanding of the art of the possible.

December, 2023

-

Salesforce Services 2024 RadarView™

The Salesforce Services 2024 RadarView™ assists organizations in identifying strategic partners for Salesforce adoption by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key Salesforce service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right Salesforce services partner. The 76-page report highlights top supply-side trends in the Salesforce space and Avasant’s viewpoint.

September, 2024

-

Insights from HCLTech’s BFSI Analyst Day 2025

The banking, financial Services, and insurance (BFSI) sector is rapidly adopting AI to optimize operations, enhance customer experiences, and strengthen risk management protocols. AI-powered chatbots and virtual assistants are transforming customer interactions by providing around-the-clock assistance and facilitating real-time query resolution. A notable trend is the transition toward hyperpersonalized financial services. According to the Avasant Generative AI Spending and Adoption Metrics for BFSI 2024, over 70% of banking functions are utilizing Generative AI (Gen AI) to improve customer experience.

March, 2025

-

Clinical and Care Management Business Process Transformation 2025 Market Insights™

The Clinical and Care Management Business Process Transformation 2025 Market Insights™ assists enterprises in identifying important demand-side trends that are expected to have a long-term impact on any clinical and care management services transformation engagement. The report also highlights key challenges that enterprises face today.

June, 2025

-

Property and Casualty (P&C) Insurance Business Process Transformation 2025 Market Insights™

The Property and Casualty (P&C) Insurance Business Process Transformation 2025 Market Insights™ assists enterprises in identifying important demand-side trends that are expected to have a long-term impact on any P&C insurance process transformation engagement. The report also highlights key challenges that P&C insurance entities face today.

September, 2025

-

Digital Commerce Services 2024-2025 RadarView™

The Digital Commerce Services 2024–2025 RadarView™ assists organizations in identifying strategic partners for digital commerce services by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key digital commerce services providers across practice maturity, partner ecosystem, and investments and innovation. The 61-page report highlights top supply-side trends in the digital commerce services space and Avasant’s viewpoint on them.

December, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 31: Property and Casualty Insurance

Chapter 31 provides benchmarks for property and casualty (P&C) insurance companies. The firms in this sector include companies that offer property and casualty insurance, auto insurance, homeowner’s insurance, renter insurance, and similar types of insurance. The 16 respondents in this sector range in size from a minimum of $100 million to over $100 billion in annual revenue.

September, 2024

-

Business Process Services Pricing and Solution Trends: H1 2023

In this report, Avasant provides key information on pricing and solution trends for the Business Process Services industry from the past 12 months. The report covers various aspects, including market demand and provider solution trends, commercial engagement trends, emerging location trends, and pricing and staffing trends in the space. The geographic coverage is global, with a large share of data points from North America. The report builds on insights gathered through our enterprise interactions, ongoing market research, data collection, and the AvaMark™ Price Benchmarking database.

June, 2023

-

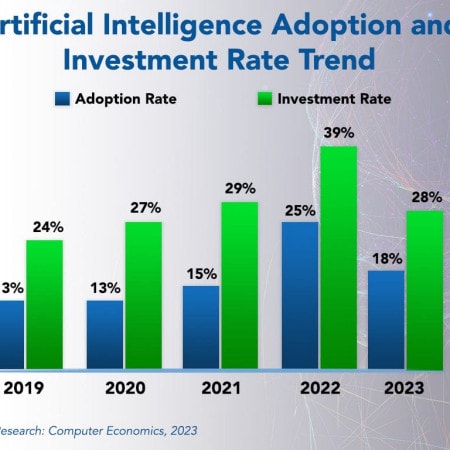

ChatGPT to Lead More Companies to Say Aye-Aye to AI

The recent frenzy of interest in generative AI has changed the perception of artificial intelligence. Once locked inside other processes, AI was often forgotten as it powered everything from IoT devices, automation, and security. Although most companies have not been investing heavily in AI, we see that changing in the coming months and years. This Research Byte summarizes our full report on AI technology trends.

May, 2023

-

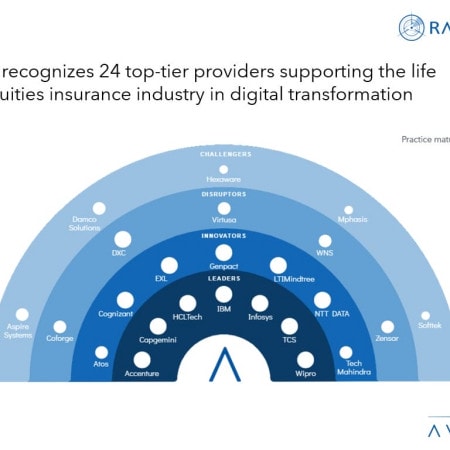

Life and Annuities Insurance: Reshaping Customer Experience with Digital Technology

Amid evolving customer demands, the life and annuities (L&A) insurance industry has been under pressure to offer personalized digital experiences and launch innovative insurance products to tap into new customer segments. To alleviate this pressure, L&A insurers are adopting digital technologies to overcome legacy challenges, augment distribution channels, and enhance customer experience. They are also streamlining operations and launching sustainable insurance products. As this requires a strong insurance domain knowledge and technological expertise, L&A insurers are collaborating with service providers for digital transformation. Both demand-side and supply-side trends are covered in our Life and Annuities Insurance Digital Services 2023–2024 Market Insights™ and Life and Annuities Insurance Digital Services 2023–2024 RadarView™, respectively.

July, 2023

-

Europe Increasing IT Budgets Even More Than US and Canada

The IT spending and staffing outlook in Europe for 2023 is positive, but CIOs are being asked to be especially careful to make sure their investments count. For over a year, European companies have dealt with inflation, poor economic growth in the region, brittle supply chains, and a war on their doorsteps. By now, we would have expected more companies in Europe to be cautiously preserving cash, preparing for a recession. And yet, for the most part, businesses are not cutting IT budgets. This Research Byte is a brief description of some of the findings in our European IT Spending and Staffing Benchmarks 2023/2024 study.

September, 2023

-

Shifting Toward Tech-enabled Trust and Safety

The emergence of new-age tools and technologies, such as generative AI and the metaverse, has led to a rapid and increased production of content and complexities in the online space in terms of new regulations and compliances. This exponential growth in content creation and consumption, driven by generative AI and content automation tools, further accentuates the need for robust trust and safety measures. Effectively addressing trust and safety gaps through a human-AI model is paramount for a safer online environment. Additionally, placing employee well-being and wellness at the forefront of trust and safety operations is becoming increasingly pivotal. These factors collectively shape the dynamic landscape of trust and safety in the digital age. Both demand-side and supply-side trends are covered in our Trust and Safety Business Process Transformation 2023–2024 Market Insights™ and Trust and Safety Business Process Transformation 2023–2024 RadarView™, respectively.

November, 2023

Grid View

Grid View List View

List View